Ether Reclaims Momentum, Outperforming DeFi and Bitcoin Amid Layer-1 Competition

Ether (ETH) is staging a strong comeback, outperforming both the decentralized finance (DeFi) sector and Bitcoin, while challenging rival layer-1 blockchains such as Solana.

In the past 30 days, ETH has surged 45%, compared to 21% gains in the DeFi market and a 13% rise for Bitcoin, according to data from DefiLlama.

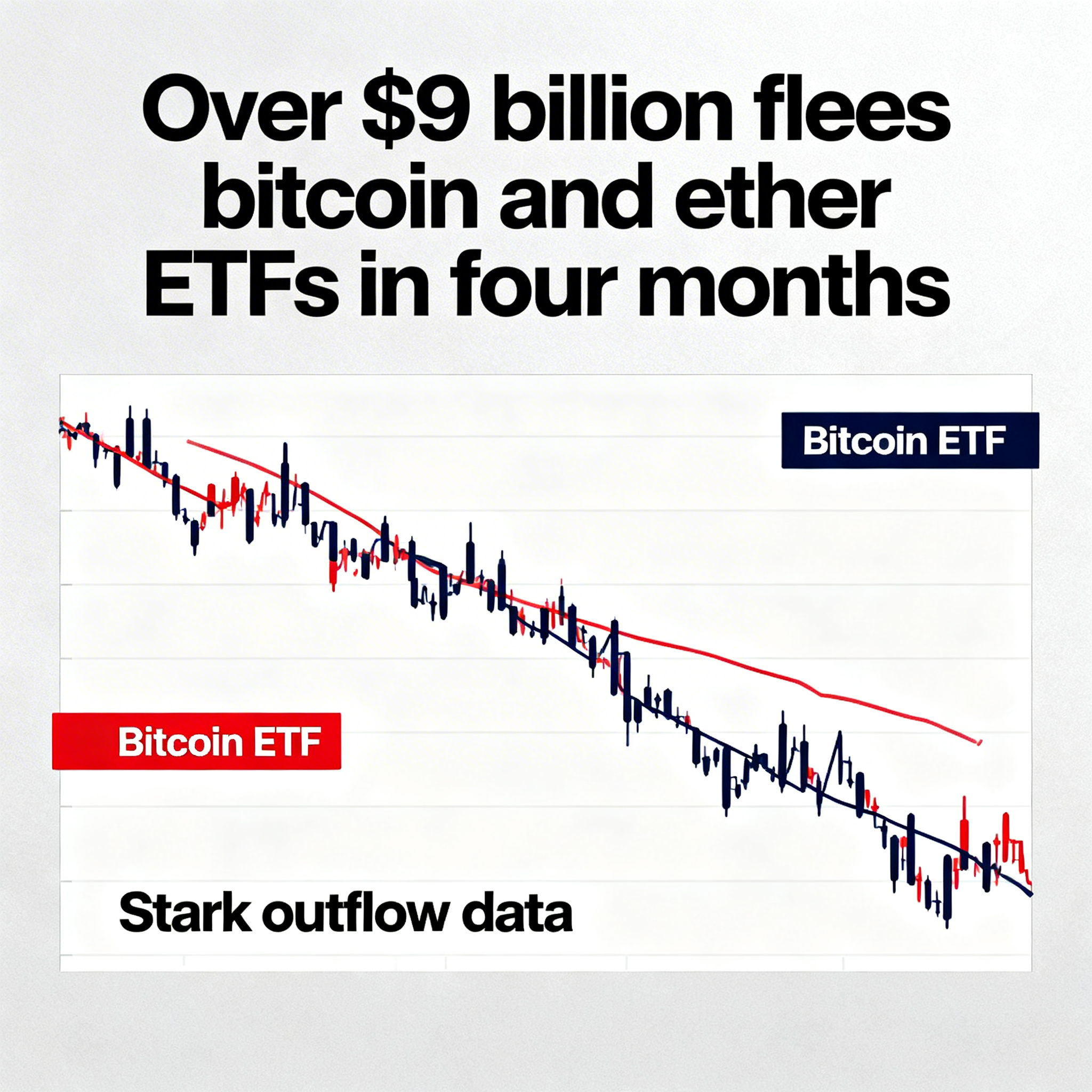

This rebound is largely fueled by increased institutional interest, reflected in record-breaking inflows into spot ETH exchange-traded funds (ETFs).

Earlier this year, Ether’s price momentum slowed as layer-1 competitors like Solana captured attention, boosted by a wave of memecoin launches. ETH started 2025 at $3,340 but fell sharply to $1,472 in early April amid global uncertainty tied to U.S. tariff tensions.

However, as highlighted in a recent CoinDesk report by analyst Omkar Godbole, Ether has broken an 18-month downtrend against Solana, signaling a potential shift in market dominance back to Ethereum.

Yield incentives are a major factor behind ETH’s resurgence. DefiLlama shows total value locked (TVL) in Ethereum restaking platforms such as EigenLayer and Ether.fi rising between 41% and 48% this month, while Binance’s staked ETH product posted a 63% TVL increase.

Meanwhile, Solana-based DeFi protocols have lagged, with Jupiter and Kamino registering modest TVL growth of 7% and 9%, and Marinade’s liquid staking protocol increasing by 29%.

Ether’s recovery highlights growing institutional demand and robust expansion within the Ethereum DeFi ecosystem, setting the stage for renewed competition in the layer-1 space.