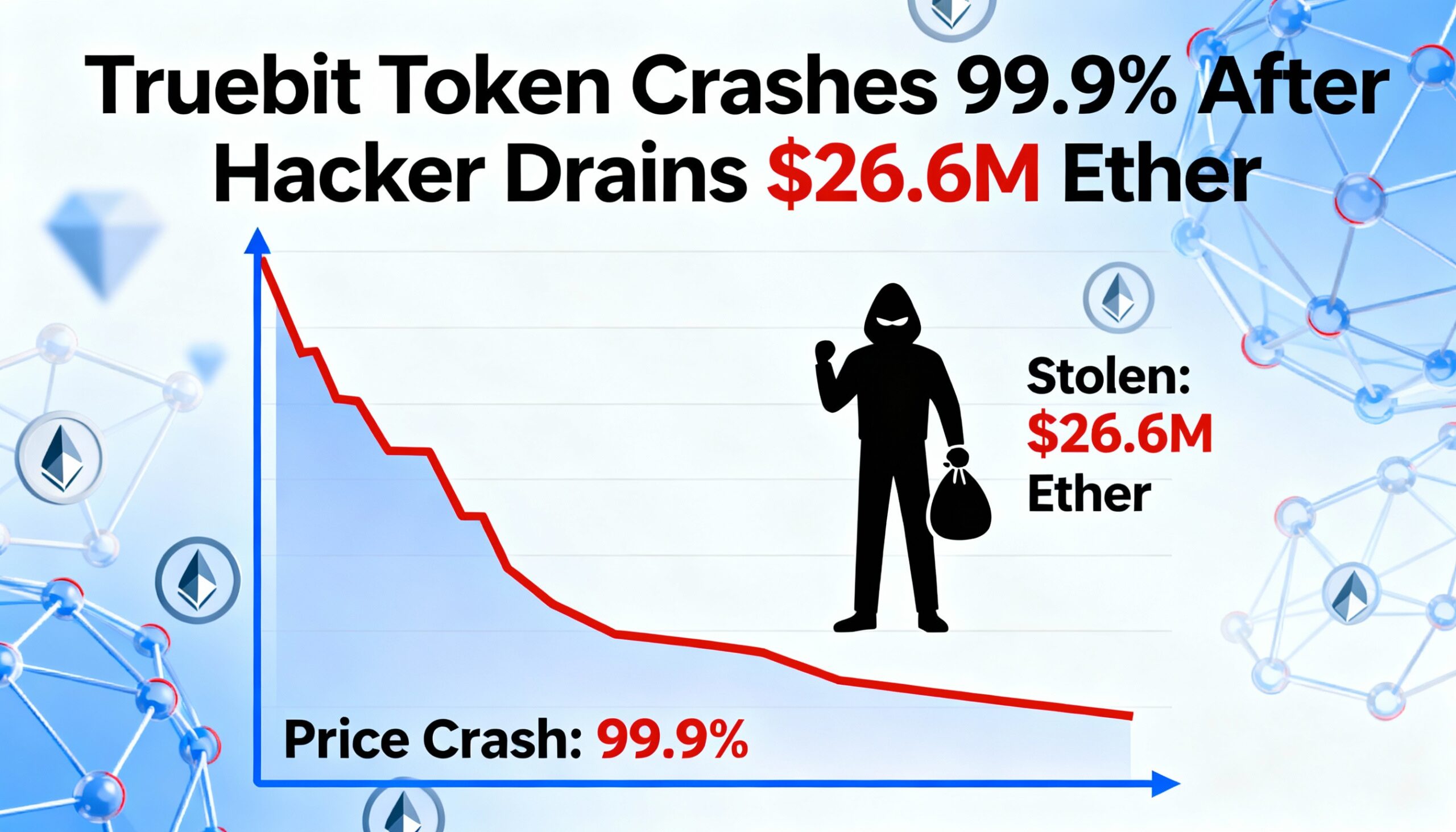

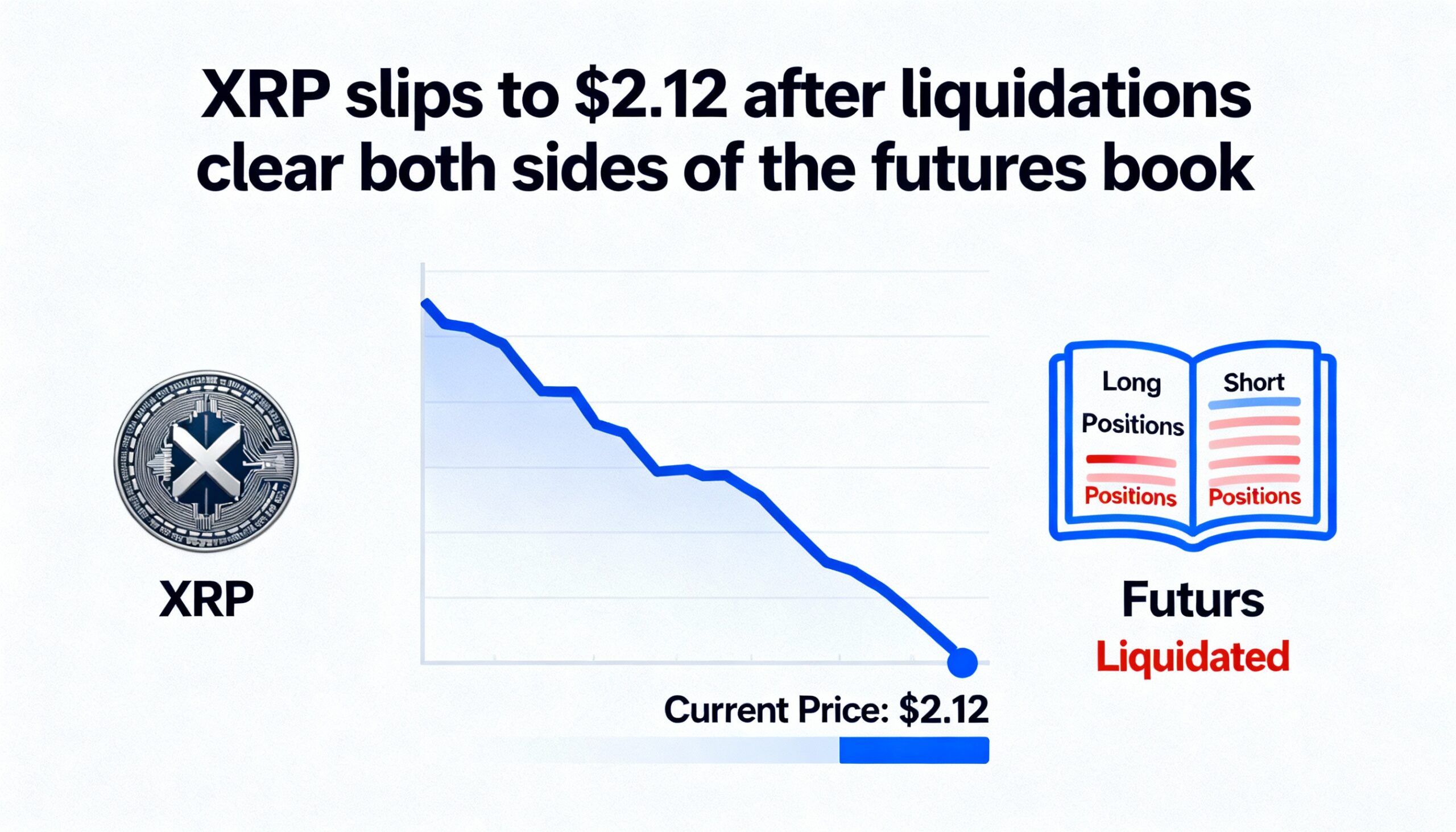

As 2025 draws to a close, few events rattled the crypto market more than the Oct. 10 “flash crash,” when bitcoin (BTC $87,784.51) plunged nearly $12,000 — almost 10% — within minutes. The sudden drop triggered more than $19 billion in liquidations, circulated a “cascade warning” among traders, and erased roughly $500 billion from total crypto market capitalization.

The crash sparked a prolonged decline, leaving bitcoin over 30% below its $126,223 peak just six days earlier. This downturn is expected to mark bitcoin’s first full-year loss since the 2022 crypto winter.

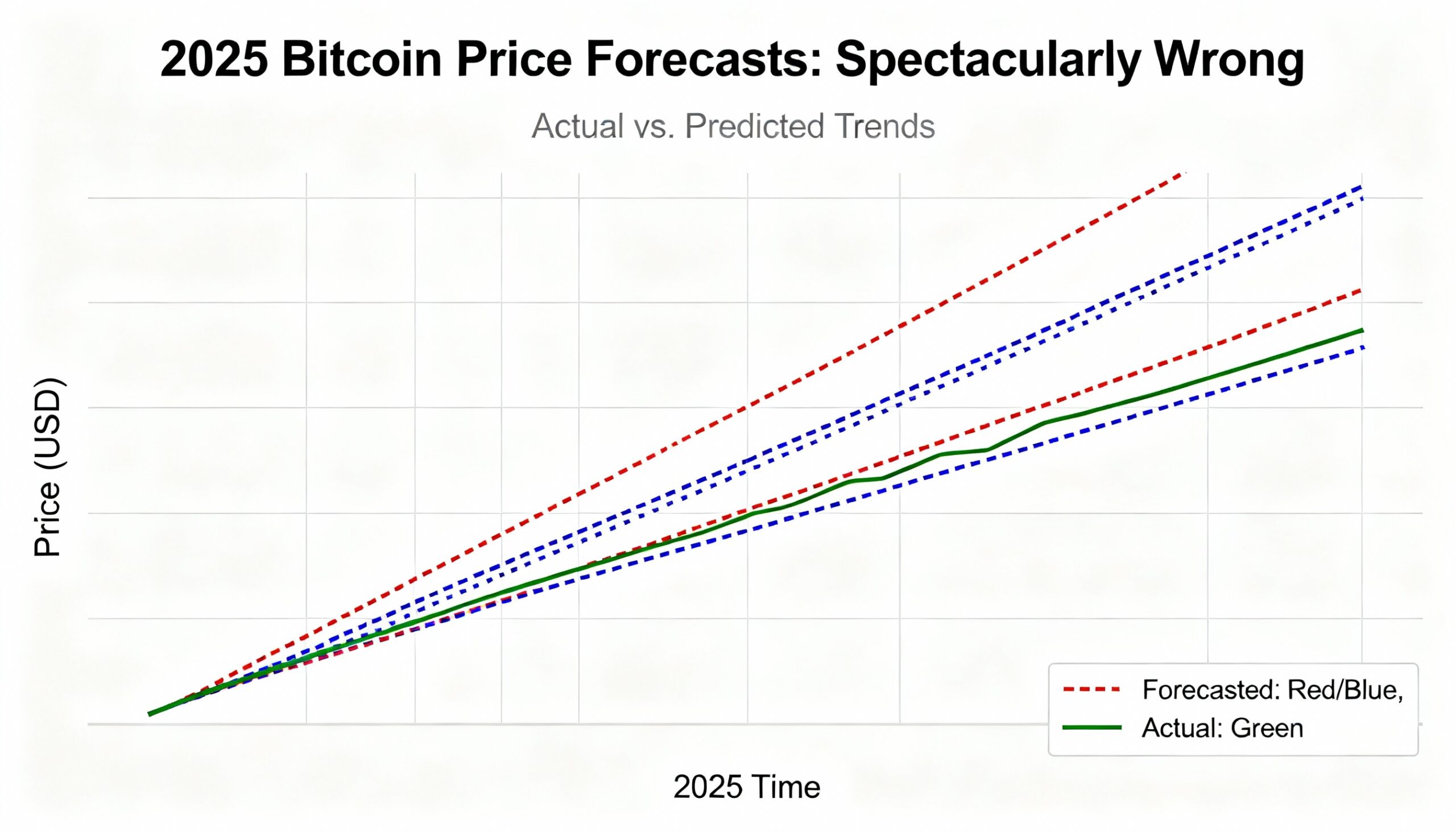

The year had begun with optimism. Price forecasts ranged from conservative estimates to ambitious projections, but the October crash quickly proved most predictions overly optimistic. Some long-term targets were extraordinary: Fidelity’s Jurrien Timmer projected $1 million by 2038, and BlackRock CEO Larry Fink suggested $700,000 if institutional adoption scaled.

Even 2025-specific forecasts were bold. Samson Mow of Jan3 predicted a “violent” surge to $1 million, while Blockstream CEO Adam Back projected $500,000–$1 million, citing ETF inflows, institutional buying, and limited supply. Venture capitalist Chamath Palihapitiya also forecast $500,000 by October.

Conservative estimates still exceeded bitcoin’s all-time high. JPMorgan analysts raised their pre-crash October forecast to $165,000, while Michael Saylor of Strategy (MSTR) expected $150,000 post-crash. Strategy added $1 billion in BTC in December, bringing total holdings to 671,268.

Throughout the year, predictions consistently missed the mark. Only a few adjusted, like Galaxy Digital’s Mike Novogratz, who revised his $500,000 forecast to $120,000–$125,000, and Standard Chartered, which cut its target to $100,000.

The lesson of 2025 is clear: bitcoin humbles everyone. It defies models, ignores charts, and proves that while forecasts are easy to make, being right is rare.