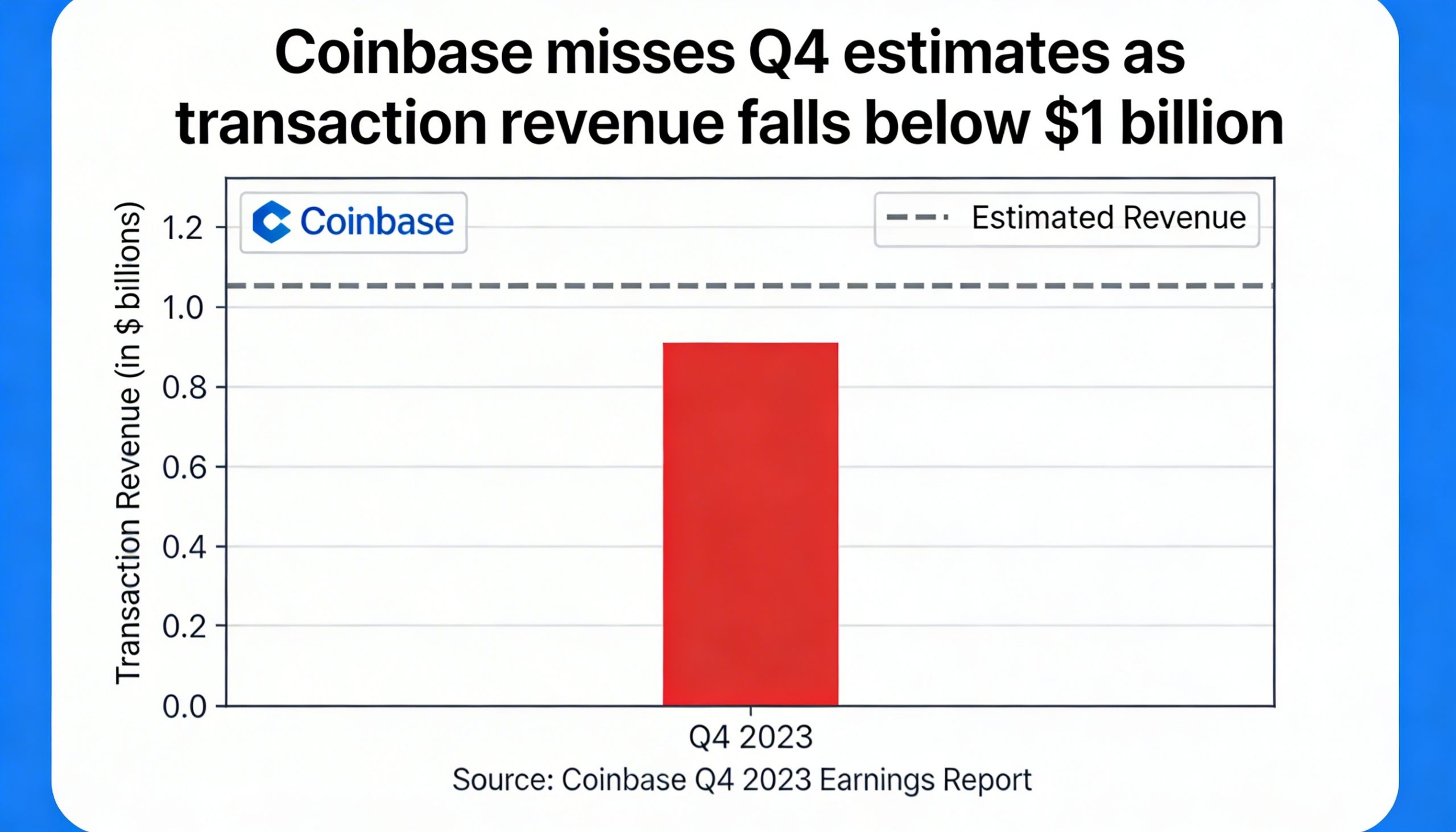

Coinbase posted weaker-than-expected fourth-quarter results on Thursday, as subdued trading volumes and lower digital asset prices pressured revenue.

The company generated $1.78 billion in total revenue, missing analyst estimates of $1.83 billion. Adjusted earnings per share came in at $0.66, below the consensus forecast of $0.86.

Transaction revenue was $983 million, falling short of the expected $1.02 billion and declining from $1.046 billion in the prior quarter and $1.556 billion a year earlier. The drop reflects softer market activity during a challenging period for crypto prices.

Subscription and services revenue totaled $727.4 million, down from $746.7 million in the third quarter but up from $641.1 million in the same quarter last year.

Looking ahead, Coinbase said it recorded approximately $420 million in transaction revenue through Feb. 10 in the first quarter. The company expects subscription and services revenue to range between $550 million and $630 million for the quarter.

Despite the earnings miss, Coinbase maintained a constructive long-term outlook. “Crypto is cyclical, and experience tells us it’s never as good, or as bad as it seems,” the company said, emphasizing continued technological progress and adoption beneath the surface of market volatility.

Shares rose slightly in after-hours trading following the report, though the stock had fallen 7.9% during the regular session, extending its year-to-date decline to about 40%.