Ether Breaks Above $2,600 as Markets Brush Off Geopolitical Risks, Institutional Demand Surges

Ethereum’s price climbed past $2,600 on Monday, tracking gains across global risk assets as investors largely dismissed intensifying conflict in the Middle East. ETH rose 3.71% in the last 24 hours, peaking at $2,636.76 before stabilizing near $2,614 in early U.S. trading.

The advance came amid surprisingly resilient global markets. Despite escalating tensions—including a renewed missile barrage and threats of retaliation from Israel’s defense chief—traditional assets rallied. Gold pulled back slightly, while equities in Tel Aviv and futures across Europe and the U.S. opened higher. Citigroup’s Luis Costa pointed to investor optimism around a restrained or short-lived military escalation.

Crypto markets mirrored this sentiment shift. All top 20 non-stablecoin tokens were trading in the green, with Ether benefiting from a fresh wave of institutional inflows.

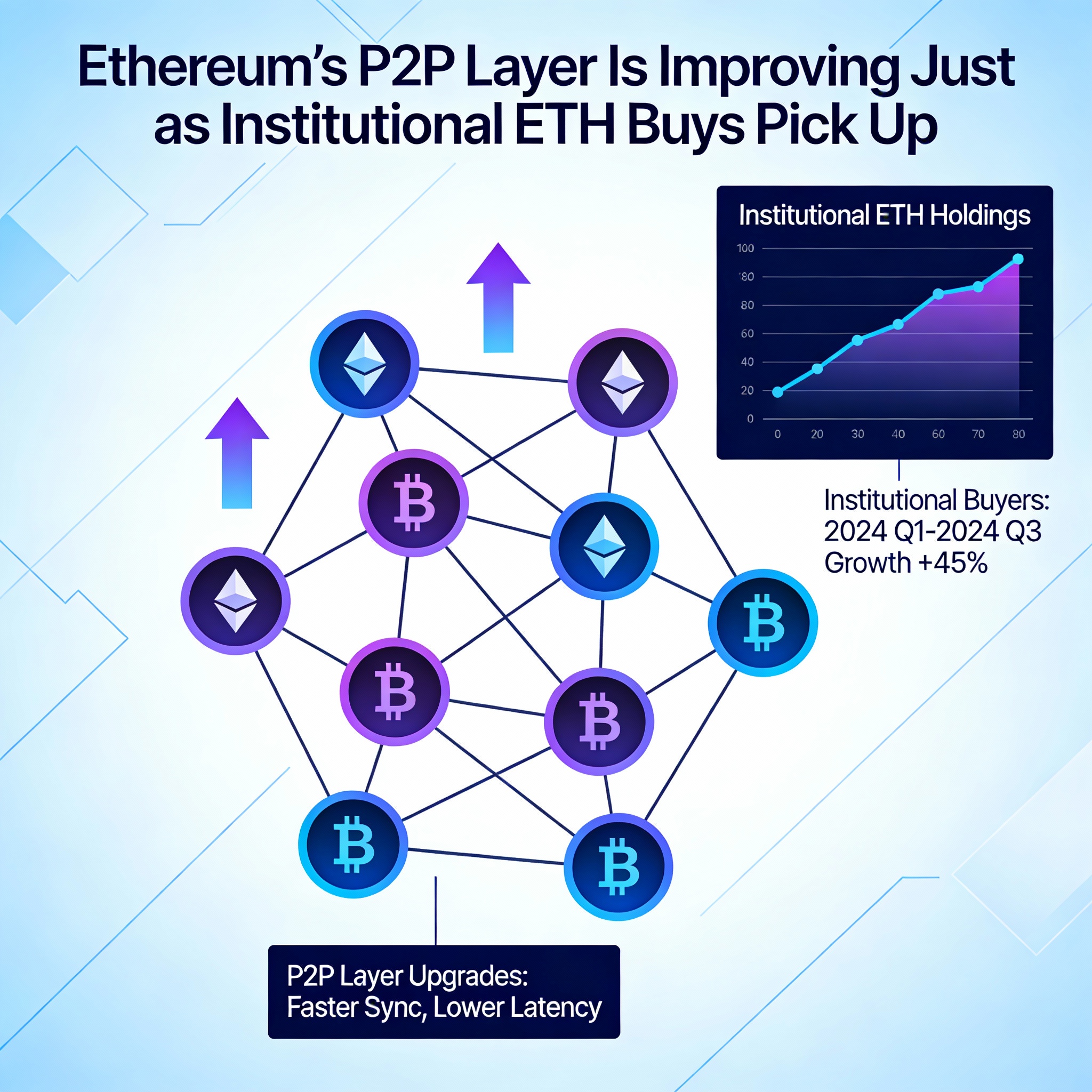

According to CoinShares’ latest weekly fund flow report, Ethereum investment products saw $583 million in net inflows last week—the strongest figure since February. ETH has now attracted $2 billion in cumulative inflows over the last nine weeks, making up 14% of total assets under management in Ethereum-linked products.

Derivatives data also reflects growing investor interest. Open interest in ETH futures has climbed to 13.89 million ETH (about $36.32 billion), per CoinGlass, signaling increased positioning from sophisticated traders anticipating continued price momentum.

Technical Analysis Snapshot

- Intraday Range: ETH moved within a $126.66 range, from $2,510.10 to $2,636.76, representing a 5.05% swing.

- Breakout Confirmation: Price breached the $2,550 resistance level with strong volume, forming a series of higher highs and lows.

- Volume Spike: The 05:00 GMT candle saw over 311,000 ETH traded, establishing support around $2,575.

- Momentum Strength: ETH printed three consecutive hourly green candles above $2,600, confirming persistent buying pressure.

- Volatility Spike: A brief dip at 07:18 GMT took ETH from $2,629.02 to $2,622.88 before quickly rebounding.

- Chart Structure: Final half-hour of trading showed ETH consolidating in a tightening range between $2,627 and $2,630, forming an ascending triangle—often a precursor to further upside.

Ether’s strength—despite macro headwinds—underscores growing confidence from institutional players and a possible shift in market structure. If bullish momentum holds, ETH could soon test resistance near $2,675 and beyond.