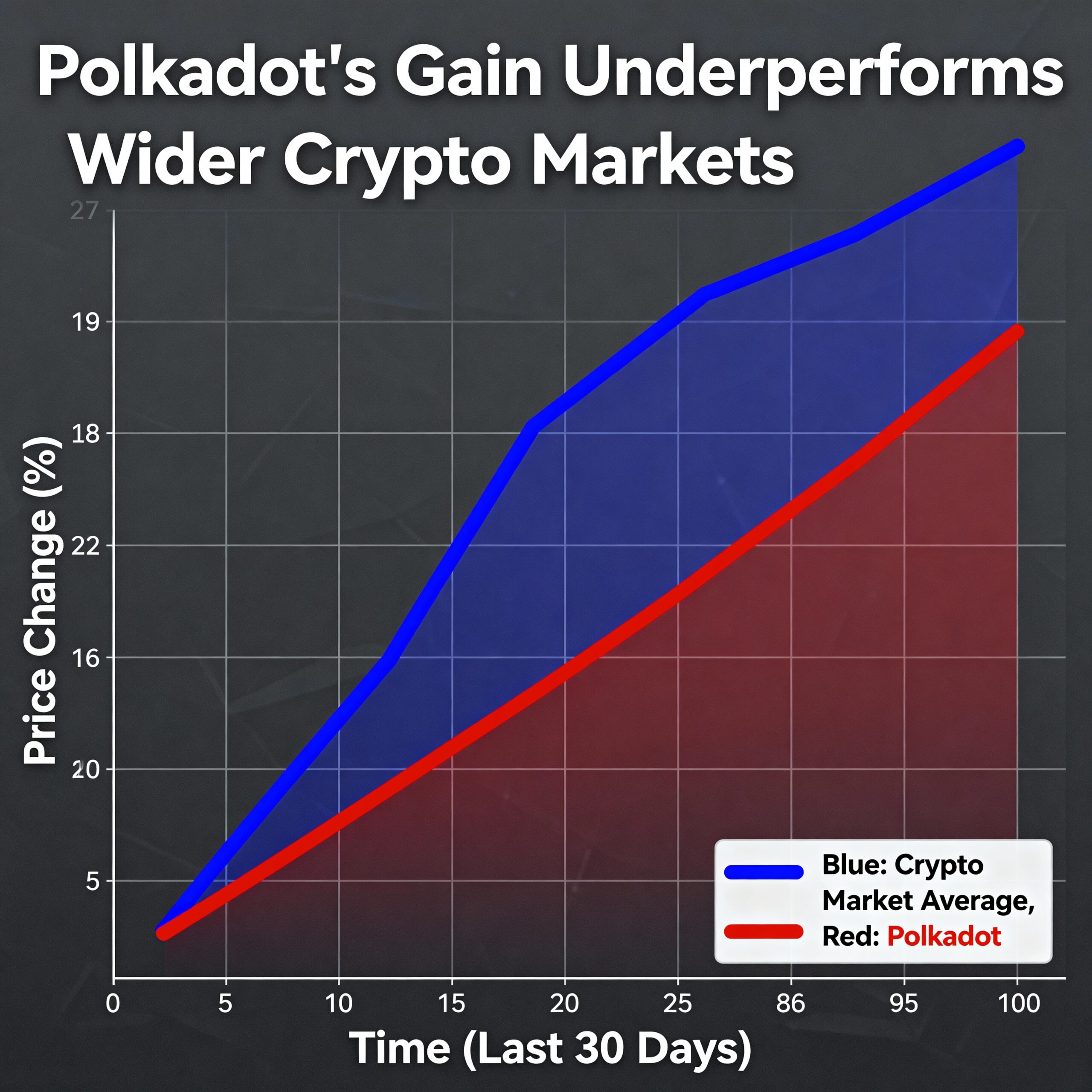

Polkadot (DOT) Underperforms Wider Crypto Market Despite Upward Momentum

Polkadot (DOT) advanced 0.8% over the past 24 hours to $2.12, underperforming the broader cryptocurrency market, with the CoinDesk 20 (CD20) index up 2.8% at publication time. Technical analysis suggests that this relative underperformance signals lingering hesitation among investors toward the Polkadot ecosystem.

According to CoinDesk Research’s model, DOT’s advance occurred on substantially elevated trading volume, with 24-hour activity 26% above the seven-day moving average. This pattern points to deliberate positioning rather than low-conviction price drift, though profit-taking appears to outweigh new accumulation.

During the session, DOT rallied from $2.09 to $2.14, forming an ascending trend with higher lows at $2.05 and $2.09, and a total trading range of $0.13, representing 6.1% volatility. The most notable volume event involved 5.75 million tokens traded—134% above the 24-hour average—which pushed the price through resistance at $2.12 and briefly touched session highs near $2.16.

Technical Highlights:

- Key support is established at $2.05, with immediate support at $2.14 critical to maintaining the bullish structure. Resistance forms near $2.16.

- Exceptional volume surged 134% above average during the resistance test, with a recent 60-minute spike of 145,000 tokens coinciding with distribution activity.

- The ascending trend of higher lows from $2.05 to $2.09 contrasts with a descending channel visible in shorter time frames.

- Upside potential remains toward $2.16, with further extension possible if volume confirms. Downside risk toward $2.05 represents a 6.1% range vulnerability.

Overall, while DOT shows short-term bullish momentum, relative underperformance against the wider crypto market and active distribution signals suggest cautious investor sentiment.