Bitcoin Holds $110K as Altcoins Lead Gains, but Market Signals Caution

Bitcoin reclaimed the $110,000 mark for a second straight day, lifted in part by stronger gains across altcoins, yet broader market sentiment remains subdued — suggesting the rally may lack solid conviction.

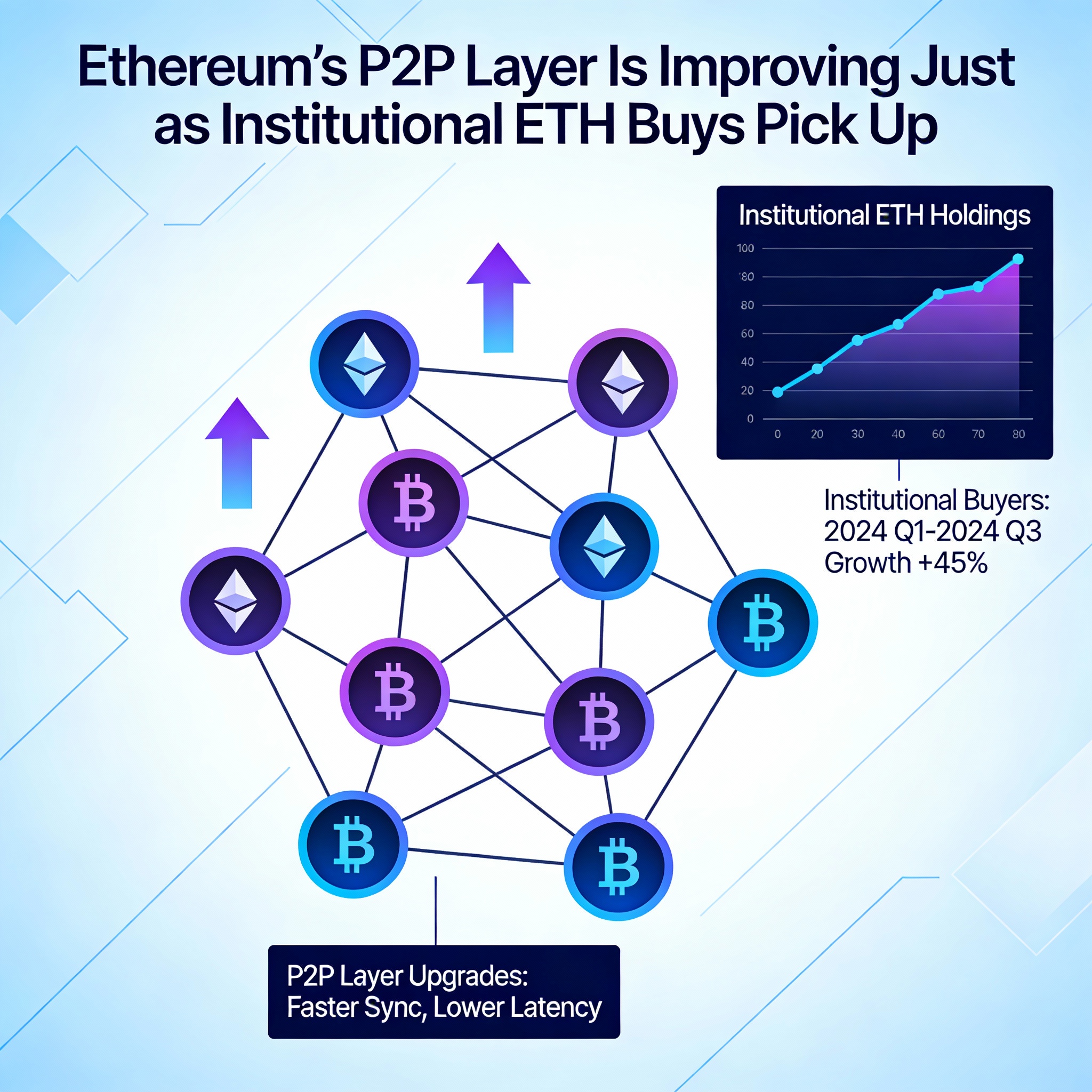

BTC was up around 0.9% over the past 24 hours, hovering just above $110,000 following Tuesday’s U.S. stock market close. The CoinDesk 20 Index, which tracks major digital assets excluding stablecoins, exchange tokens, and memecoins, rose 3.3%, bolstered by strong performances from ether (ETH), solana (SOL), and chainlink (LINK) — each gaining between 5% and 7%.

Leading the charge, however, were uniswap (UNI) and aave (AAVE), soaring 24% and 13% respectively. Their rallies followed bullish comments from SEC Chair Paul Atkins, who expressed openness to regulatory exemptions for decentralized finance (DeFi) platforms during a Monday roundtable.

In equity markets, crypto-related stocks remained mostly flat. One notable outlier was Semler Scientific (SMLR) — a firm emulating MicroStrategy’s bitcoin accumulation strategy — which dropped another 10%, pushing its share price below the value of the BTC it holds.

Despite the uptick in prices, analysts say positioning across crypto markets still leans defensive.

“Funding rates and other leverage indicators suggest the market remains cautious,” said Vetle Lunde, head of research at K33 Research, in a Tuesday note. “Risk appetite appears weak, especially considering BTC is near previous all-time highs.”

Binance’s perpetual BTC contracts have recorded negative funding rates on several recent days, with the average annualized rate sitting at just 1.3% — a level historically linked to market bottoms rather than tops, Lunde observed.

“Bitcoin doesn’t typically peak in environments where funding is negative,” he added. “In fact, such setups have often preceded rallies.”

Data from leveraged ETFs also reflects tepid enthusiasm. The ProShares 2x Bitcoin ETF (BITX) currently holds exposure equal to 52,435 BTC, down significantly from its December 2023 peak of 76,755 BTC, and inflows remain modest. According to Lunde, this lack of exuberance could provide the base for a “healthy rally” if sentiment turns.

Still, not all analysts are convinced the market is ready to break out meaningfully.

“Is this the beginning of a sustainable breakout? Probably not,” said Kirill Kretov, senior automation expert at CoinPanel. “It looks more like a typical upswing in a broader volatility cycle — one that could reverse sharply if negative news hits.”

Kretov pointed to key support zones at $105,000 and $100,000, which could come into play if the market retraces.

In short, while crypto prices are climbing, sentiment hasn’t caught up — and that disconnect has both bullish potential and risk written all over it.