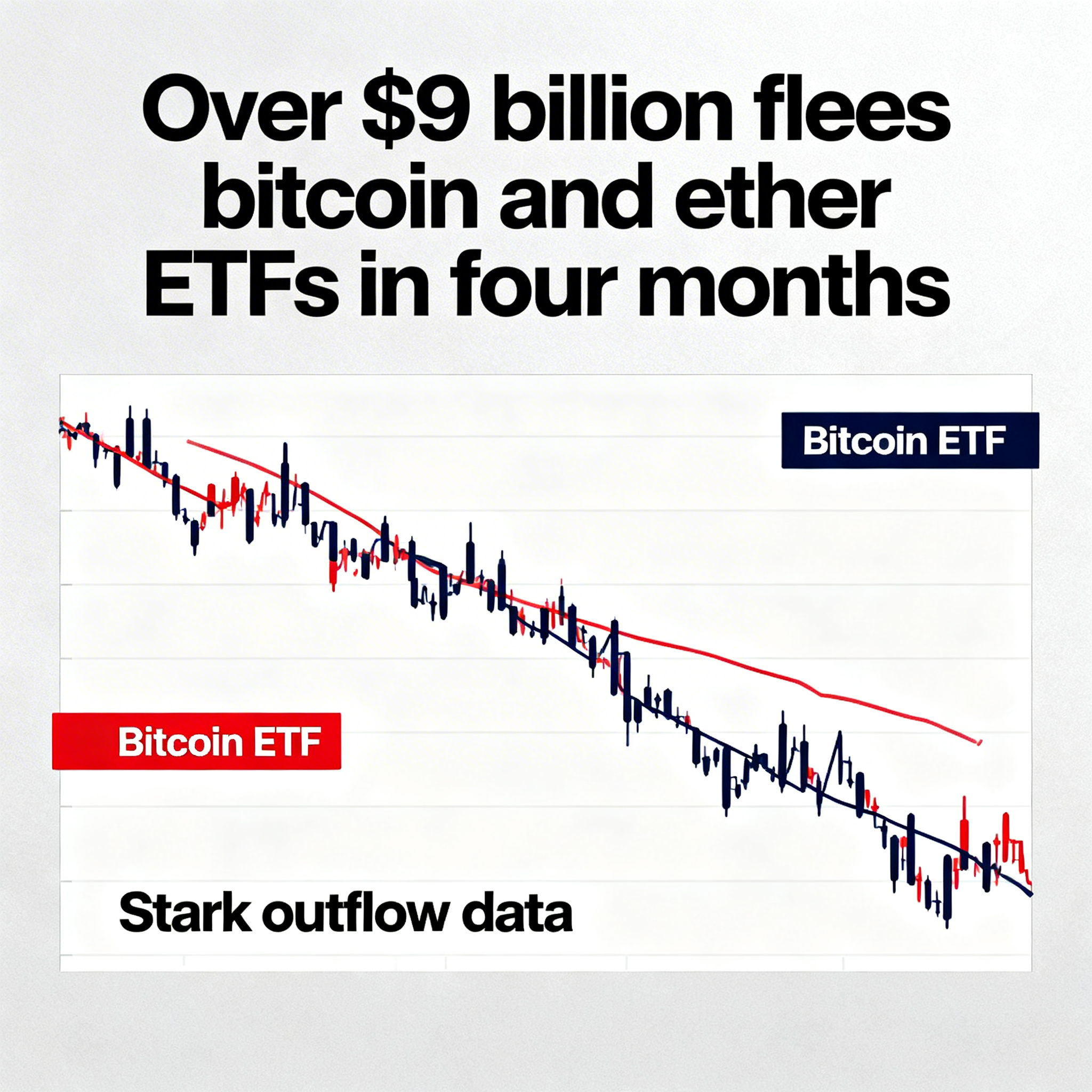

GameStop’s (GME) bitcoin holdings were valued at $519.4 million as of Nov. 1, the end of the third quarter, with the company reporting a $9.2 million loss on its digital assets during the period. Bitcoin prices slipped from around $115,000 to roughly $110,000 over the three months ending Nov. 1.

The video game retailer is believed to still hold 4,710 BTC, the same amount it purchased between early May and mid-June using proceeds from a $1.3 billion debt offering announced in March. The company has neither added to nor sold any of its bitcoin since the initial purchase, choosing to maintain its position through market fluctuations.

GameStop shares fell 5.8% on Wednesday after sales results fell short of investor expectations. The company’s decision to adopt bitcoin as part of its treasury strategy marked a notable shift in March, as it continues to navigate challenges regaining momentum after its pandemic-era meme stock surge.

Since announcing its bitcoin initiative, GameStop’s shares have dropped more than 22%, reflecting investor concerns over combining crypto exposure with a core business that remains under pressure.