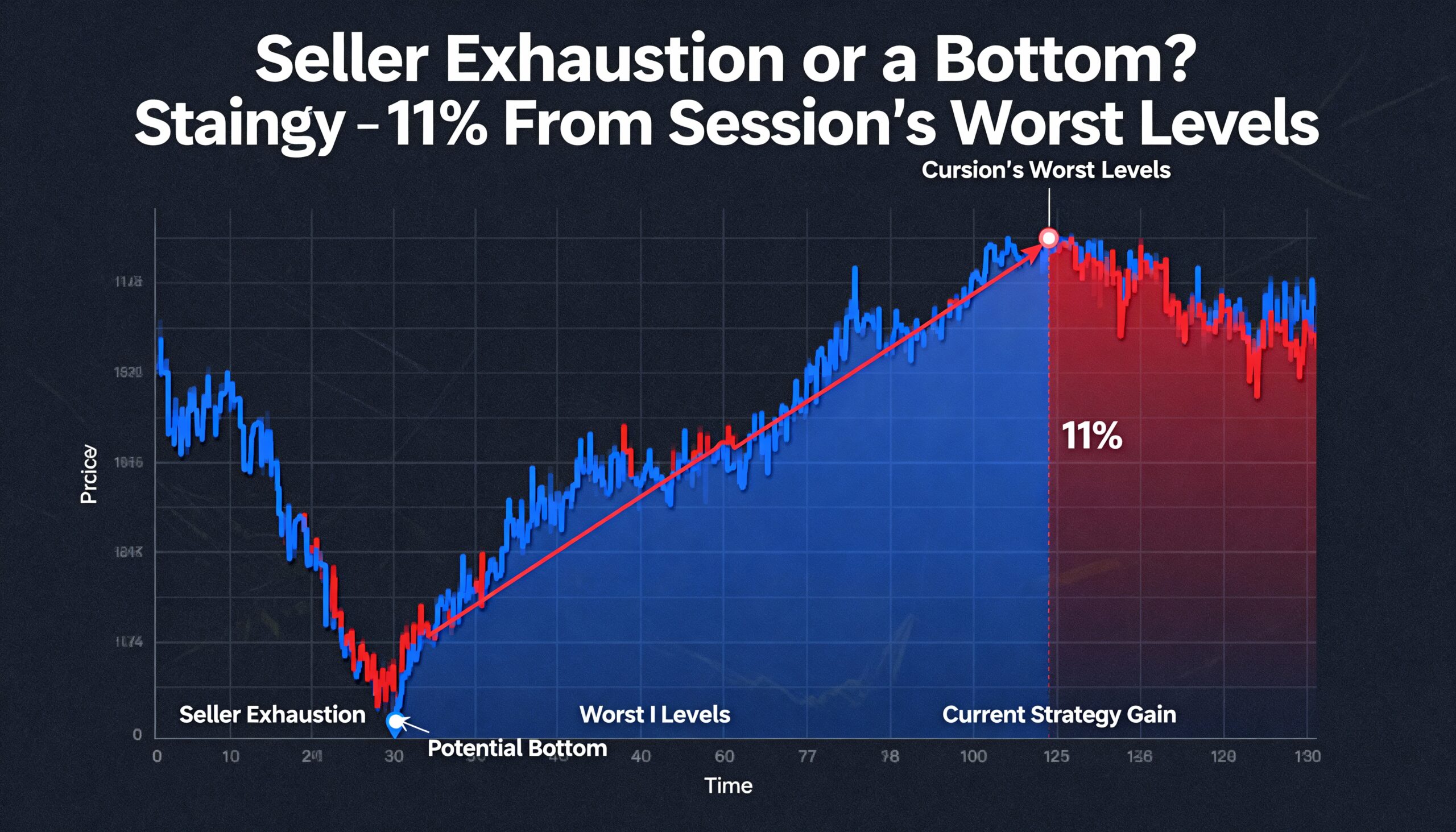

Strategy Stock Crashes on Capital Raise Before Staging Strong Intraday Comeback

Strategy (MSTR) kicked off the week with a sharp sell-off after the company disclosed it had raised $1.44 billion through common stock issuance to build a reserve for nearly two years of preferred dividend payments. The announcement — paired with a steep overnight slide in bitcoin — sent the stock tumbling 12.5% to its weakest level in almost 15 months during early Monday trading.

Bitcoin offered no relief throughout the session, hovering near its lows around $85,000. Even so, Strategy shares mounted an impressive rebound, clawing back most of the morning’s losses to close lower by only 3.25%. The move appears largely driven by shorts covering positions: at its intraday bottom of $155.61, MSTR was down nearly 40% in a month and 66% from its July 2025 peak, leaving bearish traders with little incentive to stay in.

Responding to persistent questions about how it would fund preferred dividends, Strategy revealed it had quietly sold stock over recent weeks to accumulate the $1.44 billion reserve. Management aims to extend the coverage period from 21 months to at least 24 months. With bitcoin falling and the company’s market valuation sliding relative to its roughly 650,000 BTC holdings, the firm appeared intent on avoiding forced bitcoin sales.

The capital raise sparked immediate pushback from common shareholders worried about dilution, fueling the heavy morning decline.

The announcement also gave longtime bitcoin critic Peter Schiff an opening to attack the company’s strategy.

“Strategy is now issuing stock, buying 4% Treasuries, and using that yield to service obligations costing 8%–10%,” Schiff said. “How long are investors going to pretend this is sustainable just to speculate on Bitcoin?”

He went further: “This is the start of Strategy’s unraveling. Saylor wasn’t selling stock to buy Bitcoin — he was selling to raise dollars to keep up with interest and dividend payments. The model is broken, and Saylor is the biggest con man on Wall Street.”

Whether Monday’s rebound represents a durable turning point remains uncertain. But history suggests that Schiff has often celebrated prematurely — and previous episodes of similar pessimism have sometimes marked moments just before major reversals in both Strategy shares and bitcoin itself.