MicroStrategy Lags Behind Bitcoin as Market Premium Narrows and Funding Model Shifts

Despite Bitcoin’s steady climb toward new highs, shares of MicroStrategy (MSTR), now known simply as “Strategy,” are underperforming. The company, once the clear leader in corporate bitcoin accumulation, is now facing renewed scrutiny as its valuation premium compresses and capital-raising methods evolve.

Bitcoin has gained roughly 13% in May, reaching nearly $110,000, while Strategy’s stock has dropped 3%, currently trading around $372. The performance gap, which has widened significantly since mid-May, suggests the market is reassessing the company’s role in the maturing bitcoin treasury landscape.

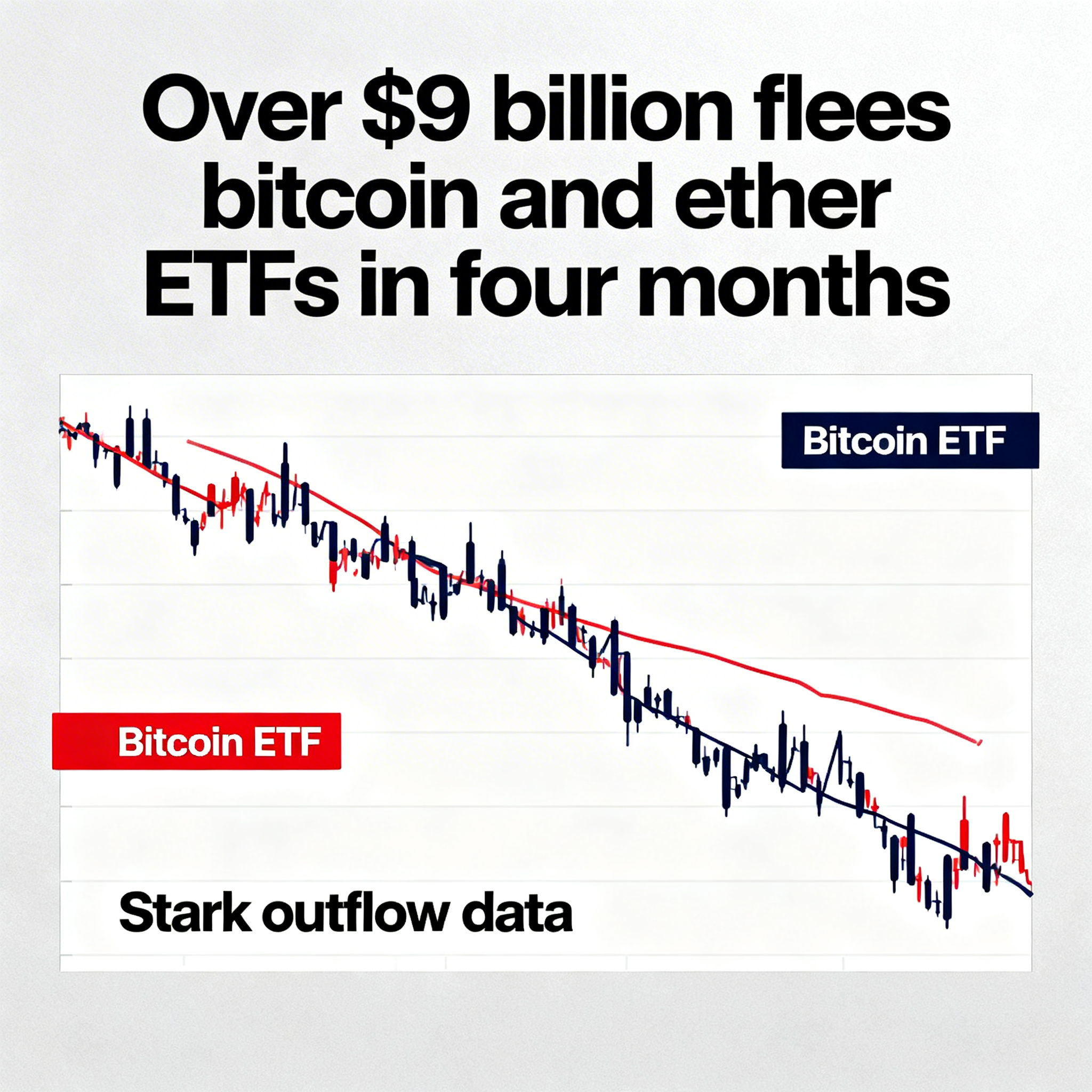

More public companies are now entering the space. According to BitcoinTreasuries.net, 113 publicly traded firms currently hold BTC, with 11 joining in just the past month. This increased competition appears to be diluting Strategy’s early-mover advantage.

The market-to-net asset value ratio (mNAV)—a key valuation metric for bitcoin-holding firms—has fallen to 1.80 for Strategy, among its lowest in a year. The mNAV compares the company’s enterprise value (including equity, debt, and preferred shares) to its total bitcoin holdings. A shrinking mNAV reduces the company’s ability to raise capital through new share issuance without significantly impacting existing shareholders.

In response, Strategy is diversifying its funding approach. Its latest bitcoin purchase—4,020 BTC—is its smallest since May 5 and was financed through a mix of common equity (81.7%) and preferred securities (15.9% STRK, 2.4% STRF), according to analyst Ben Werkman. This marks a shift from earlier accumulation rounds, which leaned heavily on equity sales.

The revised funding strategy reflects an effort to maintain bitcoin acquisition momentum while managing dilution risk. Still, with the stock under pressure and rivals quickly adopting similar treasury models, Strategy may face increasing difficulty maintaining its leadership narrative in the digital asset space.