Risk assets roared Wednesday after former President Donald Trump hit pause on some of the U.S.’s sweeping tariff measures—sparking a broad market rally led by cryptocurrencies.

In a Truth Social post, Trump said he was enacting a 90-day suspension of tariffs on nations that haven’t retaliated against the U.S., alongside a reduced interim 10% tariff rate. However, China was left out of the reprieve. Tariffs on Chinese goods have been raised to 125%, effective immediately.

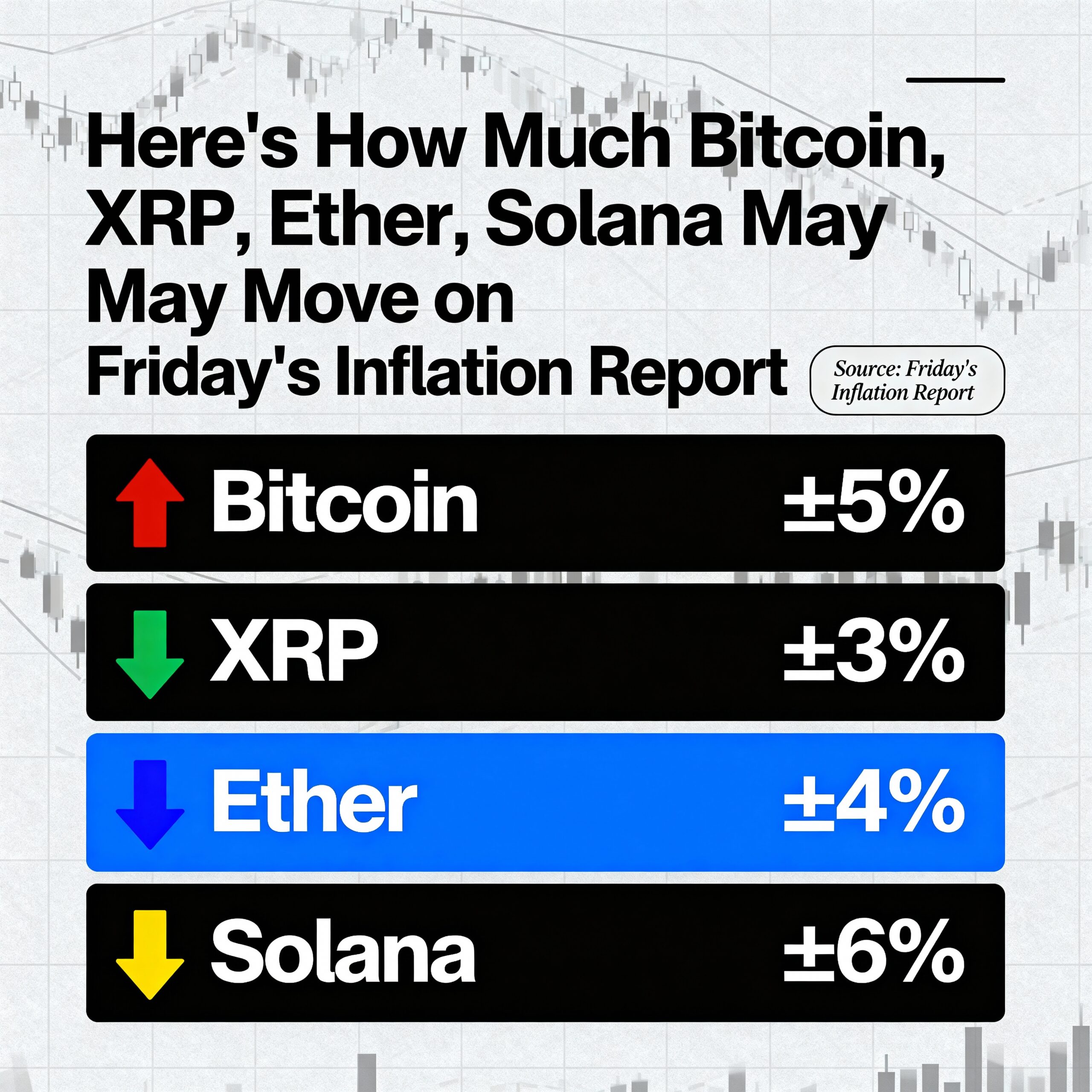

Bitcoin (BTC) jumped sharply on the news, breaking through resistance to trade above $81,000—up more than 5.5% in the last 24 hours.

Altcoins rallied across the board, with XRP, SOL, AVAX, LINK, HBAR, and SUI posting double-digit percentage gains. Ethereum surged 8% to reclaim the $1,600 level. The CoinDesk 20 Index reflected a broad crypto upswing as traders rotated back into digital assets.

U.S. equities followed suit, as the Nasdaq popped 7% and the S&P 500 soared nearly 9%—their best single-day performance since 2022.

Trump’s morning post urging followers that it was a “great time to buy” appears to have timed the bounce. The decision to ease pressure on non-hostile trade partners was seen as a tactical de-escalation—one markets quickly rewarded.