HashKey Targets Hong Kong IPO as Institutional Growth Counters High Cash Burn

HashKey, one of Asia’s largest regulated crypto exchanges, is preparing to raise up to HK$1.67 billion ($215 million) in a Hong Kong IPO, according to a recently filed prospectus. The filing highlights surging institutional activity, expanding staking and tokenization pipelines, and a user base exceeding 1.44 million accounts.

The prospectus also reveals significant historical losses. HashKey reported a cumulative loss of more than HK$3.0 billion ($386 million) from 2022 through mid-2025, reflecting heavy investment in critical infrastructure such as custody, compliance, and on-chain services required of a licensed exchange. In the first half of 2025 alone, it lost HK$506.7 million, while burning an average of HK$40.9 million per month in the third quarter.

The company argues its regulated market structure enables leverage: many of its largest costs—licensing, custody, and risk infrastructure—do not scale linearly with activity. Once client adoption grows, revenue from trading, staking, and management fees can expand faster than expenses, creating a path to margin improvement over time. Registered users jumped from fewer than 200 in 2022 to 1.44 million today.

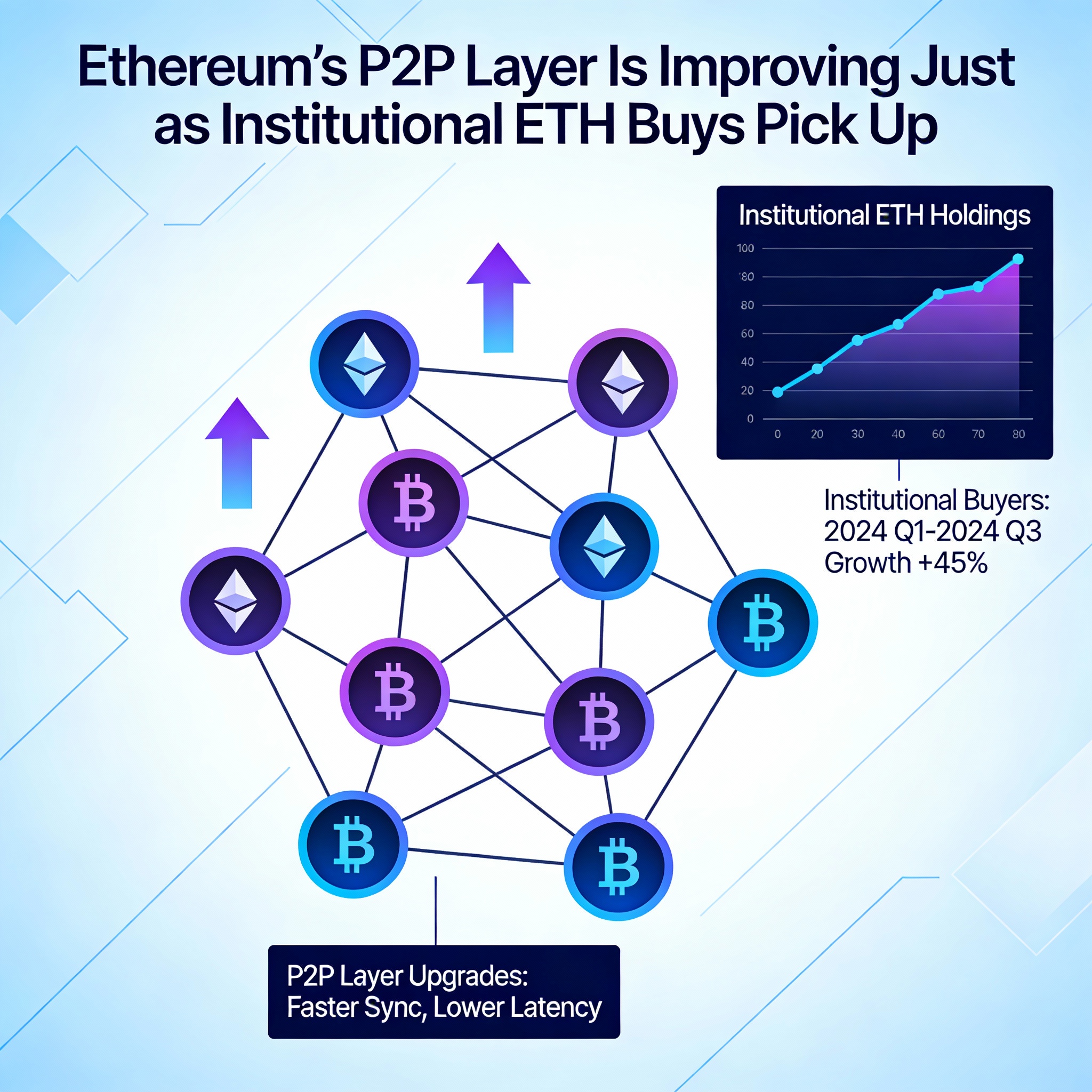

The filing also notes a strategic shift in HashKey’s user base. Retail trading volumes fell in early 2025 amid declines in Ether and other major assets, while institutional flows remained robust. HashKey Global, registered in Bermuda to attract retail clients, was scaled back due to limited fiat on- and off-ramps, reducing competitiveness in a market where local fiat rails are critical. Instead, HashKey focused on its onshore platform, which offers licensed fiat channels and has become closely linked to ETF flows and traditional financial institutions.

With cash, digital assets, and anticipated IPO proceeds, HashKey estimates over 70 months of liquidity under conservative assumptions.

HashKey competes directly with Bullish, the parent company of CoinDesk.