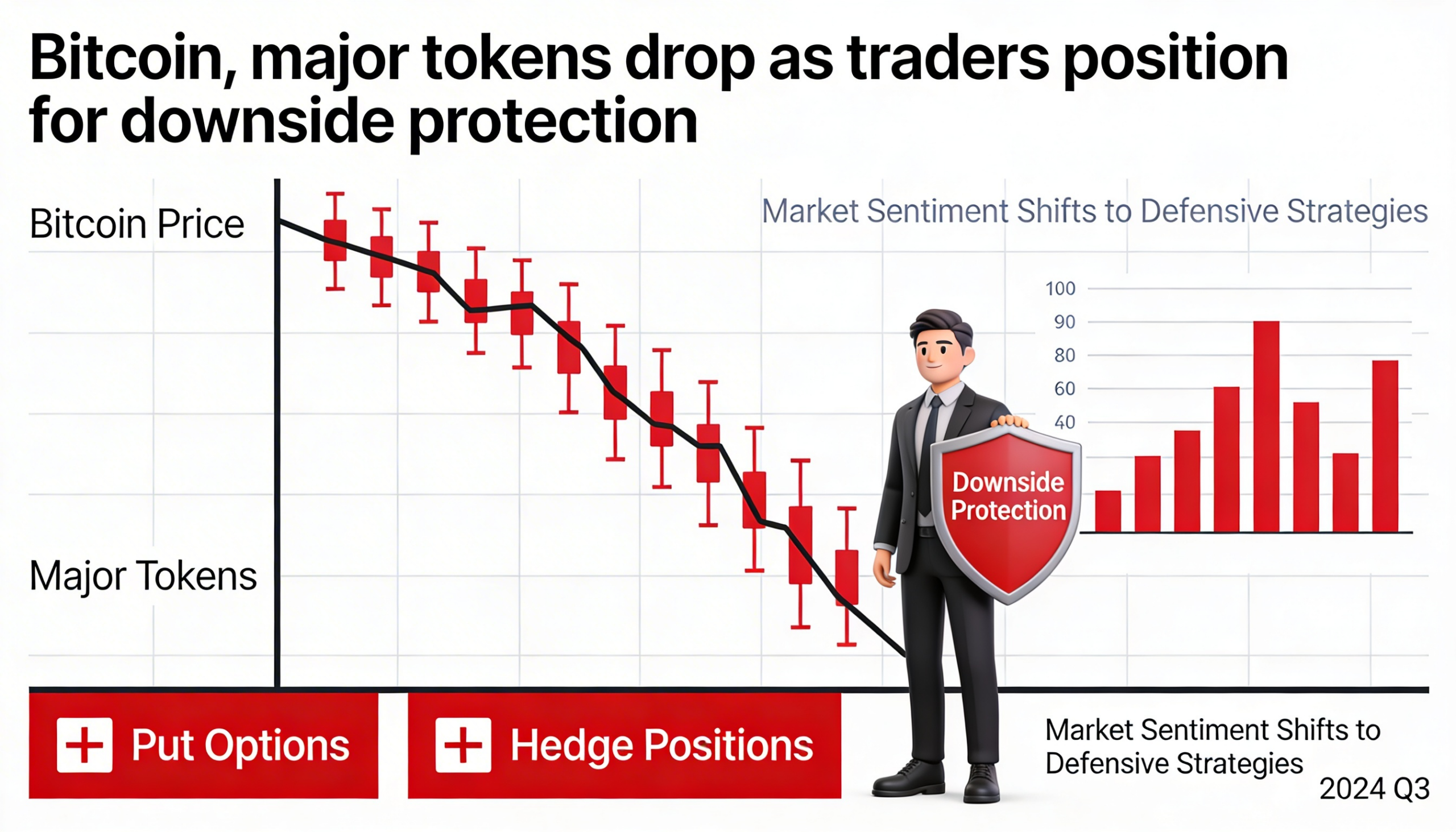

Bitcoin extended losses on Monday as derivatives data highlighted a clear shift toward risk-off positioning across crypto markets.

BTC slipped below $70,000, down more than 2.8% in 24 hours, though still well above recent lows near $60,000. Traders remain divided over whether the market is entering a deeper bear phase or approaching a bottom, with some bulls noting slowing declines as a potential sign of exhaustion.

The broader market also weakened. The CoinDesk 5 Index (CD5) fell 3.4%, while Ether underperformed, dropping roughly 5% to $2,037 but holding above $2,000. The CoinDesk 20 (CD20) index declined 3.7% as traders reduced exposure to major tokens.

Derivatives show cautious positioning

Bitcoin futures open interest fell from $19 billion to $16 billion over the past week, indicating ongoing deleveraging. Funding rates on Bybit (-2.24%) and Binance (-0.5%) turned negative, signaling short sellers are increasingly in control.

Options data confirmed the defensive mood: one-week 25-delta skew rose to 20%, call dominance dropped to 48%, and implied volatility entered extreme backwardation, with front-end volatility at 85% versus ~50% for longer-dated contracts.

Liquidations totaled $397 million in 24 hours, split evenly between longs and shorts. Bitcoin accounted for $234 million, Ether $74 million, and Solana $14 million. Binance data points to $68,160 as a key level for potential further liquidations.

Rainbow token launch hits turbulence

Rainbow’s RNBW token struggled after launching on Ethereum’s Base layer-2 network, dropping to $0.025 — a 75% decline from its $0.10 ICO — before bouncing to $0.031.

Distribution delays to early buyers and rewards participants contributed to the selloff. U.S. investors will not gain full access until December 2026. Co-founder Mike Demarais cited backend infrastructure strain.

Rainbow, known for its gamified wallet features, raised $18 million in a 2022 Series A led by Reddit co-founder Alexis Ohanian’s Seven Seven Six. The token’s fully diluted valuation has fallen to roughly $31 million from earlier expectations of $100 million.