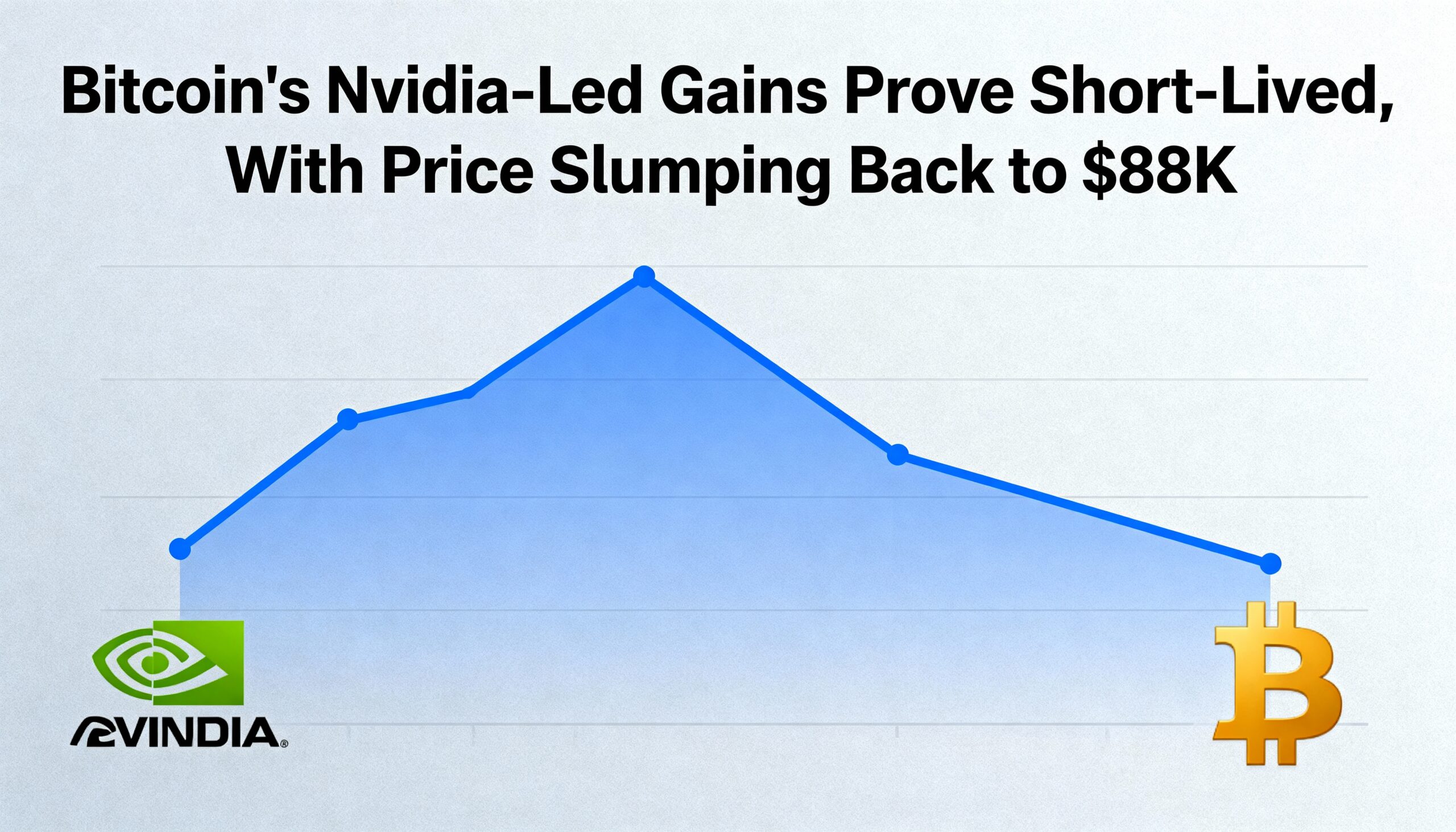

Bitcoin Sinks to Six-Month Low as Crypto Stocks Plunge, Analysts Eye Potential Local Bottom

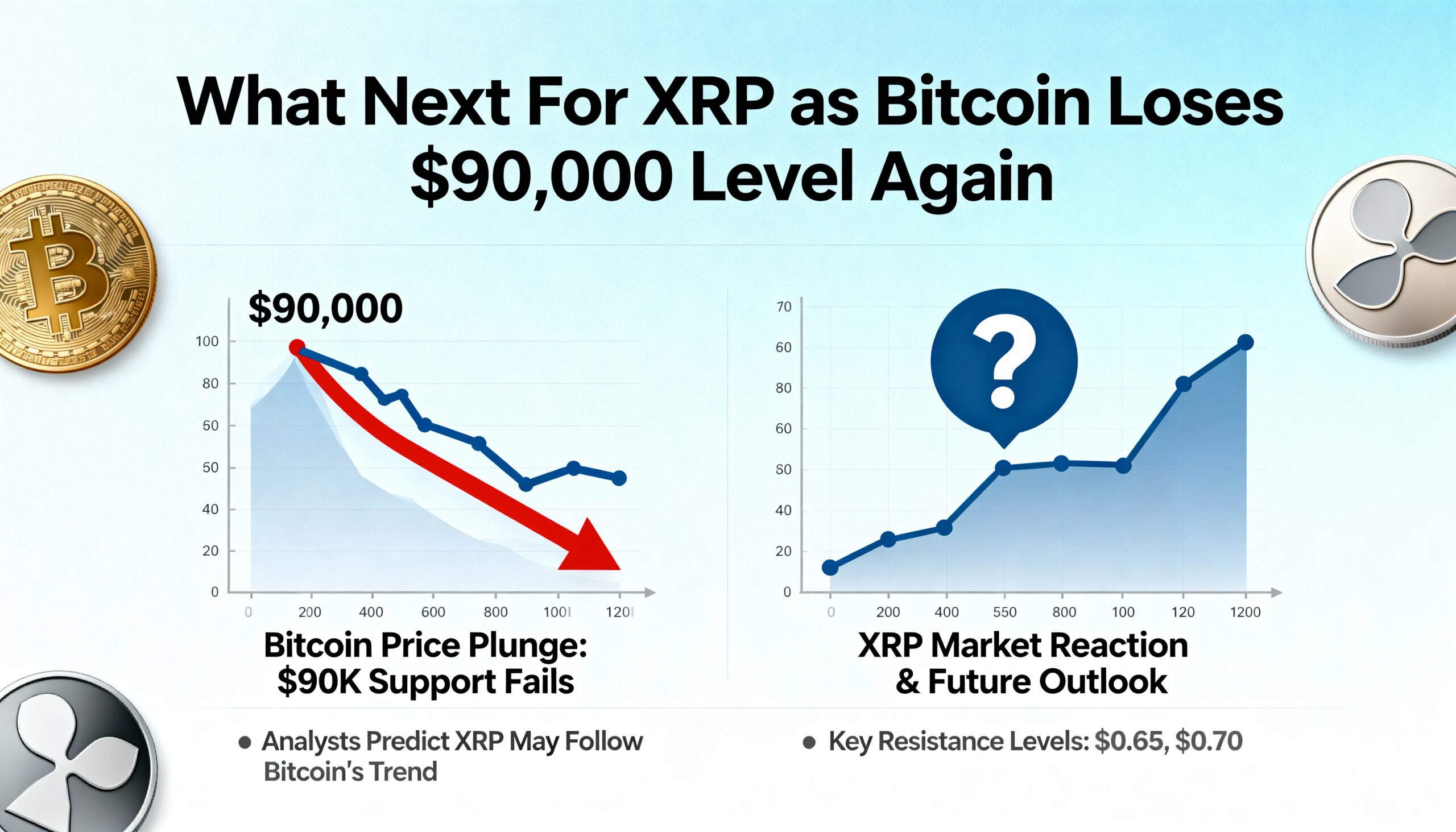

Bitcoin (BTC) tumbled to a fresh six-month low on Monday, extending its multi-week decline and erasing all year-to-date gains. The largest cryptocurrency fell to $92,500 during the U.S. session, down 2.4% over 24 hours and nearly 13% over the past week, marking a 27% drop from its record high just over a month ago. Ether (ETH) hovered slightly above $3,000, off 2% in the past 24 hours and 15% over the week, as bearish sentiment spread across the market.

Crypto Equities Slide

The broader crypto ecosystem felt the pain, with major crypto-linked stocks including Coinbase (COIN), Circle (CRCL), Gemini (GEMI), and Galaxy (GLXY) falling roughly 7%. Digital asset treasury firms also posted sharp declines: Strategy (MSTR), the largest corporate Bitcoin holder, slid 4% to its lowest level since October 2024, while Ether treasury companies BitMine (BMNR) and ETHZilla dropped 8% and 14%, respectively. Solana-linked firms Upexi (UPXI) and Solana Company (HSDT) fell 10% and 7%.

Meanwhile, miners tied to high-performance computing and AI infrastructure bucked the trend. Hive Digital (HIVE) surged 10% after announcing an AI cloud partnership with Dell Technologies, while IREN (IREN) and Hut 8 (HUT) posted modest gains.

Macro Headwinds and Fed Policy

Economic data continues to play a pivotal role amid the government shutdown, which has limited official reporting. Monday’s New York Fed Empire State Manufacturing Survey jumped unexpectedly eight points to 18.7, far above forecasts for a decline to 6. Analysts suggest this could reduce expectations for a Fed rate cut in December, with Polymarket traders assigning 55% odds of unchanged rates and the CME FedWatch Tool placing it around 60%.

Technical and Market Insights

From a technical standpoint, Bitcoin futures on the CME opened at $93,840 on Sunday, leaving an unfilled gap at $91,970 from April — a level that may exert short-term downward pressure, according to CoinDesk Senior Analyst James Van Straten.

Bitfinex analysts noted that realized losses are beginning to stabilize, signaling a potential local bottom. “Sustainable bottoms historically form after short-term holders have capitulated into losses,” they wrote. “The market appears to be nearing that threshold, with near-term resilience dependent on the exhaustion of remaining sell-side pressure.”

They added that this is now the third-largest Bitcoin pullback since 2023, and the second-largest since U.S. spot Bitcoin ETFs launched, suggesting a local bottom could emerge “relatively soon