Bitcoin Rebounds to $93K as Altcoins Lag, Precious Metals Shine

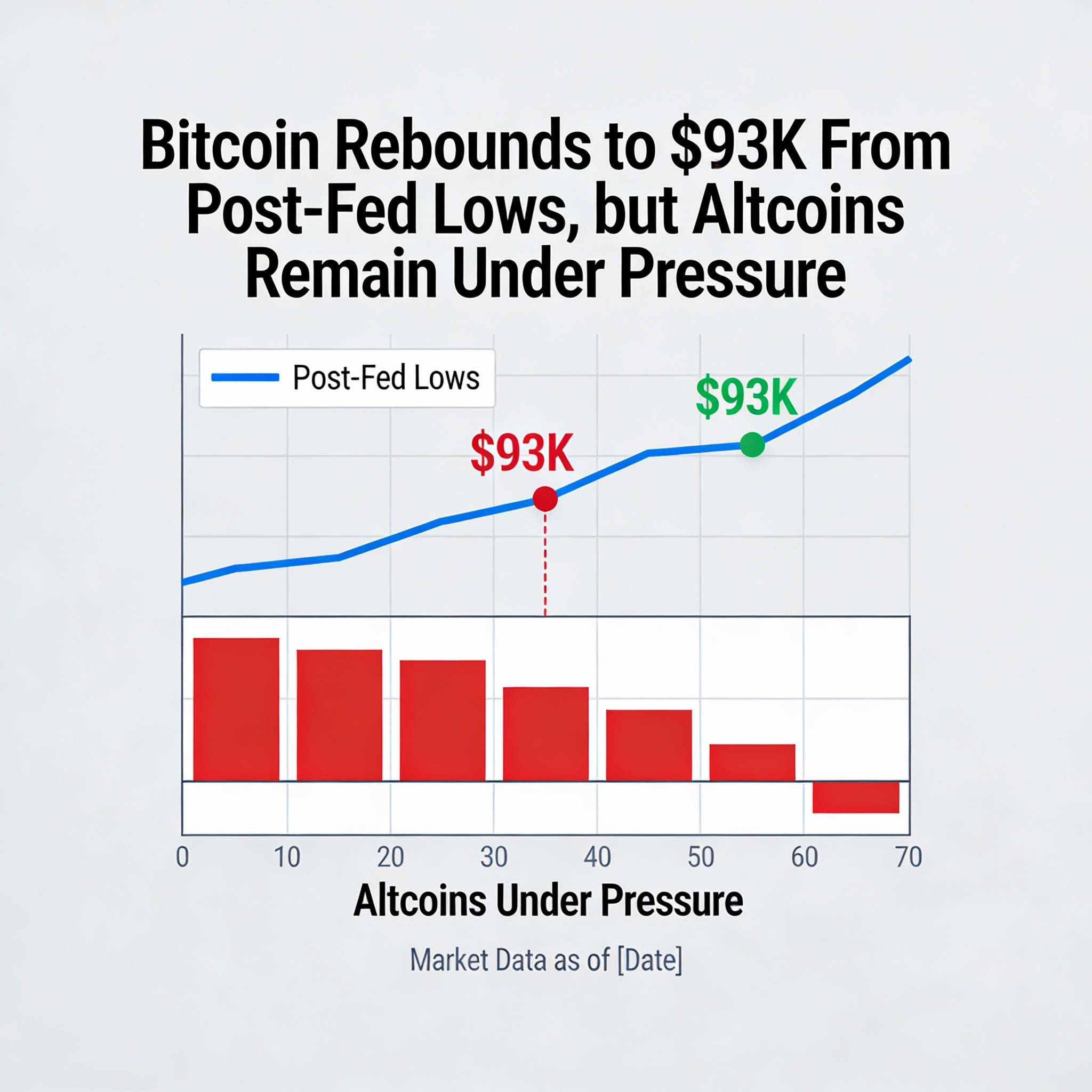

Bitcoin (BTC) clawed back to $93,000 on Thursday after falling to $89,000 following the Federal Reserve’s Wednesday rate cut and a weak U.S. stock open. Over the past 24 hours, BTC has gained modestly, signaling that downward pressure may be easing, though analysts caution the market is not yet fully out of the woods.

Altcoins largely failed to join Bitcoin’s recovery. Cardano (ADA) and Avalanche (AVAX) led losses, down 6%-7%, while Ether (ETH) slipped 3%, remaining above $3,200.

Bitcoin’s late-day bounce coincided with a partial recovery in U.S. equities. The Nasdaq closed down just 0.25% after earlier losses of 1.5%, the S&P 500 ended slightly positive, and the Dow Jones gained 1.3%.

Precious metals outperformed, with silver soaring 5% to a record $64 per ounce and gold rising over 1% to near $4,300, aided by a weaker U.S. dollar index (DXY), which fell to its lowest since mid-October.

Crypto exchange Gemini stood out among crypto stocks, surging more than 30% on news of receiving regulatory approval to offer prediction markets in the U.S.

Crypto Diverges from Equities

Jasper De Maere, desk strategist at Wintermute, noted that Thursday’s price action highlights crypto’s growing decoupling from equities, particularly around macroeconomic events.

“Only 18% of sessions in the past year have seen BTC outperform the Nasdaq on macro days,” De Maere said. “Yesterday fit that pattern: equities rallied while crypto sold off, suggesting the rate cut was fully priced, and marginal easing is no longer providing support.”

He added that early signs of stagflation concerns are emerging ahead of 2026, and markets are beginning to shift focus from Fed policy toward U.S. crypto regulation as the next major driver.

Bitcoin Sell Pressure Eases

Analytics firm Swissblock observed that Bitcoin’s downward pressure is slowing, with the market stabilizing.

“The second selling wave is weaker than the first, and selling pressure is not intensifying,” the firm said in an X post. “There are signs of stabilization… but not confirmation.”