Bitcoin has recently hit fresh all-time highs, yet retail investors are largely absent from this rally, leaving institutional players to drive the momentum.

So, what happens when the retail crowd logs off and Wall Street steps on the gas? Bitcoin’s surge past $109,700 might seem like a sign of broad market confidence and maturation in the crypto space — but the story beneath the surface tells a different tale.

Retail Investors Are Missing in Action

A quick look at Google Trends for the term “bitcoin” shows no sign of the retail frenzy that defined the 2021 bull market. Back then, everyday investors were hyped, flooding social media with memes and piling into altcoins. Today, that excitement has largely evaporated. The “wen Lambo” crowd is nowhere to be found.

There was a brief burst of retail interest during the recent U.S. presidential election, sparked by a short-lived memecoin rally. But as memecoin prices quickly collapsed, that enthusiasm faded, even as Bitcoin marched to new heights beyond $111,000 this week.

Toronto-based crypto platform FRNT Financial sums it up: early in the current cycle, memecoins were the hotspot for risky retail trading, but since January, that interest has virtually disappeared. This “wash-out” signals a cautious, low-risk appetite among crypto investors right now.

In other words: retail traders burned by past losses aren’t rushing back to the scene.

From Lambos to Toyotas

The shift in risk appetite can be seen through the lens of a car metaphor. The 2021 crypto boom was like a joyride in souped-up sports cars—reckless, fast, and risky, with little regard for what might go wrong.

Today’s investors are driving Toyotas instead: reliable, steady, and built for the long haul rather than quick thrills. The risk-on frenzy has cooled to a more measured approach.

This change is visible in the funding rates on bitcoin perpetual contracts. When BTC hit around $42,000 in early 2021, traders were paying a sky-high 185% rate to maintain long positions—a sign of extreme bullishness. Fast forward to today, with Bitcoin near $110,000, and the rate sits closer to 20% on exchanges like Deribit, reflecting a far more cautious but still optimistic stance.

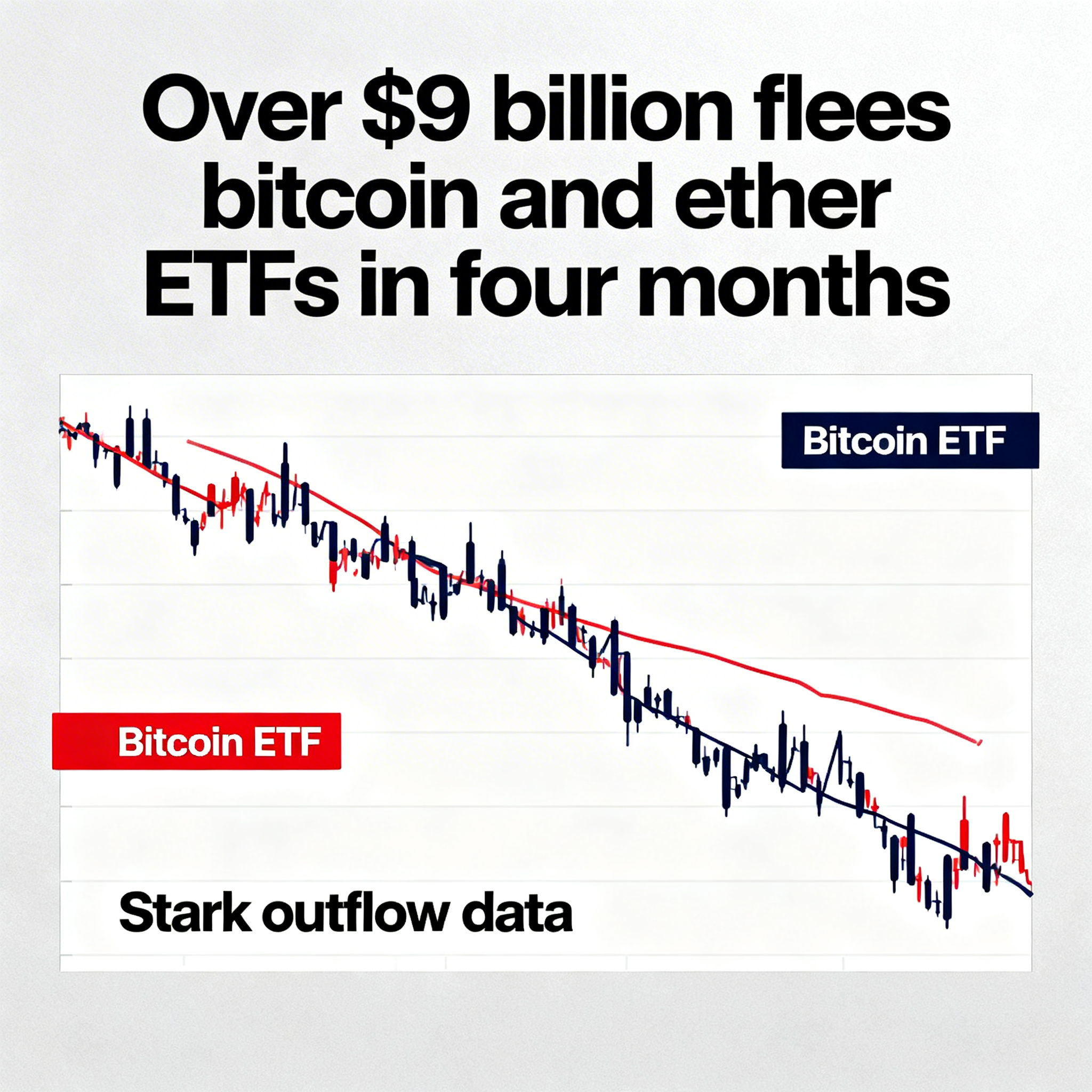

Shorts Are Still Betting Against the Rally

Another sign of cautious sentiment is the high level of short positions. As reported by CoinDesk’s Oliver Knight, the bitcoin long/short ratio is at its lowest since the crypto winter of September 2022. Many traders remain skeptical of this rally, hedging bets on Bitcoin’s price dipping even as it climbs.

This dynamic played out dramatically on Friday, when Bitcoin briefly plunged from near $111,000 to $108,000 within minutes before bouncing back to $109,000—showcasing the jitters around swift price swings.

So, the current market scene looks like this: some investors are still taking their flashy sports cars out for a spin, while many others prefer to stick with dependable sedans ready to pick them up if things go sideways.

Cautious Optimism May Signal Sustainable Growth

Given the macroeconomic uncertainties, it’s no surprise investors are wary. But this cautious stance might actually be a good sign.

According to FRNT Financial, periods marked by low leverage and risk appetite often precede more sustainable price gains in crypto.

With a range of bullish catalysts on the horizon, Bitcoin appears to be in such a phase—primed for steady, long-term growth rather than a reckless, short-lived surge.

Bottom Line: The retail “Lambos” may have left the lot, but institutional “Toyotas” are filling the garage. This shift could mark the start of a slower, steadier journey toward new highs—not just a wild joyride.