Crypto ETFs Emerge as Core Investment Tools Amid Regulatory and Operational Advances

Staking guidance, standardized listing rules, and new index strategies are helping transform crypto ETFs from speculative instruments into core portfolio holdings.

At the ETP Forum in New York on Tuesday, a panel of ETF issuers, auditors, lawyers, and derivatives experts explored the forces reshaping the crypto ETF landscape and the behind-the-scenes operational work supporting rapid product growth.

From Speculation to Investment

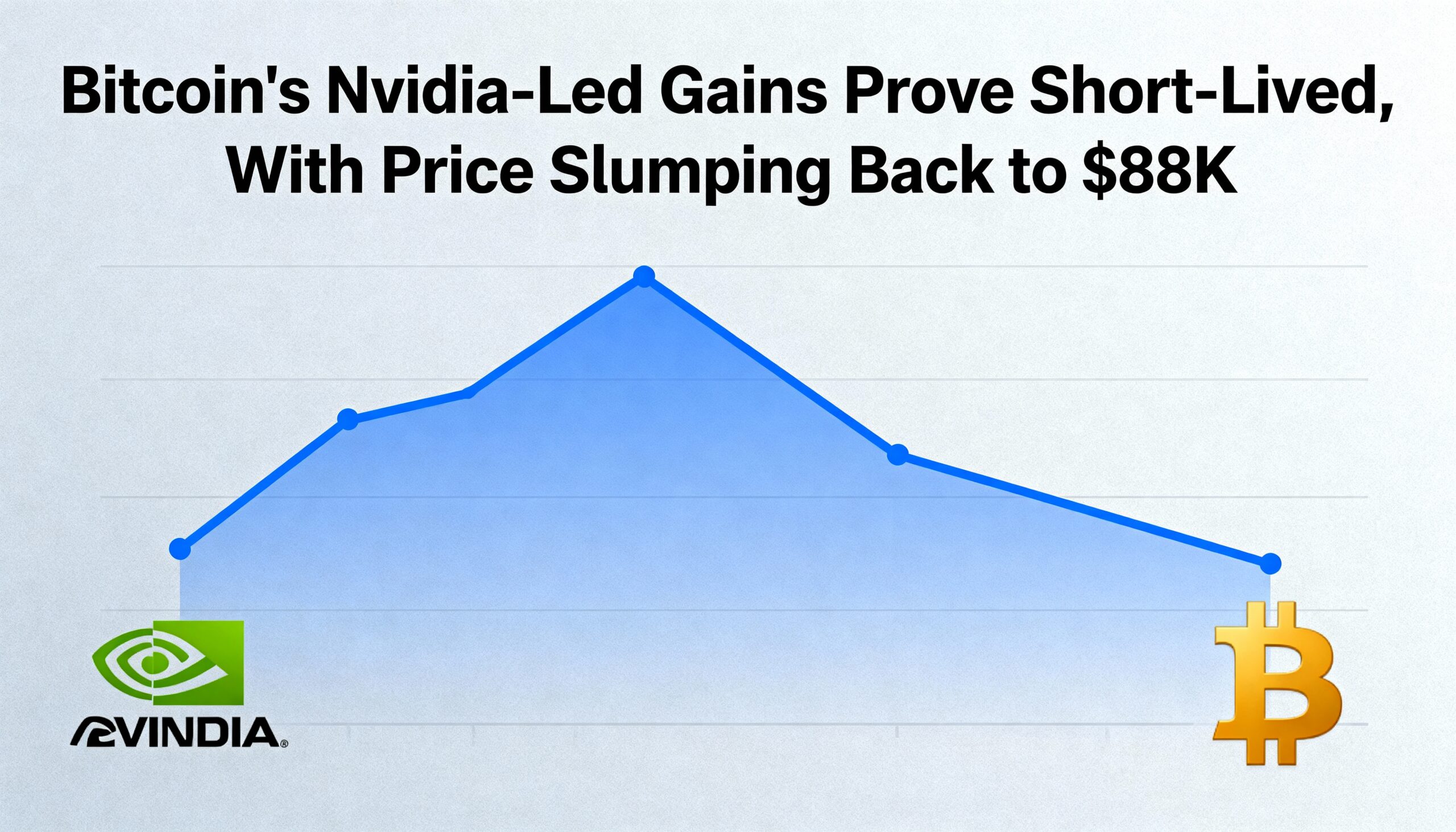

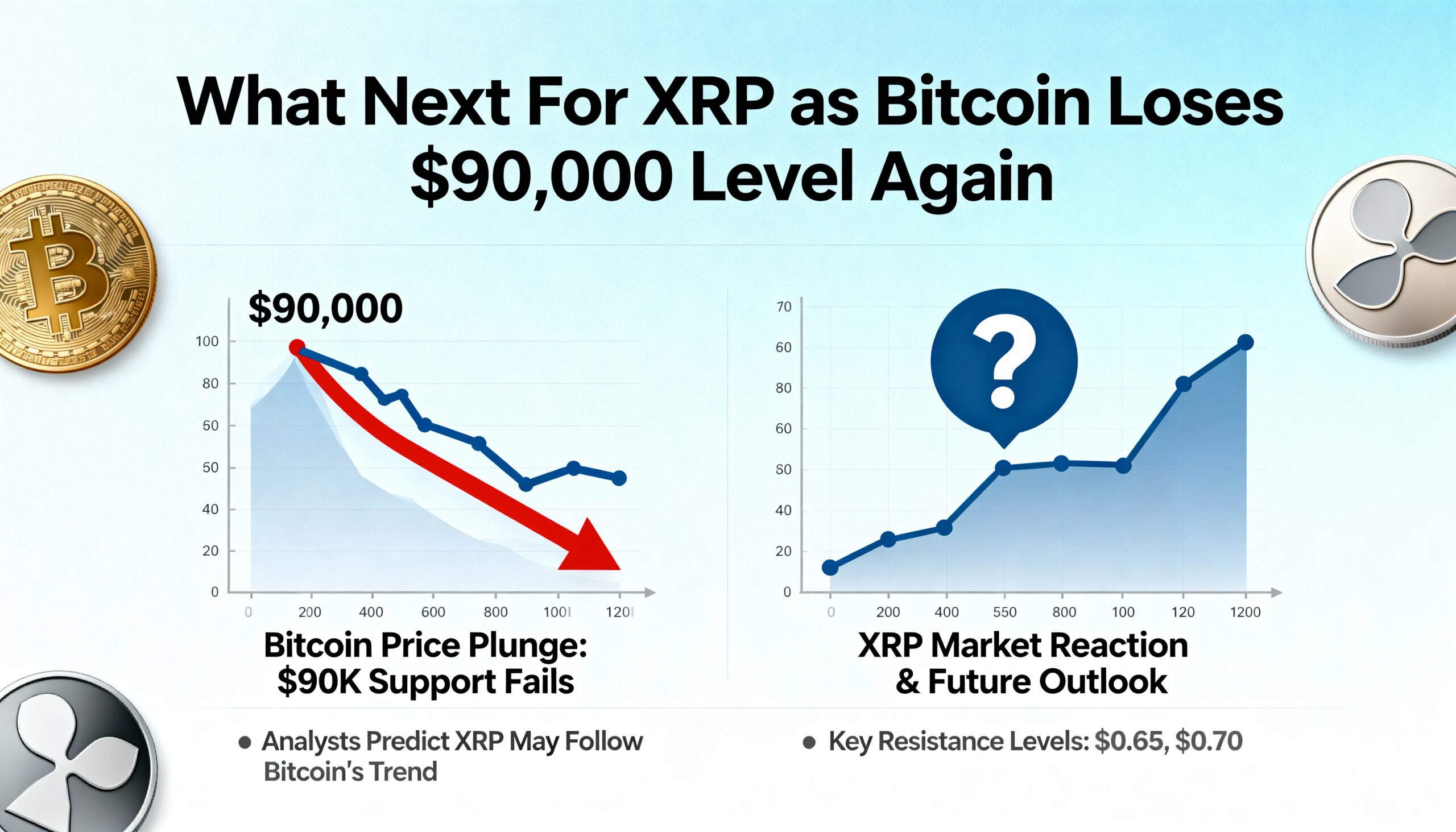

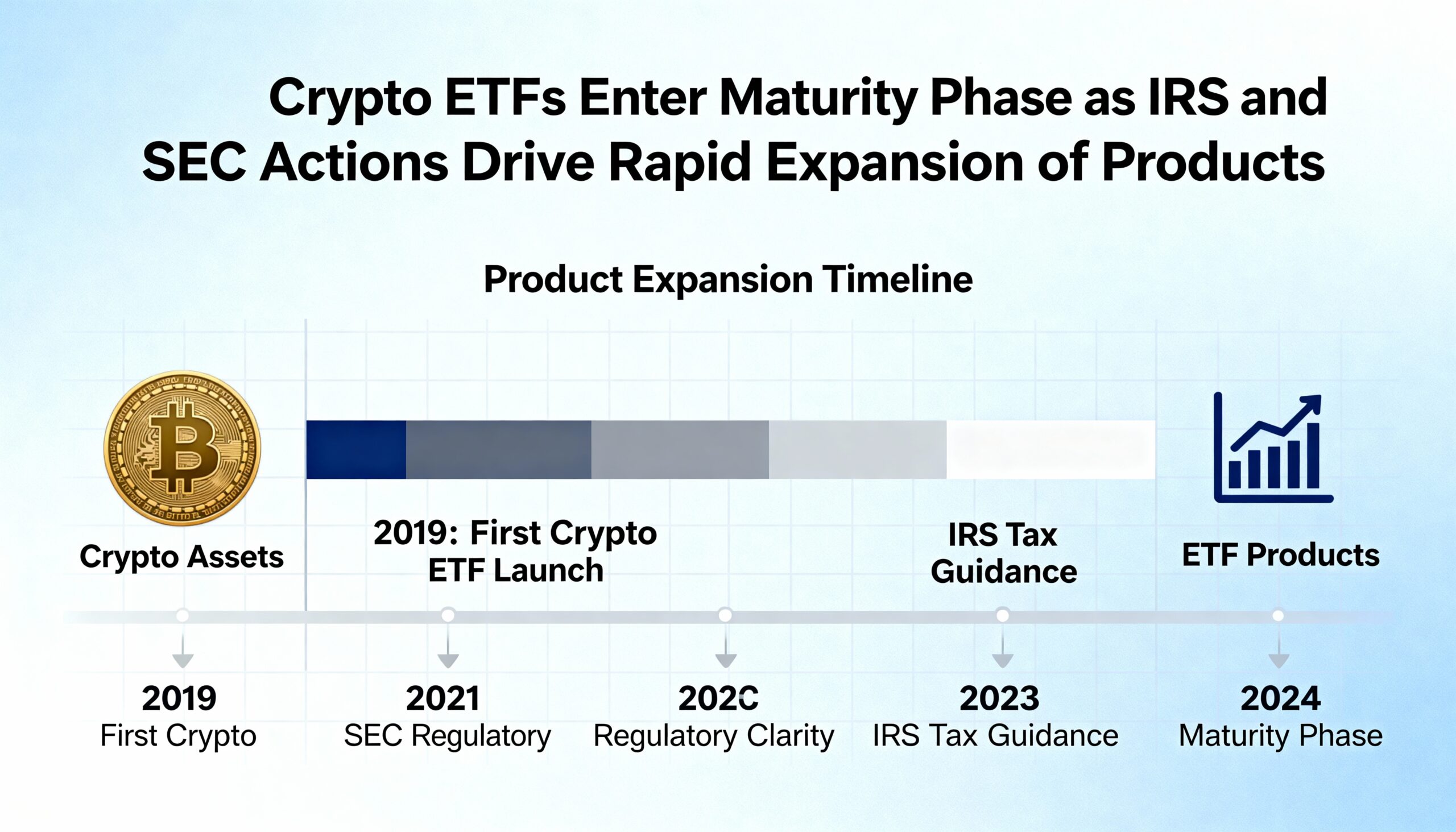

The discussion highlighted a shift in perception: crypto is moving from a speculative trading asset to a mainstream investment class. Earlier cycles were driven by price swings, momentum, and retail enthusiasm. Today, ETFs hold a meaningful portion of bitcoin’s ($86,124) market cap, while new spot funds for ether ($2,815) and major altcoins have brought digital assets into mainstream brokerage channels. Investors now expect ETFs to function more like long-term holdings than isolated bets.

Staking Guidance Brings On-Chain Yields to Regulated Funds

A major catalyst for this transition came from the IRS, which issued guidance allowing funds to stake assets like ether and solana ($129) without jeopardizing tax compliance. Staking, which secures blockchain networks and produces predictable yield, was previously only accessible through private wallets. The new framework allows ETFs to earn and distribute staking rewards while maintaining regulatory oversight, introducing on-chain economics into the traditional investment structure. For issuers, this requires managing lockups, liquidity, and redemption processes when assets are bonded.

SEC Listing Standards Accelerate Product Growth

Regulatory progress on the listing side has also accelerated adoption. The SEC introduced generic listing standards allowing exchanges to approve certain crypto ETFs without individual exemptions, creating a faster route for product launches. Funds for Solana, Litecoin ($83), and Hedera (HBAR) quickly followed. These standards rely on surveillance agreements and volume data to detect market manipulation, with plans to expand approvals as more assets meet the criteria, potentially paving the way for dozens of new ETFs.

Operational Infrastructure Evolves

Rapid approvals have required firms to refine internal processes. Auditors must handle quarterly reporting for 33 Act funds and tax events triggered by protocol changes. Swap desks are building structures to provide leverage, staking yield, and synthetic exposure without holding the underlying tokens. In-kind transactions help ETFs closely mirror underlying crypto markets while maintaining regulatory guardrails.

Index Funds and Diversification

Panelists also noted the growing role of diversified crypto index products. Many investors prefer broad exposure over picking individual blockchains. New index ETFs offer automated rebalancing, tax efficiency, and active management under the 40 Act framework—benefits that grantor trusts cannot provide.

Digital Asset Treasuries and Derivatives

The discussion touched on digital asset treasuries (DATs), which hold tokens as primary assets and may use debt to amplify exposure. While DATs offer flexibility and narrative-driven marketing, ETFs provide clearer mandates, tighter tracking, and established redemption flows. Retail familiarity with futures and derivatives remains limited, though increasing CFTC oversight may drive gradual adoption. ETFs, however, remain the simplest path for most investors.

Conclusion

The panel agreed: crypto ETFs have moved beyond the novelty stage. They are now embedded in a broad regulatory, operational, and strategic framework akin to traditional investment products. The challenge ahead is less about launching new access points and more about sustaining the infrastructure to support a growing ecosystem of strategies, assets, and investors.