Meme coins are starting 2026 on a strong note, with sharp gains across the sector pointing to a renewed burst of speculative activity.

Dogecoin and PEPE led the advance on Friday, reigniting “meme season” talk among traders. Dogecoin rose about 11% over the past 24 hours, while PEPE jumped roughly 17% following a strong intraday breakout.

The rally appears to be broad-based rather than isolated. CoinGecko’s GMCI Meme Index showed a total market value of around $33.8 billion and roughly $5.9 billion in 24-hour trading volume, highlighting increased activity across meme tokens.

Dog-themed coins were broadly higher. Shiba Inu gained around 8%, Solana-based Bonk added nearly 11%, and Floki climbed close to 10%, following Dogecoin’s lead.

Smaller-cap meme tokens moved even faster. Mog Coin advanced about 14% on the day and roughly 37% over the past week, while Popcat rose nearly 9% and is up more than 17% over the same period.

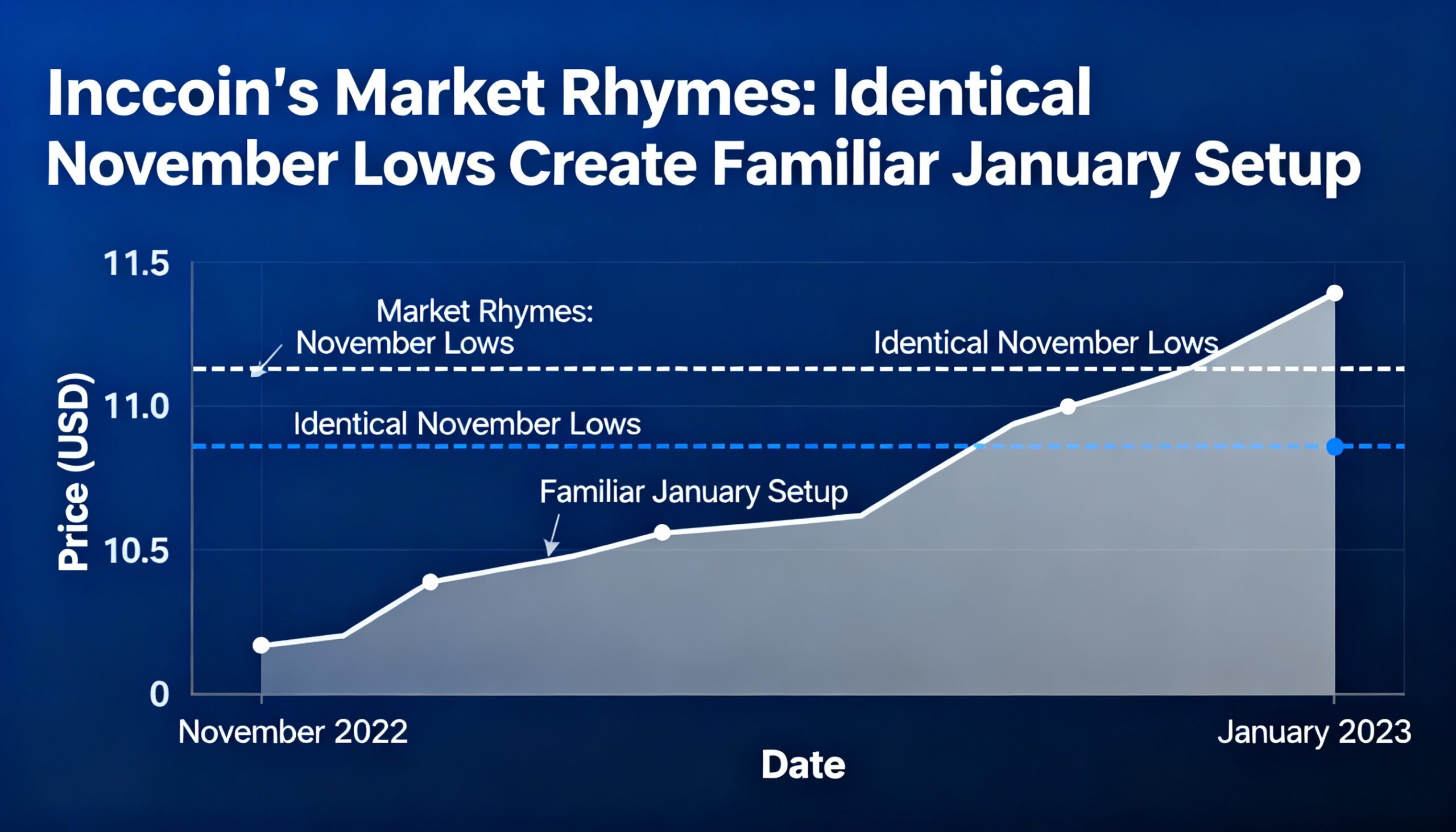

Traders on X pointed to PEPE’s breakout as a key catalyst, with technical setups suggesting momentum players are rotating into meme coins as liquidity returns. Similar patterns in the past have seen speculative flows spill from large-cap assets into higher-beta meme names.

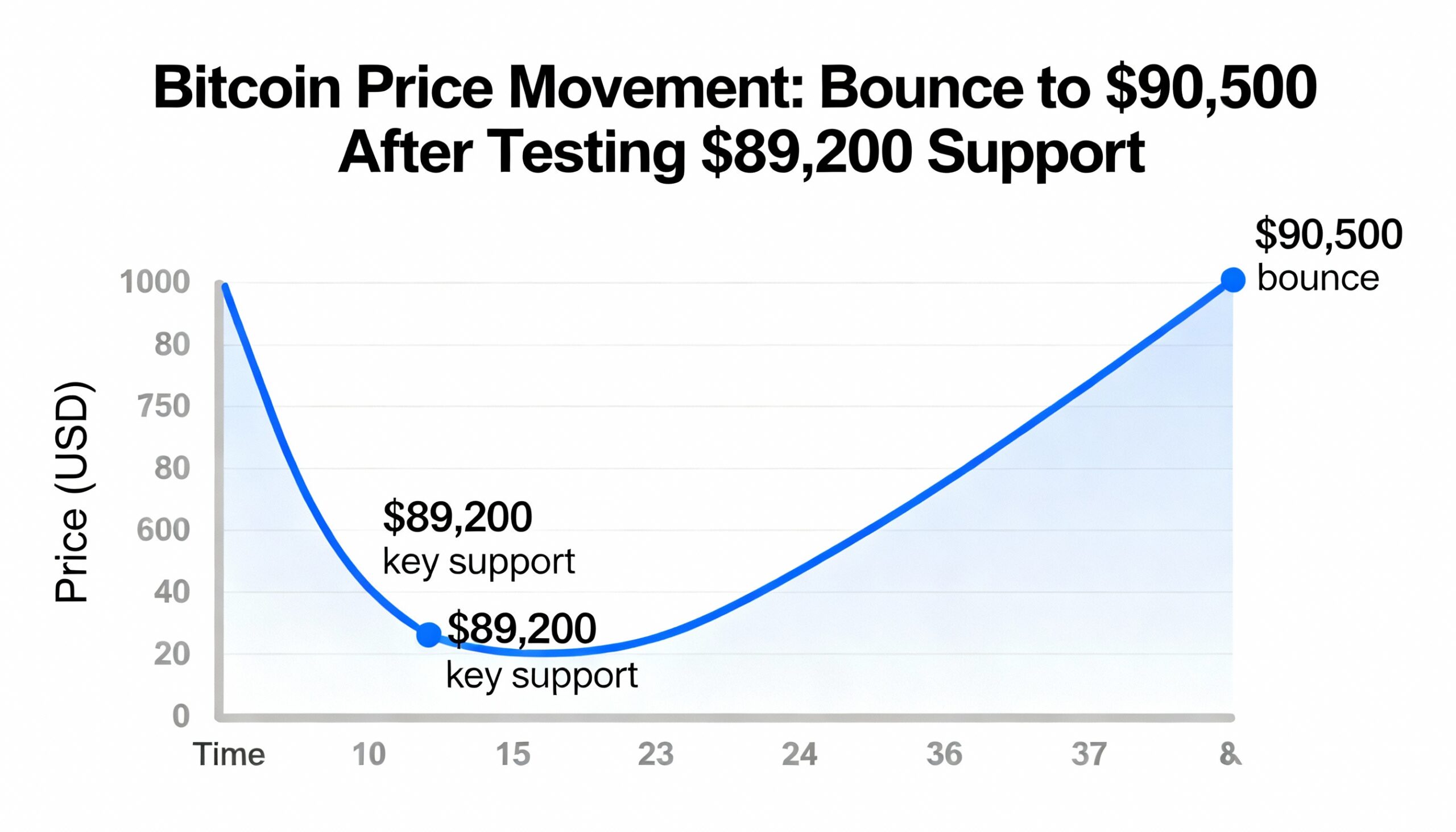

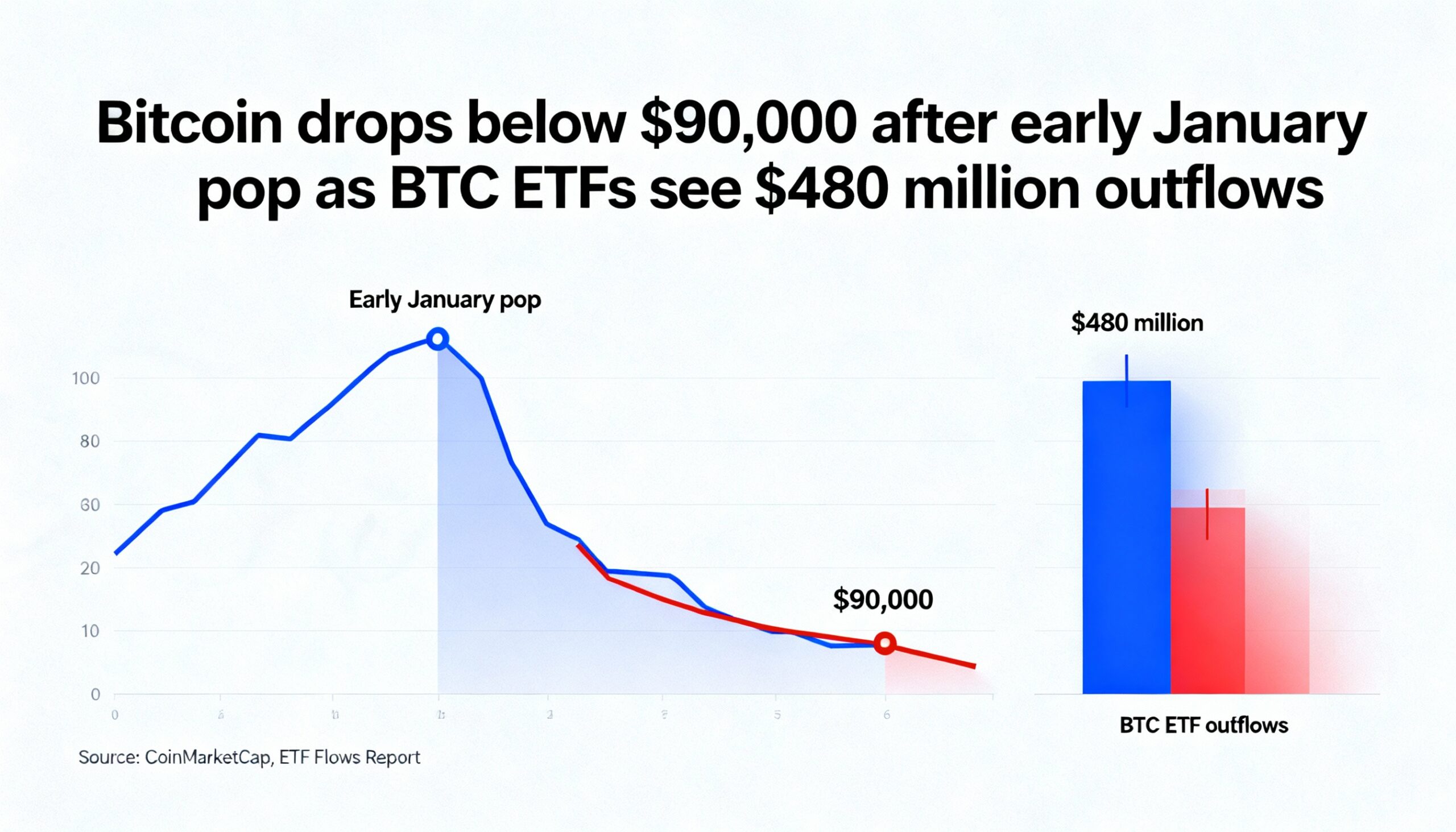

The move comes as bitcoin remains largely rangebound and post-holiday liquidity stays uneven. In that environment, meme coins often attract traders seeking high-beta exposure without waiting for a clear macro catalyst. Their rapid price moves, deep derivatives markets, and momentum-driven flows make them natural targets.

Still, the rally does not necessarily signal the start of a sustained meme cycle. Such moves can be self-reinforcing in the short term but fragile, with crowded positioning, thinning spot demand, or a bitcoin pullback capable of triggering sharp reversals.

For now, meme coins appear to be acting as a barometer of speculative appetite. The key question is whether momentum broadens beyond a handful of liquid names—or fades as quickly as it emerged.