The likelihood of Bitcoin (BTC) falling to $75,000 by March 28 has doubled, now sitting at 22%, as a renewed trade war between the U.S. and its major trade partners raises concerns about global inflation, according to data from Derive.xyz’s on-chain options market.

The surge in probability follows the imposition of 25% tariffs on imports from Mexico and Canada, along with 10% tariffs on Chinese goods, leading to fears that these moves will spur inflation, thereby limiting the ability of central banks—especially the Federal Reserve—to cut interest rates. According to Derive, this inflationary threat could erode investor confidence in risk assets like cryptocurrencies.

Bitcoin has already dropped 11% in just four days, currently hovering around $93,700, while Ethereum (ETH) has slipped below $2,200, its lowest point since August. Technical analysis suggests that BTC may be forming a double top reversal pattern, which could open the door for a drop to the $75,000 level.

While the short-term outlook is bearish, some analysts believe the longer-term potential for Bitcoin remains strong. Arthur Hayes, former BitMEX CEO and current CIO of Maelstrom, has stated that BTC will likely first dip to around $75,000 before entering a more significant bull run.

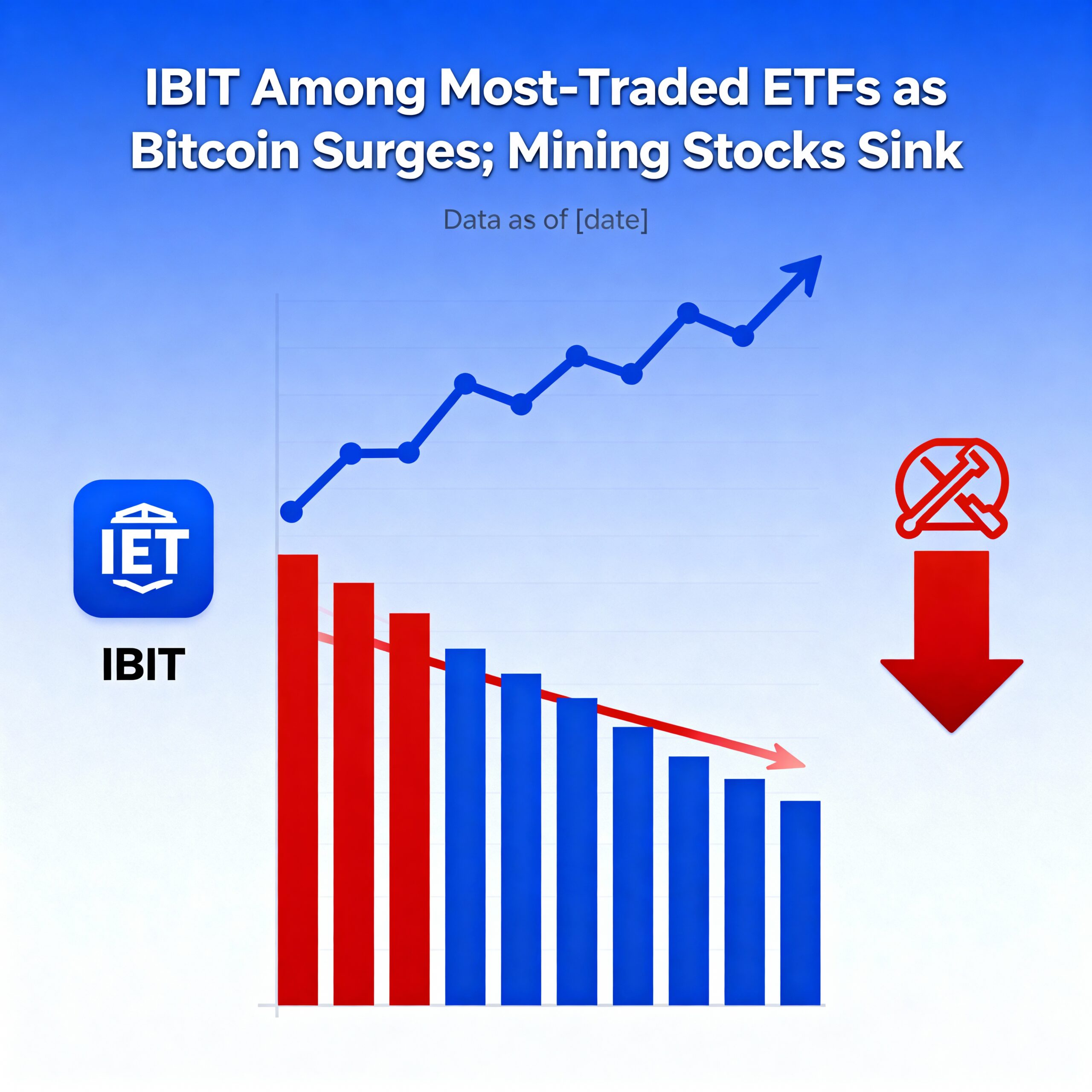

On a broader scale, Derive points to positive trends in the crypto industry. Notably, there are multiple active spot ETF filings for cryptocurrencies like DOGE, SOL, XRP, and LTC from major institutional players such as Bitwise and Grayscale. If the SEC approves these filings, it could provide further legitimacy to the crypto market, attracting institutional investment and potentially driving prices higher.

Bitwise’s Andre Dragosch also anticipates that the Fed will eventually intervene to support the economy. “At some point, the Fed will likely reintroduce quantitative easing to stem the rise of the dollar and avoid further tightening of financial conditions, which could hinder global growth,” Dragosch commented.