Bitcoin Investors Hold Their Ground as Accumulation Trend Builds in April

Bitcoin (BTC) may be trading well below its all-time highs, but data suggests that both short-term traders and long-term believers are doubling down in early April.

Analytics from Glassnode show a notable trend shift: short-term holders—those in the market for under 155 days—have begun accumulating again, despite recent volatility. This group, often associated with emotional trading, has increased its holdings by roughly 15,000 BTC since the beginning of the month, pushing their total stash above 3.7 million BTC.

Their return as buyers follows a wave of selling that began in February, when roughly 280,000 BTC were offloaded. Much of that distribution came during a period of heightened profit-taking after a Trump-election-fueled surge and amid panic selling triggered by Bitcoin’s sharp decline from January highs.

Long-term holders, on the other hand, have continued to show unwavering confidence. Since February, they’ve added about 400,000 BTC to their holdings, with minor continued buying in April, bringing their total to over 13.5 million BTC. These seasoned investors appear unfazed by market noise and are quietly reinforcing their positions.

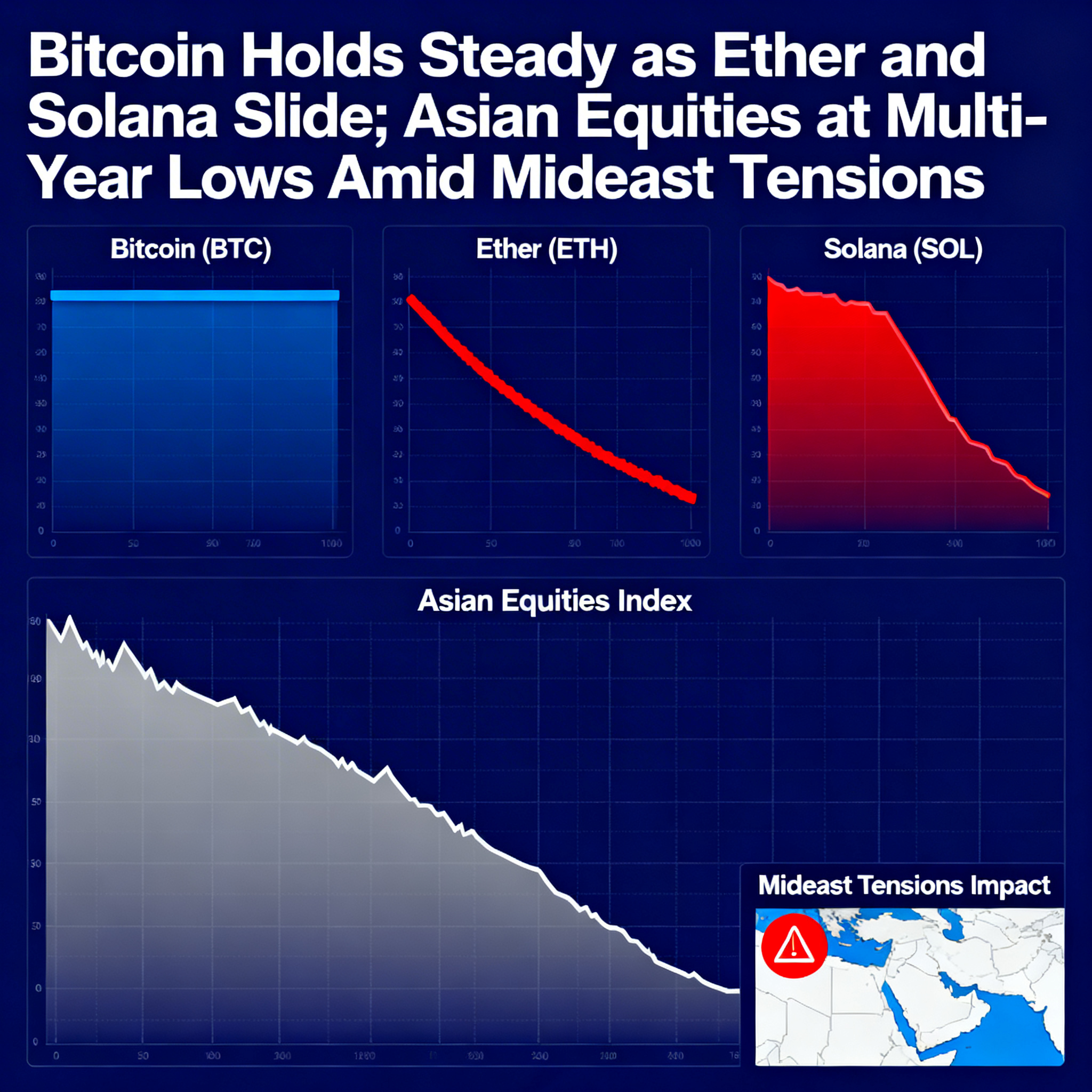

While Bitcoin has traded mostly sideways since the start of the month, its resilience stands out against traditional markets. The Nasdaq is down 3.5% over the same period, with futures pointing toward further losses—highlighting BTC’s relative stability in a shaky macro environment.