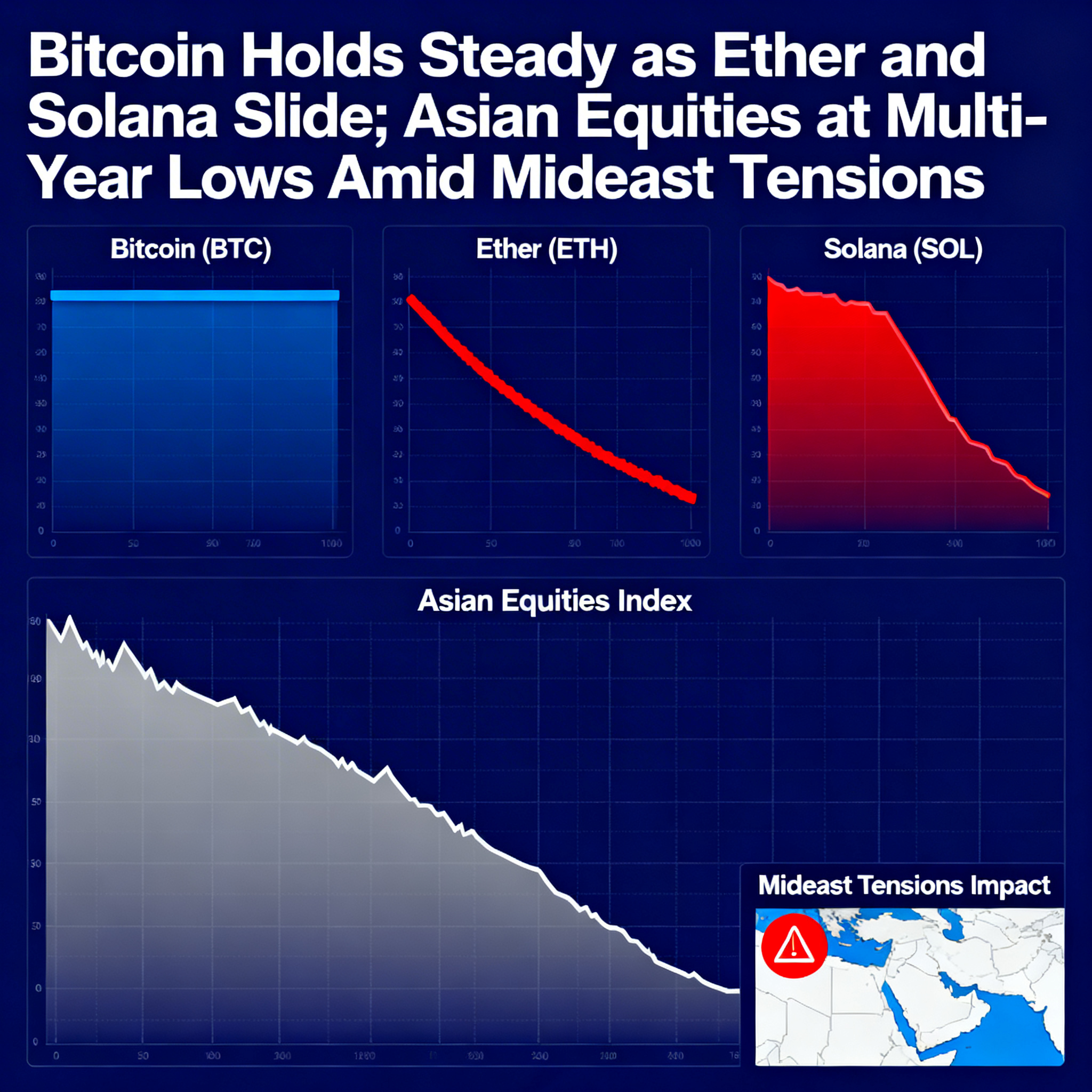

Bitcoin (BTC) continues to hit new all-time highs, but options market data suggests that traders are displaying a more cautious approach, signaling a shift in sentiment compared to previous rallies.

On Monday, Bitcoin surpassed $107,000, breaking its previous high set on December 5, bringing the post-U.S. election surge to over 50%, according to CoinDesk data. This rally follows President-elect Donald Trump’s announcement that the U.S. would build a Bitcoin strategic reserve, akin to its oil reserve. Market analysts predict that the rally could continue into 2025, with prices potentially reaching between $150,000 and $200,000 by next year’s end.

Despite the impressive price gains, options pricing on Deribit reveals that traders are no longer chasing the rally with the same urgency. The 25-delta risk reversal for options expiring on Friday was negative, indicating a relative preference for put options, which hedge against price drops. Puts expiring on December 27 were trading at a premium over calls, and the risk reversal for options expiring in March reflected a more balanced view with a slight call bias of just three volatility points.

This is in stark contrast to the previous weeks, when traders aggressively bid on call options, driving both short-term and long-term call biases to four to five volatility points. The current data suggests that market participants are not as bullish as they were during the early stages of the rally.

Additionally, recent block trades tracked by Amberdata show a bearish tilt. The largest trade so far was a short position on the December 27 call at the $108,000 strike, followed by long positions on $100,000 strike puts expiring on December 27 and January 3.

This more cautious outlook could be driven by anticipation of the Federal Reserve’s upcoming announcement on Wednesday, which could include a slower pace of rate cuts in 2025, even though a 25 basis point cut is widely expected. A stronger dollar and rising bond yields could dampen the appeal of riskier assets like Bitcoin. As a result, many traders may be positioning for a potential price correction, reflecting a shift in sentiment compared to the earlier, more exuberant phase of the rally.