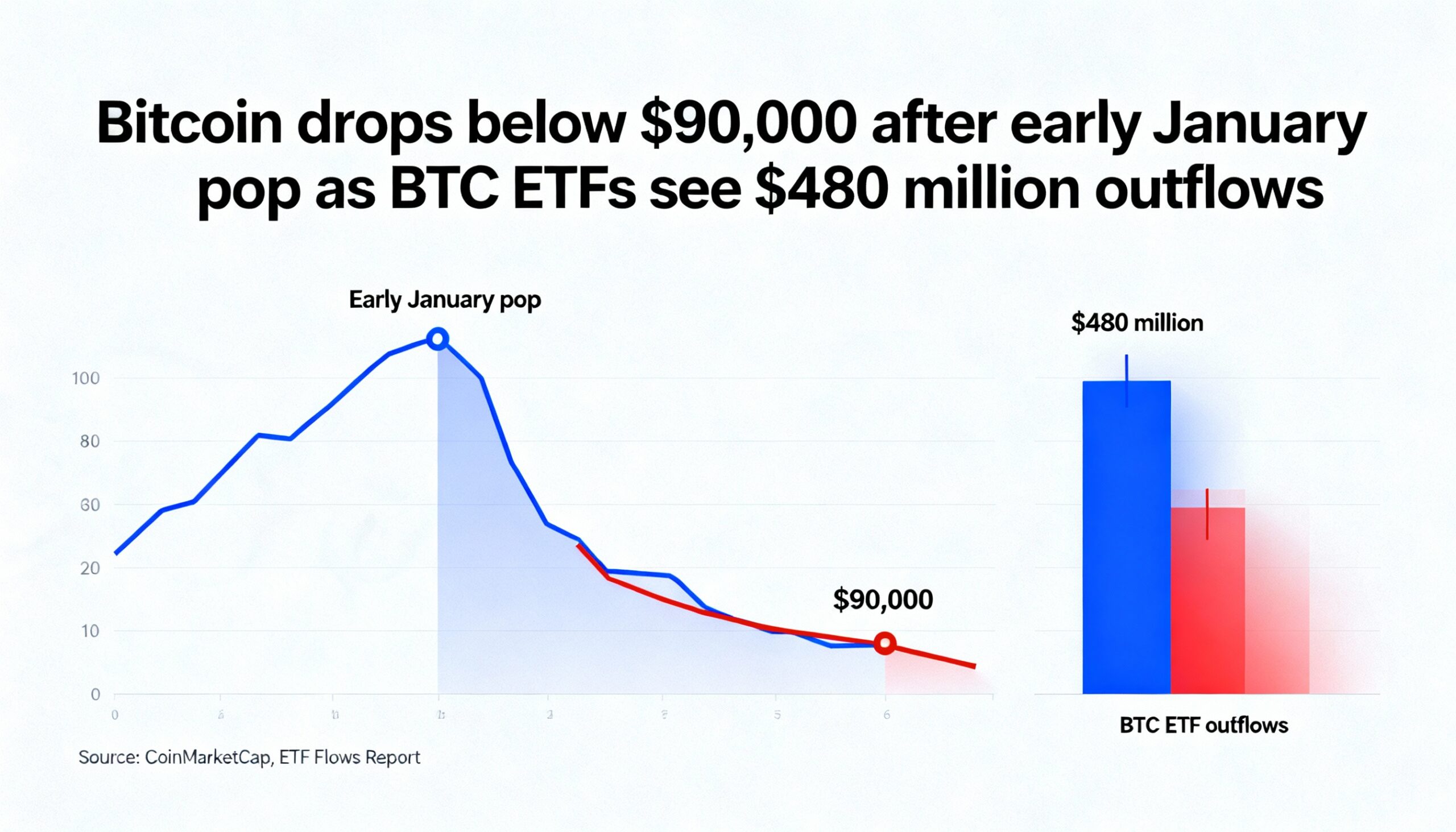

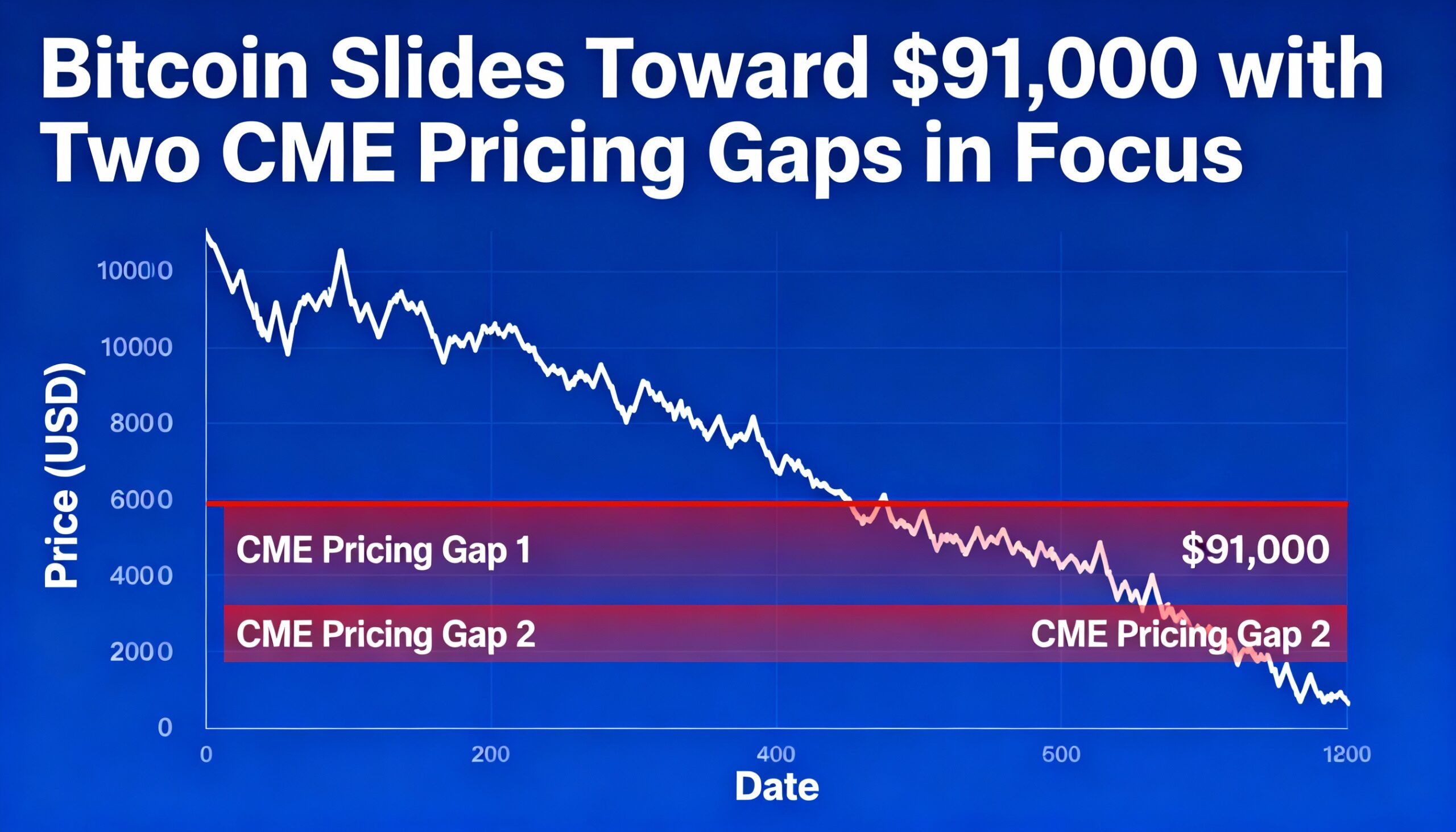

Bitcoin’s BTC $90,458.54 recent drop toward $91,000 may be facing technical pull as an unfilled CME futures gap lies just below current levels.

The gap formed over the weekend after CME bitcoin futures closed Friday near $90,600 and reopened Sunday evening around $91,600. Unlike spot markets, CME futures are cash-settled contracts that pause daily and remain offline over the weekend, allowing gaps to emerge when bitcoin moves sharply.

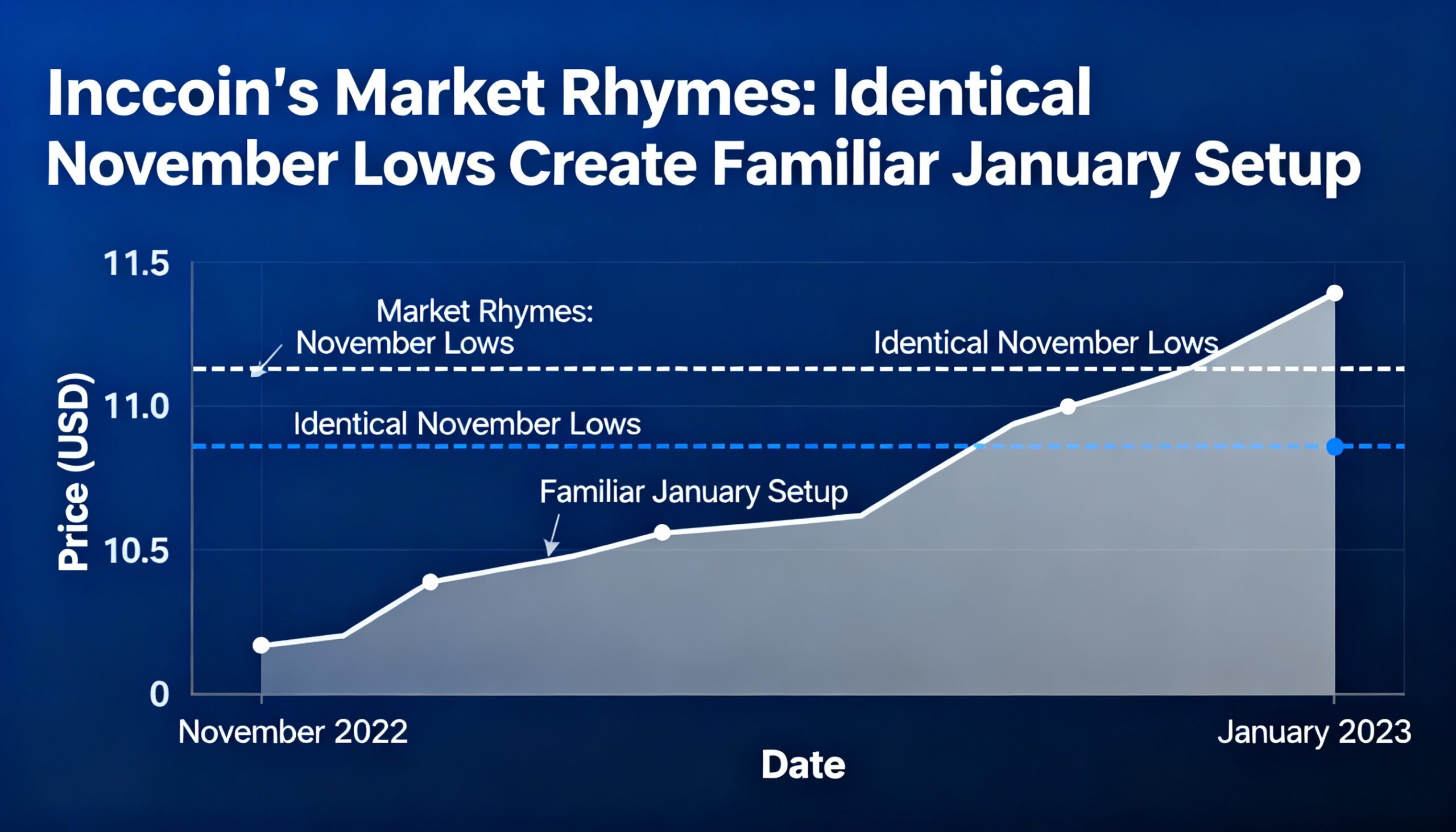

Traders often monitor these gaps because bitcoin has a history of retracing to “fill” them. While not guaranteed, gap fills frequently occur within days — typically within a week — though some gaps remain open longer.

This dynamic is similar to the “max pain” theory in options markets, where widely observed technical levels influence trading behavior. CME gaps can become self-reinforcing as traders position for moves toward the gap simply because it exists.

A similar pattern is appearing in BlackRock’s iShares Bitcoin Trust (IBIT) ETF, which closed Tuesday at $52.45. Open gaps around $48 and $50 suggest ETF trading is increasingly mirroring futures-based technical levels.

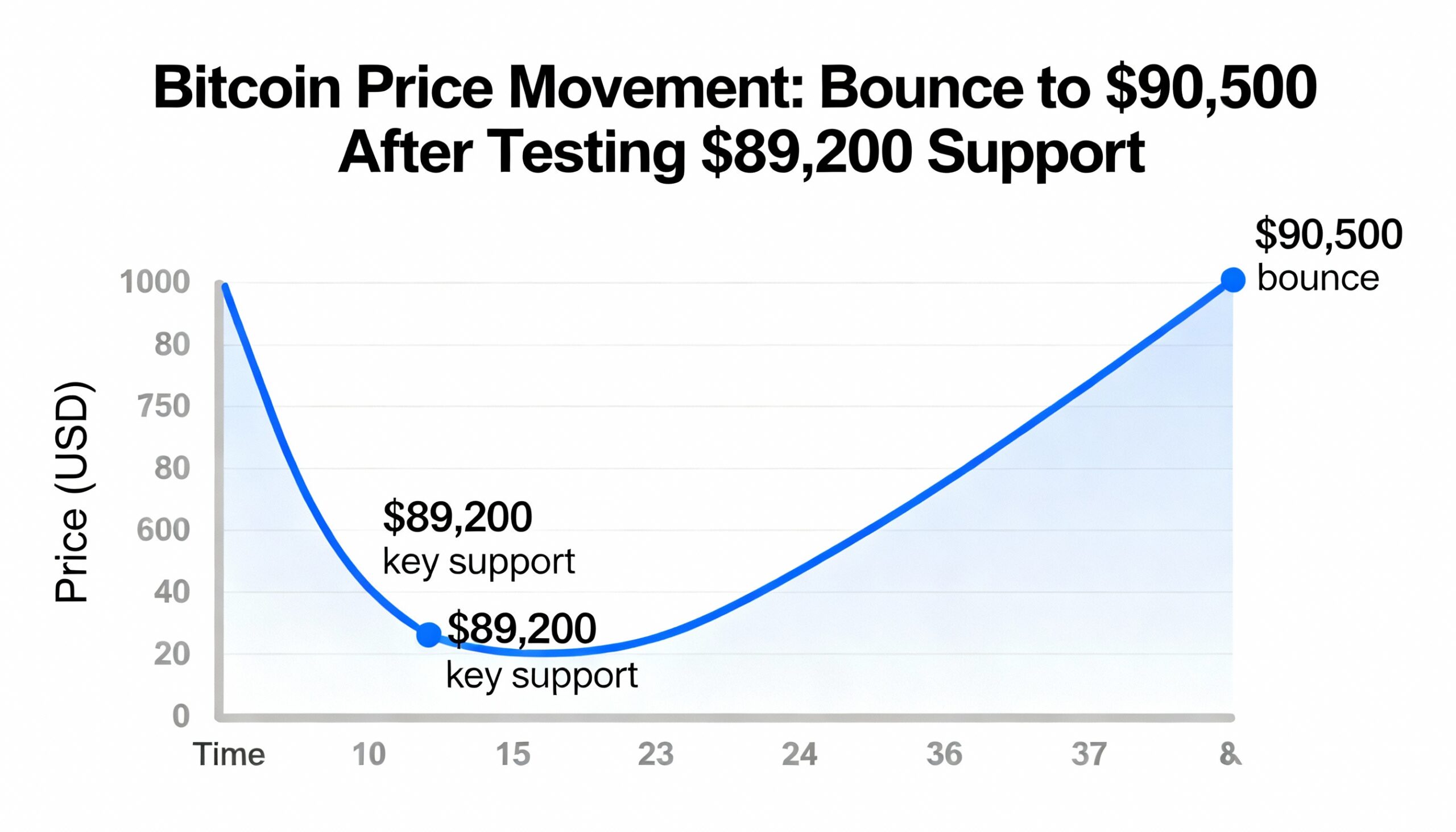

CME bitcoin futures are trading near $91,900. Filling the weekend gap at $90,600 would require roughly a 1.6% drop, while closing the New Year’s Day gap near $88,000 would require a roughly 4% decline.