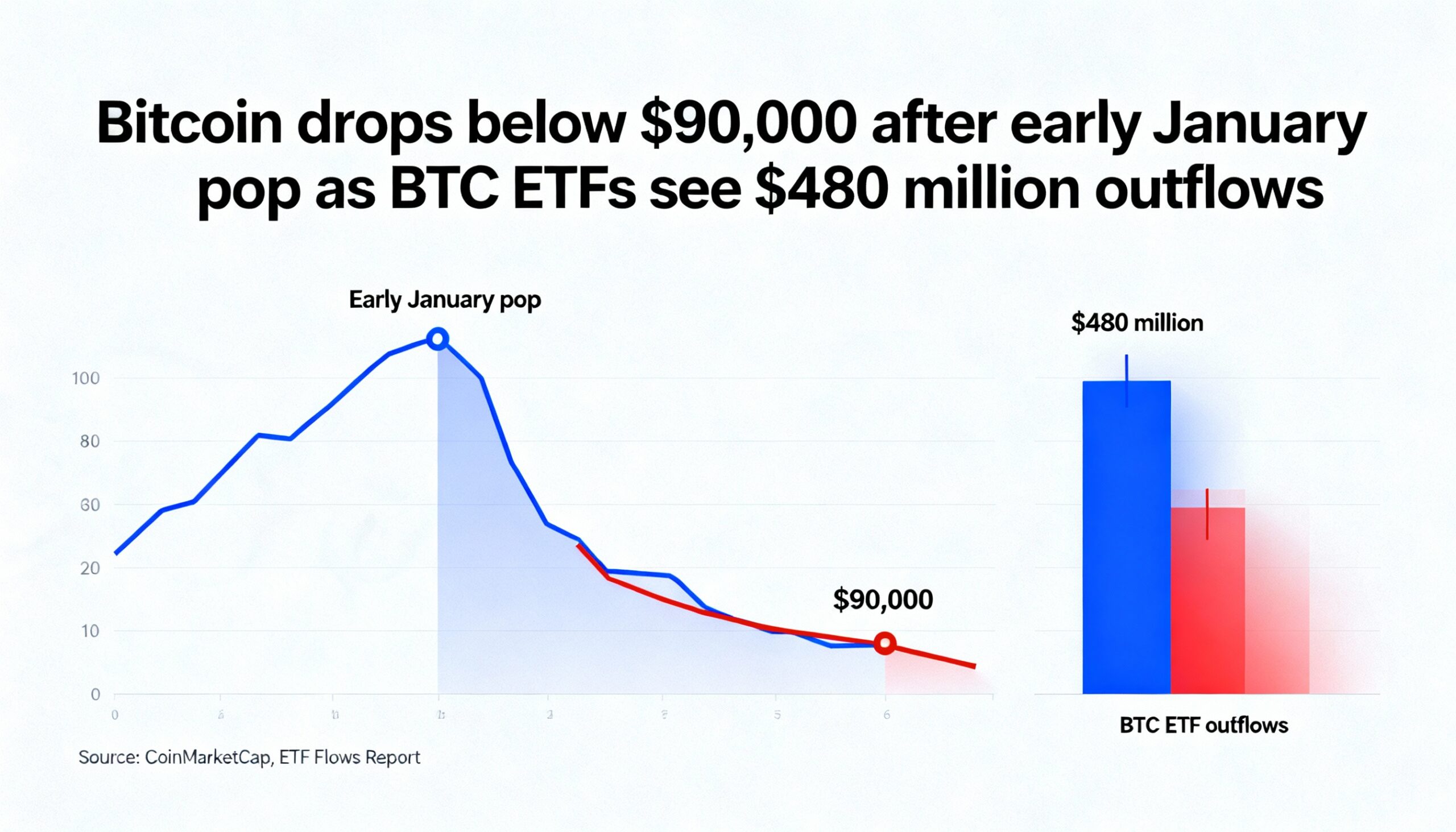

Spot bitcoin and ether ETFs recorded fresh outflows on Dec. 24 as traders headed into the Christmas holiday amid thinning liquidity and a softer appetite for risk.

SoSoValue data showed bitcoin spot ETFs posted $175 million in net outflows on Wednesday, while ether spot ETFs saw $57 million exit the category.

BlackRock’s iShares Bitcoin Trust (IBIT) led the day’s redemptions, with $91.37 million leaving the fund. Grayscale’s GBTC followed with $24.62 million in outflows.

Ethereum-focused ETFs also saw continued pressure. Net outflows from ether spot ETFs totaled $52.7 million, according to SoSoValue, led by Grayscale’s ETHE, which shed $33.78 million. That pushed ETHE’s cumulative historical net outflows to $5.083 billion.

The lone offset came from Grayscale’s Ethereum Mini Trust ETF, which recorded $3.33 million in inflows and has now accumulated $1.506 billion in cumulative net inflows.

The flow pattern aligns with typical holiday trading dynamics. Volumes tend to decline sharply, desks operate with reduced staffing, and positioning becomes more defensive. Under these conditions, even relatively small trades can have an outsized impact on ETF flows, especially as market makers widen spreads and investors choose to hold cash rather than carry exposure through illiquid sessions.

Importantly, ETF outflows do not necessarily signal a shift toward bearish sentiment. Some of the activity reflects routine portfolio rebalancing, tax considerations, or rolling exposure between products.

Still, the direction of flows remains closely watched, as spot crypto ETFs have become a key gauge of institutional demand. Sustained outflows reinforce the view that crypto continues to trade as a risk asset, particularly vulnerable when liquidity tightens.