Fed’s Rate Cut of 25 Basis Points Sparks Hawkish Outlook, Bitcoin Drops Below $102K

The Federal Reserve reduced its benchmark interest rate by 25 basis points on Wednesday, bringing it to a range of 4.25%-4.50%, in line with market expectations. This marks the Fed’s third consecutive rate cut this year, with a cumulative 100-basis-point reduction since September. However, Fed Chair Jerome Powell’s cautious tone during the post-meeting press conference unsettled markets.

Although the rate cut was anticipated, the Fed’s updated economic projections revealed a less accommodative outlook. The “dot plot” indicated a slower pace of easing in the coming years, with the federal funds rate expected to settle at 3.9% by the end of 2025, higher than the 3.4% projection in September. Meanwhile, inflation forecasts edged up, with PCE inflation for 2025 now estimated at 2.5%.

Market Ripple Effects

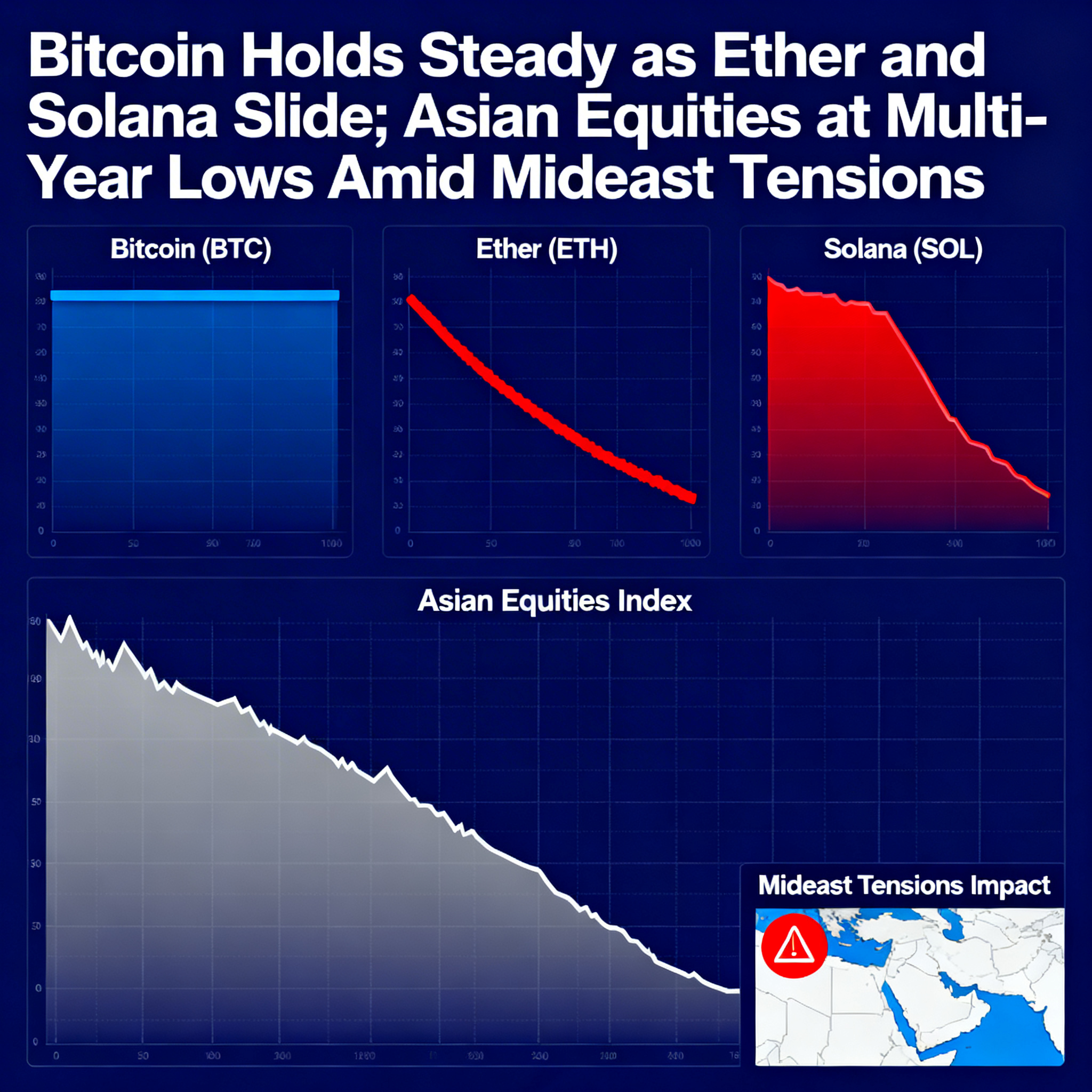

Bitcoin (BTC) saw immediate selling pressure, slipping from $104,000 pre-announcement to $101,000 shortly after Powell’s remarks—a 5% drop over the past day. Altcoins faced even steeper declines, with XRP, ADA, and LTC losing nearly 10%. Equities followed suit, as the S&P 500 hit intraday lows amid concerns over tighter monetary policy.

Powell acknowledged the Fed’s cautious stance, citing persistent inflationary pressures. “The proximity to a neutral rate justifies a more deliberate approach moving forward,” he explained.

On the topic of cryptocurrency, Powell dismissed the notion of the Federal Reserve holding bitcoin, reiterating that it is prohibited under current law and that the Fed has no intention of pursuing legislative changes to allow such actions.

Analysts Weigh In

Andre Dragosch, European Head of Research at Bitwise, commented on the broader implications of the Fed’s decisions. “The combination of rate cuts and a stronger U.S. dollar creates mixed signals for financial markets. The dollar’s continued strength tightens global liquidity, which typically puts downward pressure on bitcoin and other risk assets,” Dragosch stated.

Despite these macroeconomic headwinds, Dragosch pointed to optimistic on-chain metrics for bitcoin. “A consistent decline in exchange balances suggests a tightening supply, which could bolster BTC’s long-term outlook despite near-term volatility,” he added.

The Fed’s latest move underscores the fine line it must walk between addressing inflation and supporting economic growth. Meanwhile, the crypto market remains sensitive to macroeconomic signals, reflecting the evolving interplay between traditional and digital assets.