Markets Shudder as U.S.-China Trade War Escalates; Bitcoin Teeters Near ‘Death Cross’

Financial markets across Asia tumbled on Thursday after President Donald Trump unveiled a sweeping round of “reciprocal tariffs,” triggering fears of retaliation from China and broader global instability.

The centerpiece of Trump’s announcement is a sharp increase in tariffs on Chinese goods, raising the total rate to 54% — the highest among all 180 countries targeted. While Canada and Mexico were spared, much of Asia wasn’t so lucky, including Vietnam, Taiwan, and South Korea.

The market response was swift. Asian equities sank, the Japanese Nikkei dropped to an eight-month low, and U.S. stock futures plunged more than 2%. Meanwhile, the Chinese yuan weakened to a seven-week low at 7 per U.S. dollar, and investors braced for Beijing’s response.

“If China lets the yuan slide in response, we could see a wave of global risk-off selling,” warned Robin Brooks, chief economist at the Institute of International Finance.

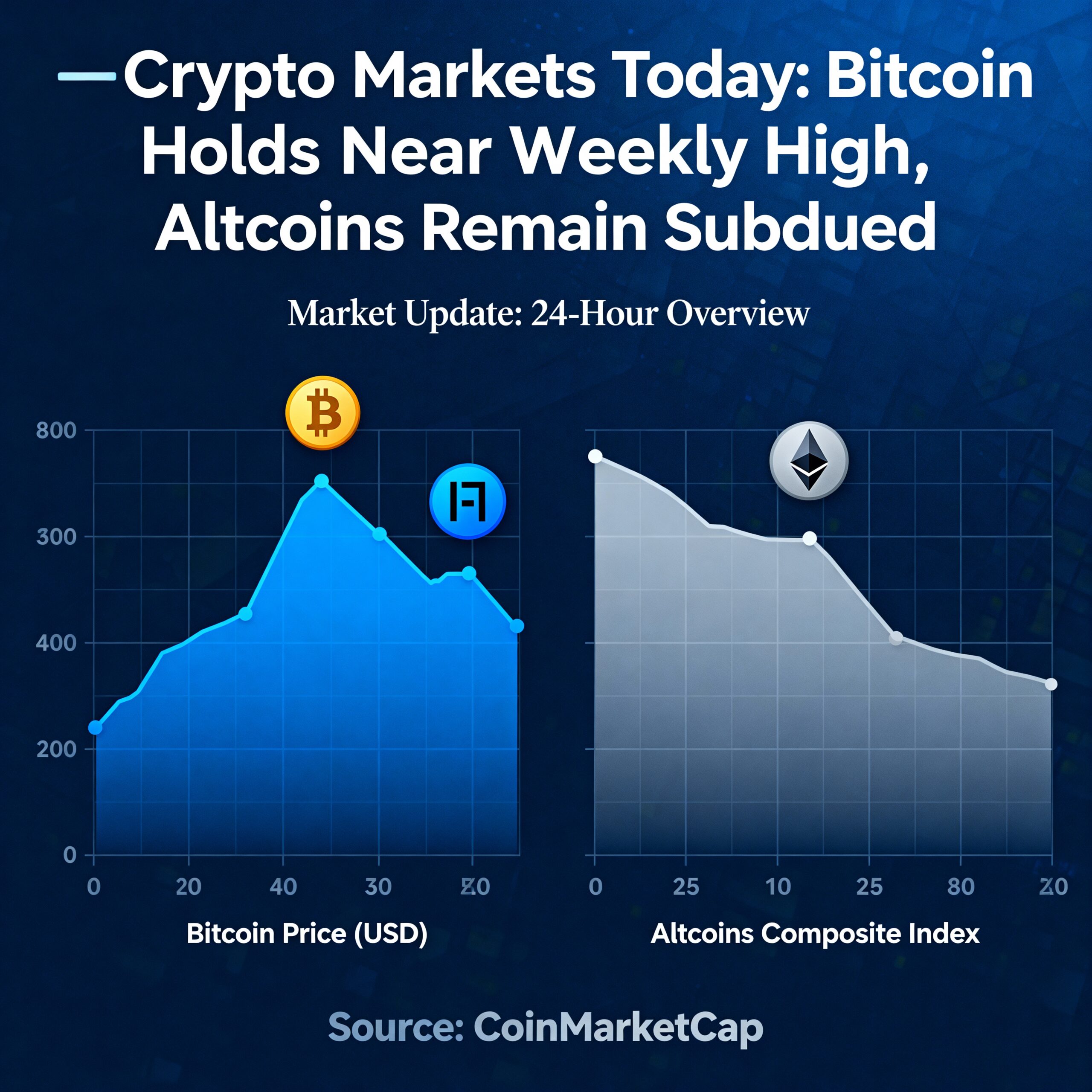

Bitcoin, often viewed as a hedge against fiat and geopolitical uncertainty, wasn’t immune. It dropped from $88,000 to $82,500 before stabilizing around $83,300. Traders also noted the cryptocurrency is nearing a “death cross” — a technical formation where the 50-day moving average crosses below the 200-day, often seen as a bearish indicator.

Derivatives markets are reflecting growing fear, with a noticeable uptick in put option activity extending to the end of Q2, according to data from Amberdata and Deribit.

With China promising swift retaliation and investors on edge, markets may remain volatile until the next move becomes clear — and right now, all eyes are on Beijing.