Bitcoin Closes at Record High Near $107K, Eyes $110K as Key Resistance Level

Bitcoin is approaching a pivotal price point as it closed at an unprecedented daily high of $106,830 (UTC) on Tuesday, according to TradingView. The $110,000 level now stands out as the next significant threshold that could trigger heightened market activity.

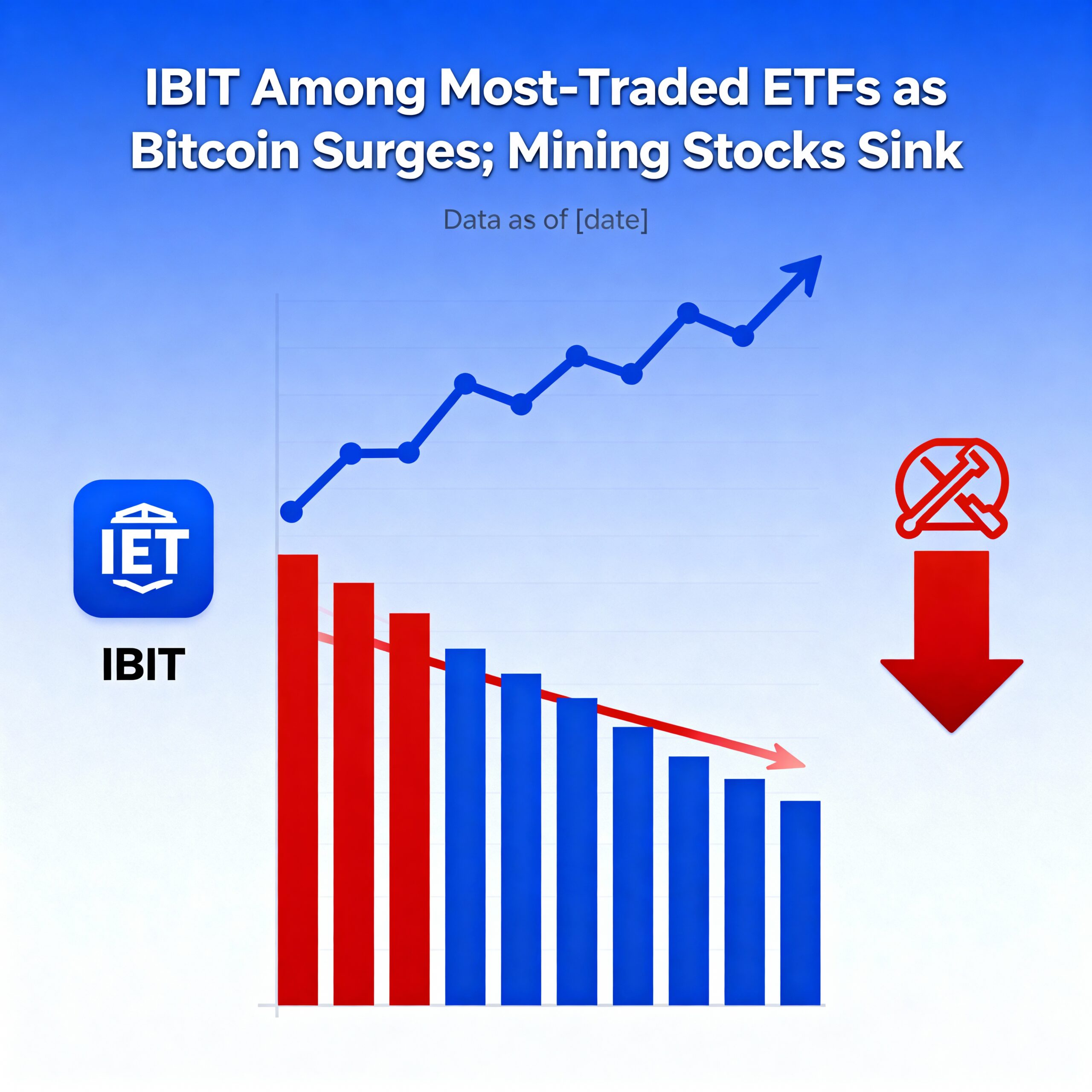

Despite trading 24/7, Bitcoin’s daily candlestick closes—akin to forex markets—offer valuable insights into investor sentiment. This latest record close came amid strong inflows into Bitcoin spot ETFs, as bond market volatility raised alarm over fiscal stability in major economies like the U.S.

Market analysts recently told CoinDesk that increasing concerns over national debt may boost demand for Bitcoin and other traditional safe havens such as gold.

The Coinbase Bitcoin Premium Index, which tracks price differences between Coinbase Pro and Binance trading pairs, remains elevated, signaling sustained buying interest from U.S.-based traders.

Looking ahead, $110,000 is attracting attention from options traders. Data from Deribit’s BTC options market, provided by Amberdata, shows substantial net “negative gamma” exposure clustered at this strike price. Negative gamma typically means market makers adjust hedges in the direction of price moves, which can amplify volatility.

This dynamic suggests that a successful break above $110,000 could fuel accelerated upward momentum. Over the past several years, the expansion of options trading and associated dealer hedging has often contributed to swift, amplified Bitcoin price swings.