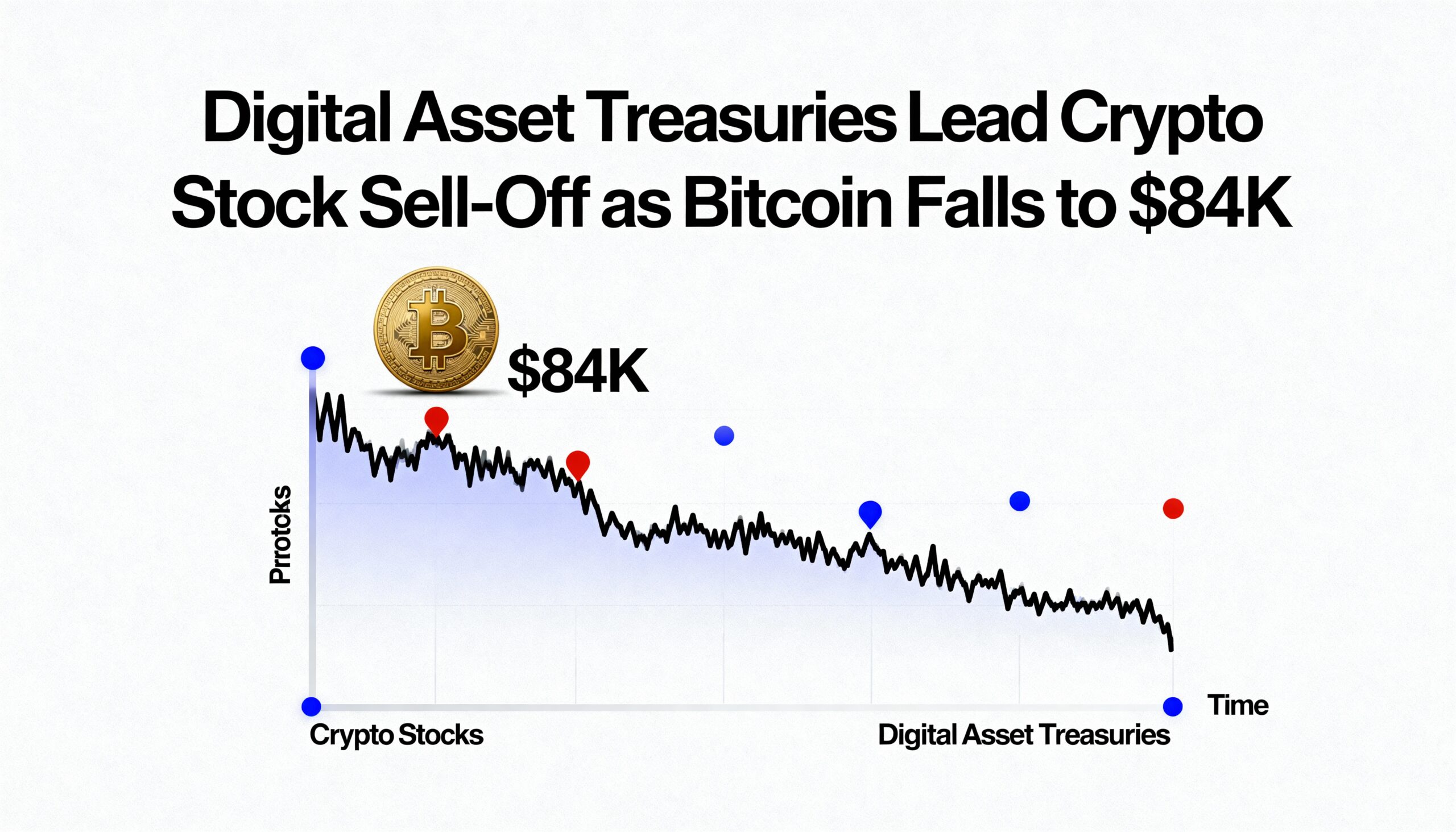

Crypto Stocks Slide as Bitcoin Falls Toward $84K Amid BoJ Rate-Hike Signals

Crypto-related stocks opened December lower as bitcoin dipped toward $84,000 during U.S. morning trading.

Major exchanges—including Coinbase (COIN), Gemini (GEMI), and Galaxy Digital (GLXY)—fell nearly 6%, while crypto miners MARA Holdings (MARA), Riot Platforms (RIOT), and Hive Digital (HIVE) dropped 7%–9%.

Bitcoin treasury play Strategy (MSTR) slumped 11% to its lowest level since October 2024 after announcing a $1.44 billion cash reserve and cutting its 2025 profit forecast. Other crypto treasury stocks also declined: Metaplanet (MTPLF) ADRs fell 10%, KindlyMD (NAKA) lost 9.9%, and American Bitcoin (ABTC) dropped 6.7%. Ether-focused BitMine (BMNR) and SharpLink Gaming (SBET) fell more than 10%, while Solana-focused firms DeFi Development (DFDV) and Solana Company (HSDT) posted double-digit losses.

Broader markets were weaker as well, with the Nasdaq down nearly 1% and the S&P 500 off 0.3%.

Analysts attributed part of the sell-off to renewed signals of potential interest-rate hikes from the Bank of Japan. Paul Howard, senior director at trading firm Wincent, said, “The potential rate hike news from BoJ took many in the markets by surprise and led to a pulldown in risk assets generally overnight. Cryptocurrency continues to be the risk-on asset class and a bellwether of macroeconomic events 24/7.”