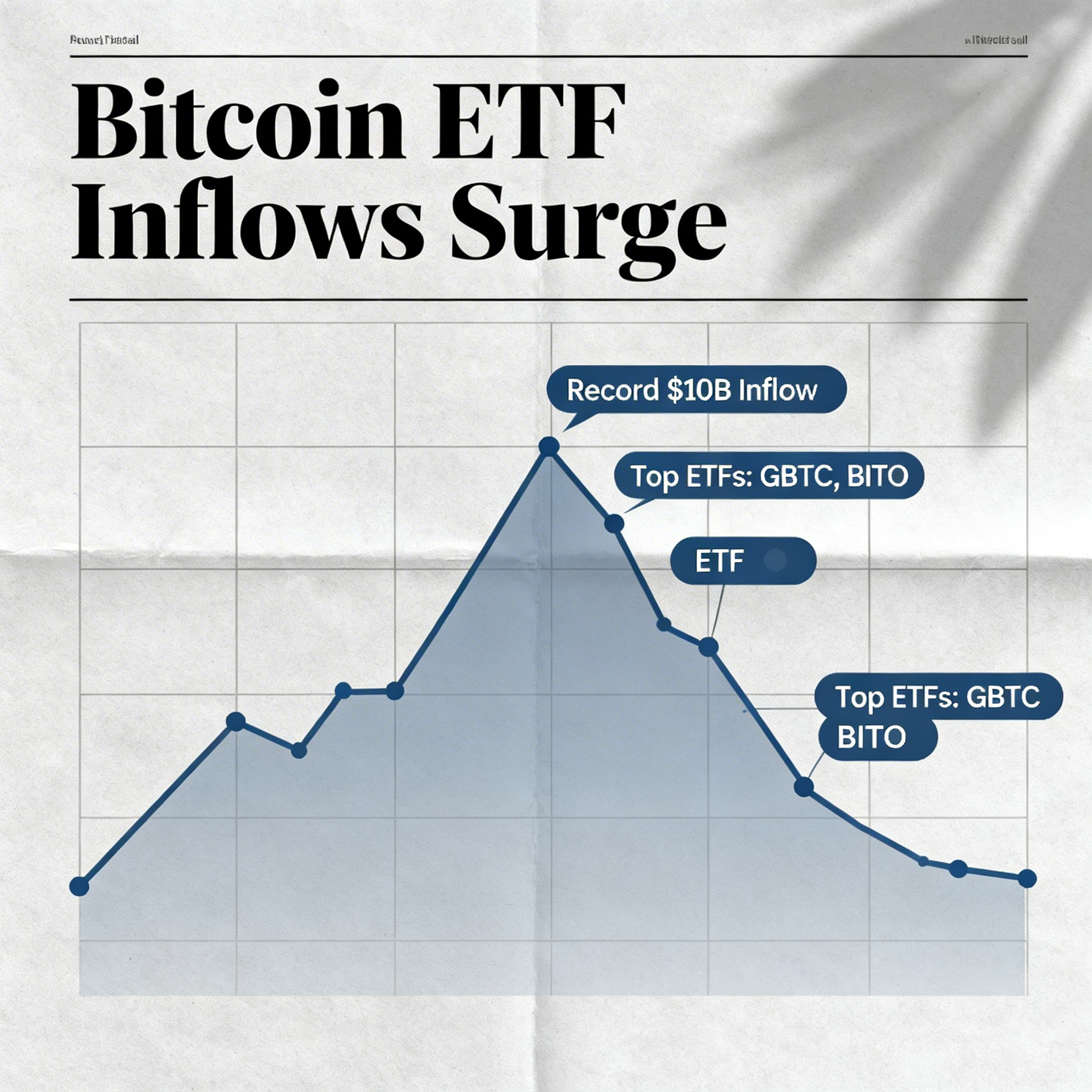

BlackRock’s Spot Bitcoin ETF Sees $6.96B in Inflows, Outpaces Gold ETF

BlackRock’s Spot Bitcoin ETF (IBIT) has drawn in $6.96 billion in inflows since the start of 2025, making it the sixth-largest ETF in terms of new capital, according to Bloomberg’s Eric Balchunas. This performance stands in contrast to gold’s strong 29% price gain this year, which has outperformed Bitcoin’s modest 3.8% increase.

Despite Bitcoin’s underwhelming price action, investor confidence in the digital asset remains robust, as evidenced by IBIT’s growing inflows. The SPDR Gold Trust (GLD), which holds the title of the world’s largest physically-backed gold ETF, has seen $6.5 billion in inflows, dropping it to the seventh position in terms of net inflows for the year.

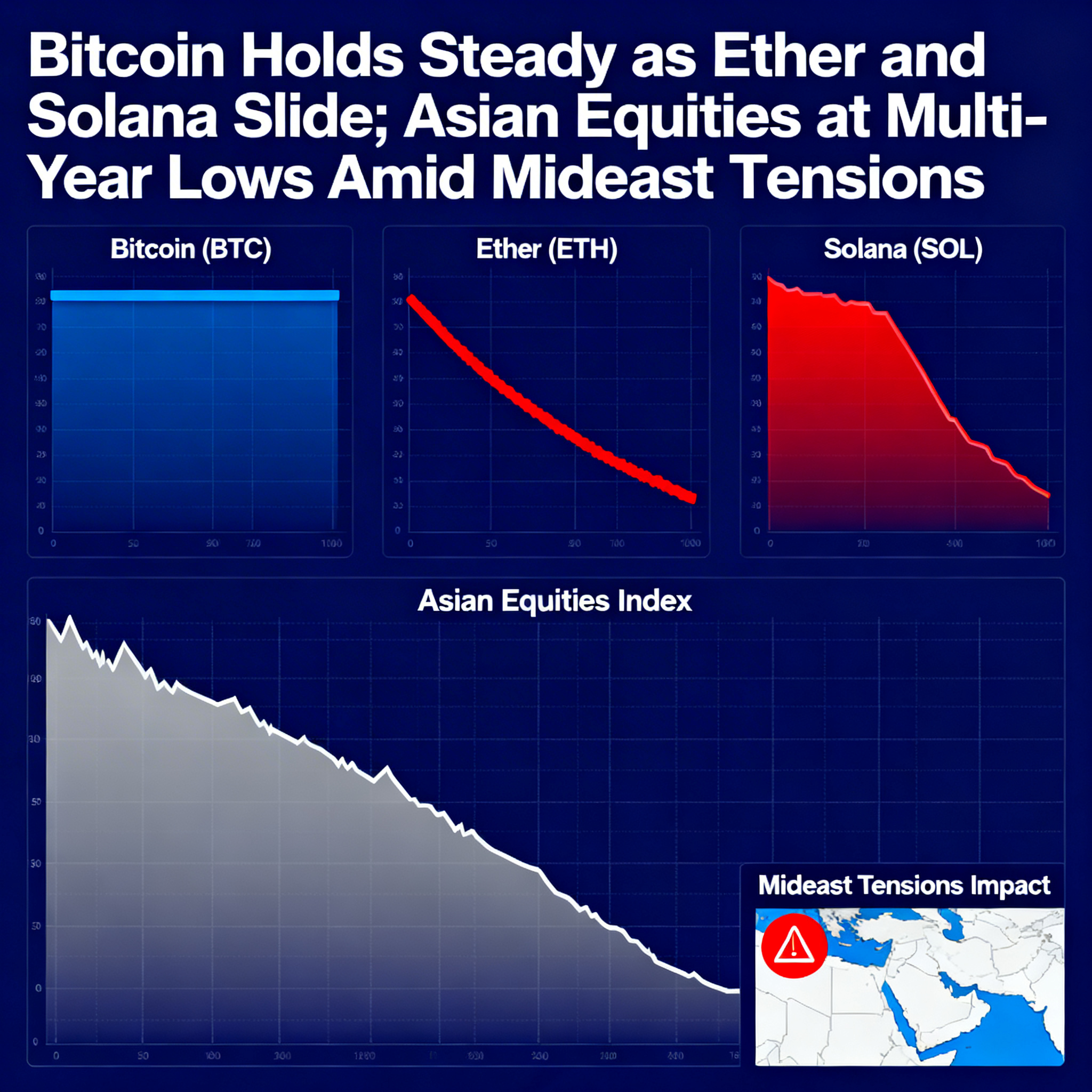

The surge in IBIT’s popularity underscores institutional faith in Bitcoin’s future, even as gold has benefited from global trade uncertainties, inflationary pressures, and geopolitical tensions. Bitcoin, while briefly reaching an all-time high in January, is now trading more than 10% below that level.

Eric Balchunas highlighted the significance of this trend, stating that such inflows during a period of market uncertainty point to a solid long-term outlook for Bitcoin. He also projected that within 3 to 5 years, Bitcoin ETFs could surpass gold ETFs in assets under management.

“The resilience of Bitcoin ETFs, even amid a lackluster price performance, suggests they are positioning themselves for significant growth in the coming years,” Balchunas said on X.