Fed Expresses Concern Over Stagflation Risks, Analyst Predicts Positive Outlook for Bitcoin

The Federal Reserve is becoming increasingly cautious about the potential for stagflation—a challenging blend of rising inflation and stagnating growth that could create major obstacles for policymakers.

While Federal Reserve Chair Jerome Powell reassured markets by stating that the U.S. economy remains in “good shape” and that the Fed is “in a good position to wait and see” before adjusting its policy stance, subtle changes in the language of the central bank’s statement suggest growing concerns about the economy’s direction.

In its latest meeting, the U.S. central bank decided to hold its key interest rates steady, acknowledging that the risks of both inflation and rising unemployment are becoming more pronounced—effectively pointing toward stagflation, a situation reminiscent of the 1970s. This would leave the central bank with limited options for supporting the economy without worsening inflation.

“There’s a clear worry about stagflation at the Fed,” said Zach Pandl, head of research at Grayscale, on social media. “We believe this scenario could be bullish for bitcoin.”

Pandl has argued that increasing tariffs could contribute to stagflation, which historically undermines traditional assets like stocks and bonds but benefits assets like gold, which are seen as scarce stores of value. While bitcoin wasn’t available during previous stagflation periods, he noted that it has characteristics of a modern, scarce commodity and is increasingly seen as a store of value in the current financial landscape.

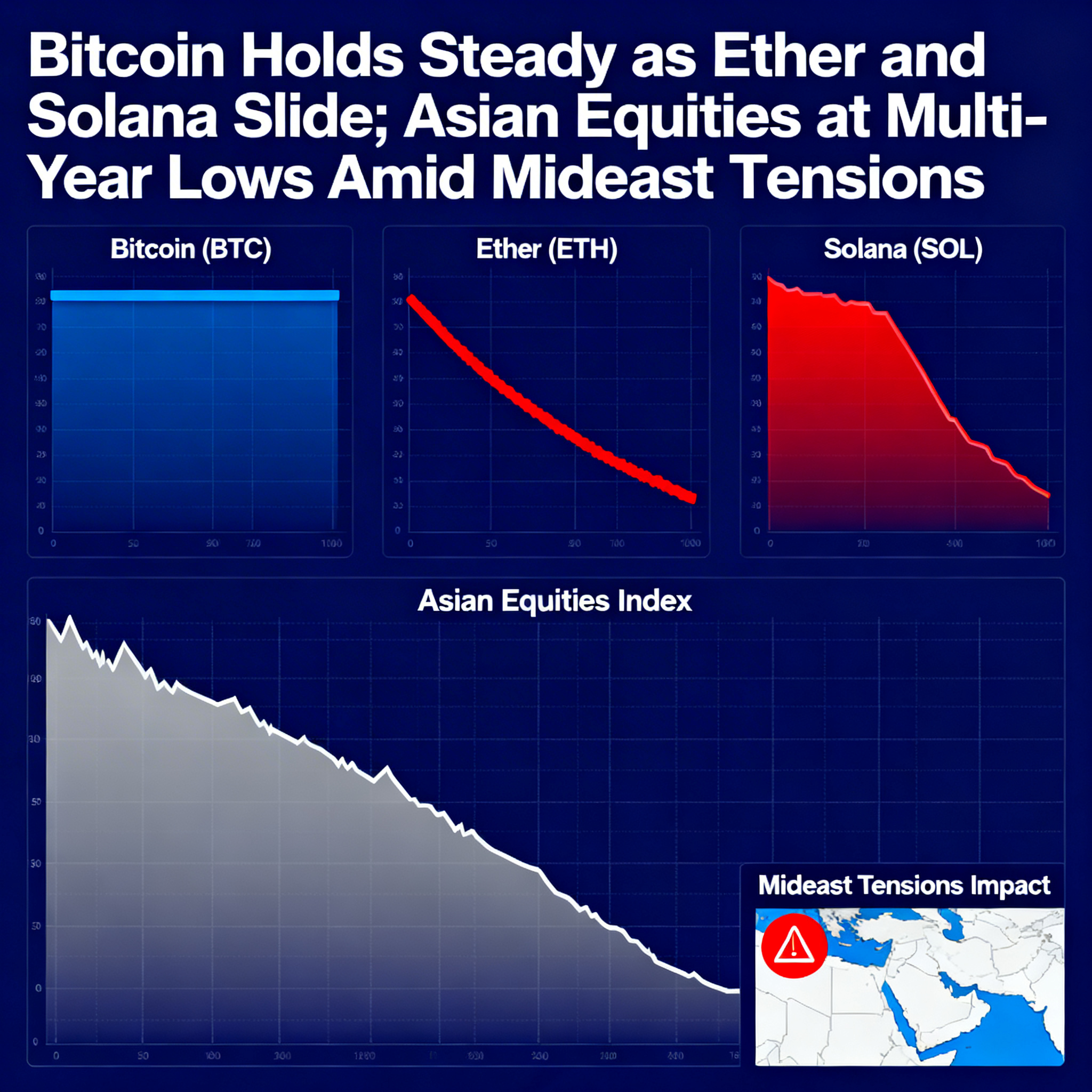

Following the Fed’s announcement, bitcoin traded within a narrow range, briefly touching $97,500 before retreating back to $96,500, marking a 1.6% increase over the last 24 hours.

In contrast, the broader crypto market, as reflected by the CoinDesk 20 Index (CD20), saw modest gains of 0.3%. Altcoins such as XRP, AVAX, UNI, NEAR, and AAVE experienced declines in the range of 1% to 3%.

Meanwhile, U.S. stock indices showed a modest recovery, with the S&P 500 and Nasdaq finishing 0.4% and 0.3% higher, respectively.