Bitcoin has staged a strong rebound off the $80,000–$83,000 support band and is now testing the Friday swing high near $93,100. A confirmed move above that level would bring the trendline drawn from the Oct. 8 all-time highs into play, which remains a key short-term resistance zone.

For now, consolidation looks likely. The hourly MACD histogram is producing shallow positive bars, signaling fading upside momentum, even as the daily MACD maintains a bullish posture—suggesting the consolidation may ultimately resolve higher. On the downside, the $80,000–$83,000 zone remains the critical level that bulls must defend.

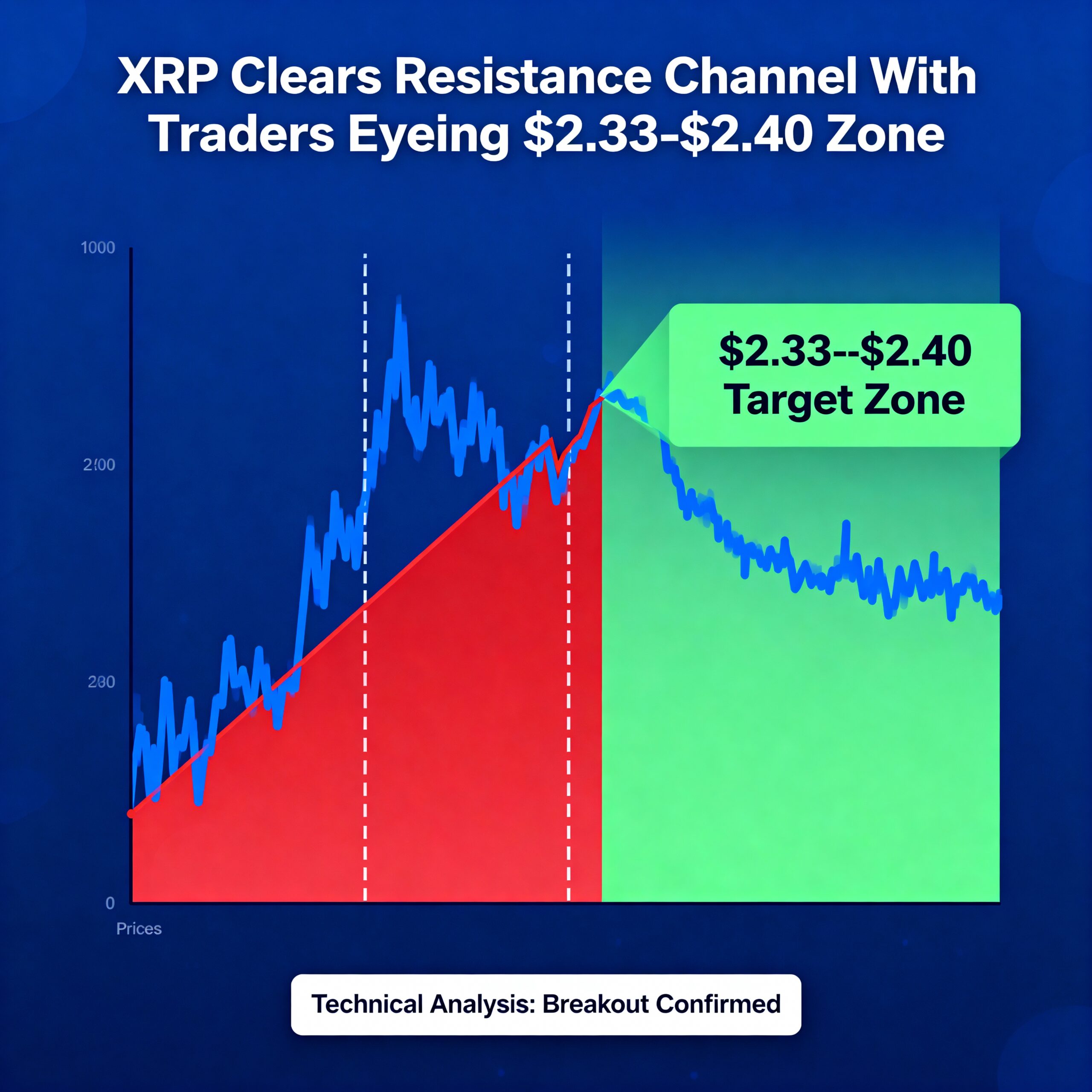

XRP has once again rebounded from its long-standing $2 support, pushing back above the Ichimoku cloud on the hourly chart. The intraday trend has shifted firmly upward, though the token still needs to clear resistance at $2.28–$2.30 to extend the move. A successful breakout would shift focus toward the bearish trendline near $2.50, while a failure could trigger another pullback toward $2.00.

Ether’s hourly chart shows a textbook bear trap: price briefly broke below the lower boundary of its descending channel before snapping back higher. This type of move following a downtrend often signals seller exhaustion and a shift in control toward buyers. With bulls now pressing the momentum, ETH is targeting Friday’s swing high at $3,100, followed by potential upside toward the $3,500 level tied to the Oct. 10 decline. Key support sits at $2,600–$2,700.

Solana is approaching the upper edge of its well-defined sideways range around $145. A strong breakout above that level would create room for an advance toward $165. While the hourly MACD suggests waning bullish momentum, the daily MACD remains supportive, making an eventual upside breakout the more likely scenario.