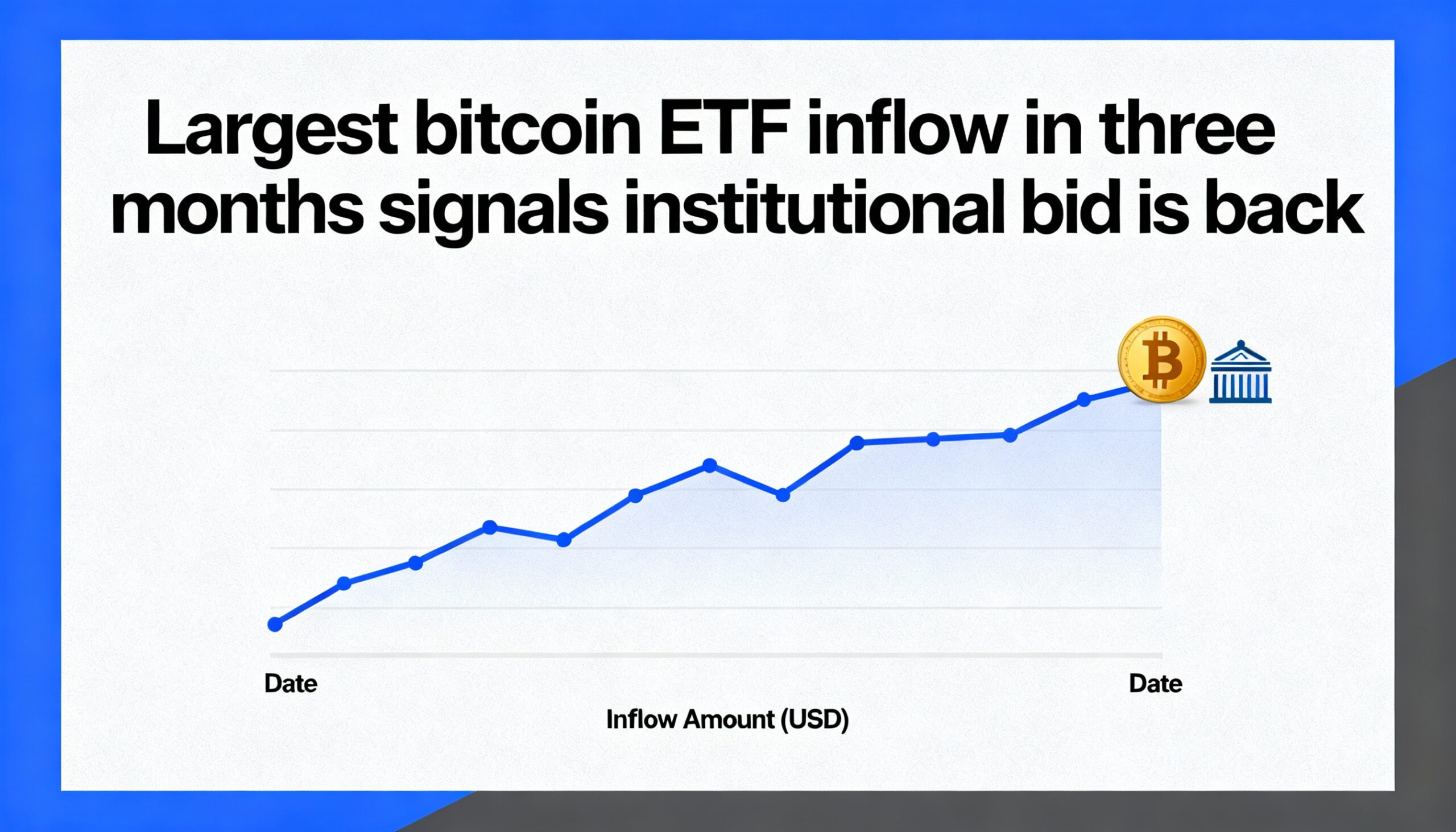

Bitcoin ETFs See Strongest Inflows Since Early October as Market Sentiment Improves

U.S.-listed bitcoin exchange-traded funds recorded $697.2 million in net inflows on Monday, the largest single-day intake since Oct. 7, according to Farside data.

The surge brings total ETF inflows to roughly $1.2 billion over the first two trading sessions of 2026, aligning with a nearly 7% rise in bitcoin (BTC $92,052), which has climbed from about $87,000 at the start of the year to just under $94,000.

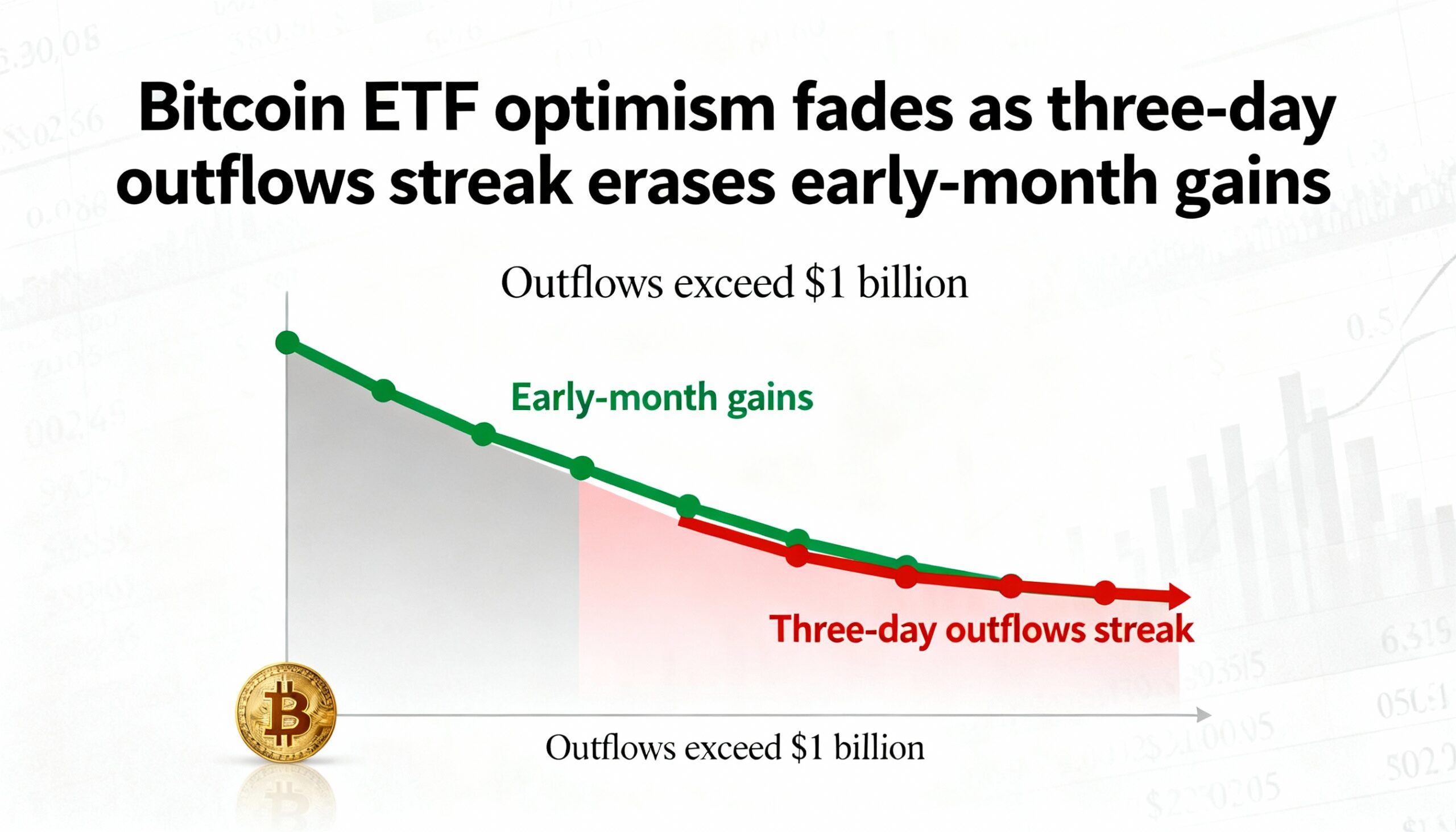

Flow data suggests ETF activity has historically marked key inflection points in bitcoin’s price cycle. Since the launch of spot bitcoin ETFs in January 2024, extended stretches of net outflows — tracked via a 30-day moving average — have often coincided with local price bottoms, according to Glassnode.

Examples include August 2024, when the unwinding of the yen carry trade pushed bitcoin down to around $49,000, and April 2025 during the “tariff tantrum,” which saw prices find support near $76,000.

After remaining negative through much of late 2025, ETF flows are now turning positive. The shift is echoed by the Coinbase premium index, which has recovered toward mildly negative territory, suggesting selling pressure has eased and the market is moving away from capitulation dynamics.