Markets Look Past Warnings as Bitcoin Climbs Near $96K and Tariff Uncertainty Lingers

Bitcoin continued its steady rise on Tuesday, nearing $96,000 for the first time since mid-February, even as economic signals flash caution and uncertainty looms over U.S. trade policy. The leading cryptocurrency gained 1% over the past 24 hours, trading around $95,400.

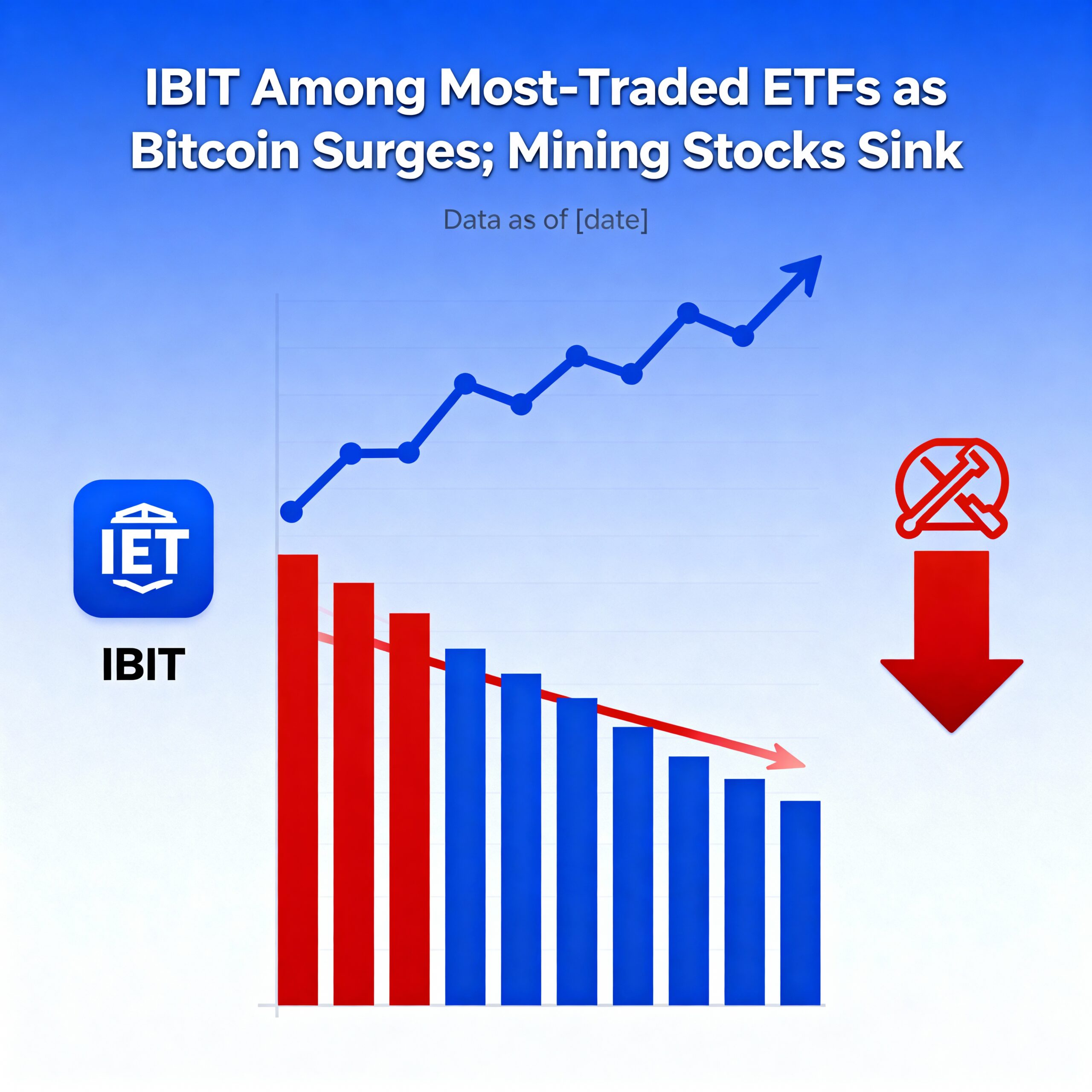

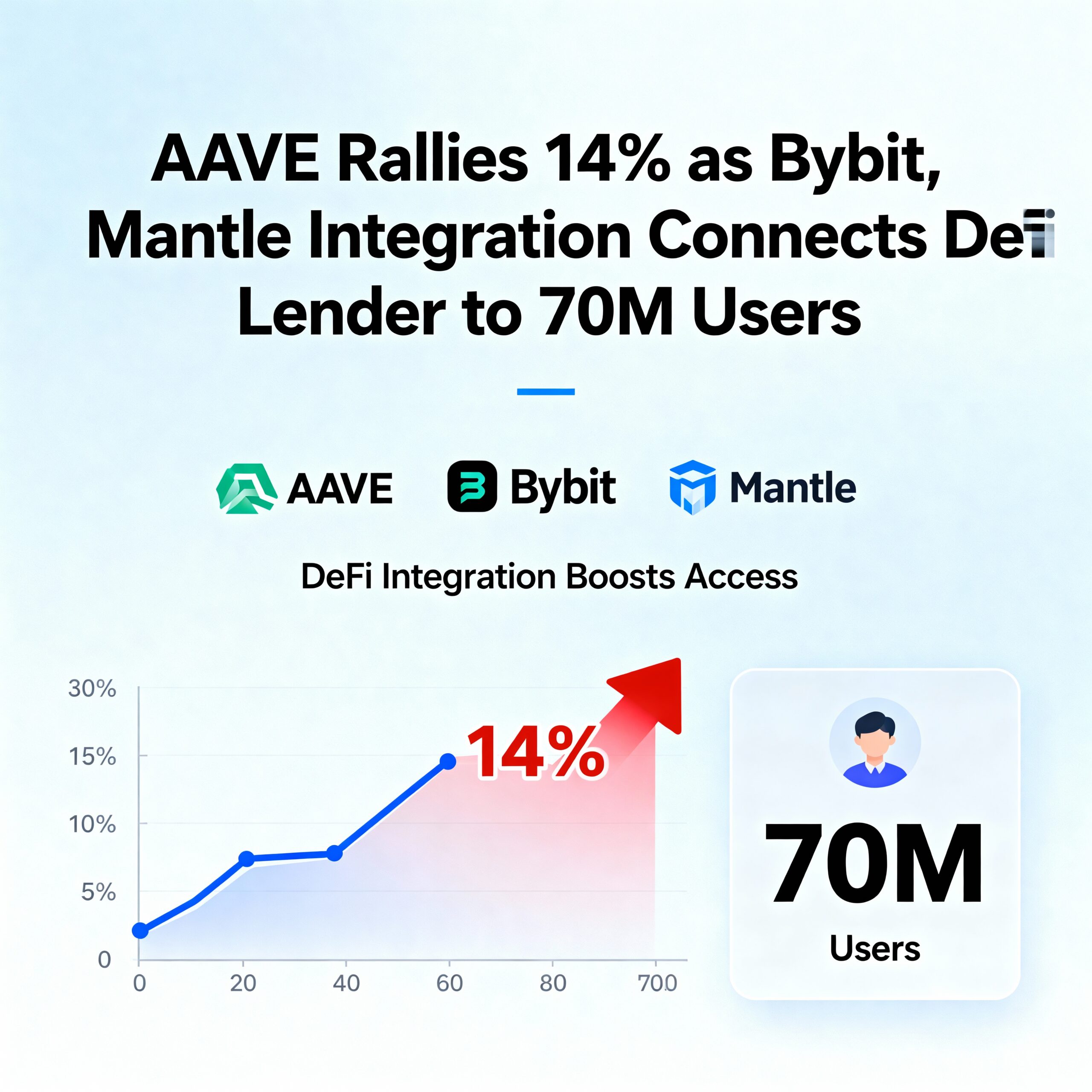

The broader crypto market followed suit, with the CoinDesk 20 Index posting a 1.1% gain. Bitcoin Cash (BCH) stood out with a 6.3% rally, while crypto-linked equities like Coinbase (COIN) and MicroStrategy (MSTR) inched higher by 0.9% and 3.3%, respectively. Janover (JNVR) surged 16%, buoyed by continued investor interest in its Solana (SOL) accumulation strategy.

Wall Street also extended its recent rebound, with both the S&P 500 and Nasdaq climbing 0.55%, shaking off fears tied to the economic fallout from the Trump administration’s tariff policies.

But beneath the surface, the data paints a grimmer picture. The Conference Board reported that consumer confidence dropped to a four-year low, while consumer expectations plunged to levels last seen in 2011. Additionally, March’s JOLTS report revealed job openings had fallen to 7.19 million — well below the anticipated 7.5 million.

In trade news, Secretary of Commerce Howard Lutnick announced that a deal had been struck with an unspecified country, though details remain scarce and the agreement still requires formal approval from that nation’s leadership.

Despite these concerns, markets continue to push upward — a trend some experts find troubling. “Hard to fathom how blind the market really is,” wrote Jeff Park, head of Alpha Strategies at Bitwise, on X.

Park cautioned that the market’s obsession with potential Federal Reserve rate cuts misses a bigger issue: “A Fed cut means nothing if U.S. creditworthiness is permanently impaired by the global community as a result of dollar weaponization.” He warned that if the foundation of U.S. risk-free assets is shaken, it could permanently raise the global cost of capital.