Ethereum (ETH) is showing renewed signs of strength after rebounding off critical support at $2,477, as rising trading volumes and sustained institutional inflows into spot ETFs help lift market sentiment.

Despite ongoing global economic uncertainty and market-wide volatility, ETH has managed to stabilize within a key technical range. Traders now watch closely as it approaches the crucial $2,530 resistance zone, which could determine the next leg of price action.

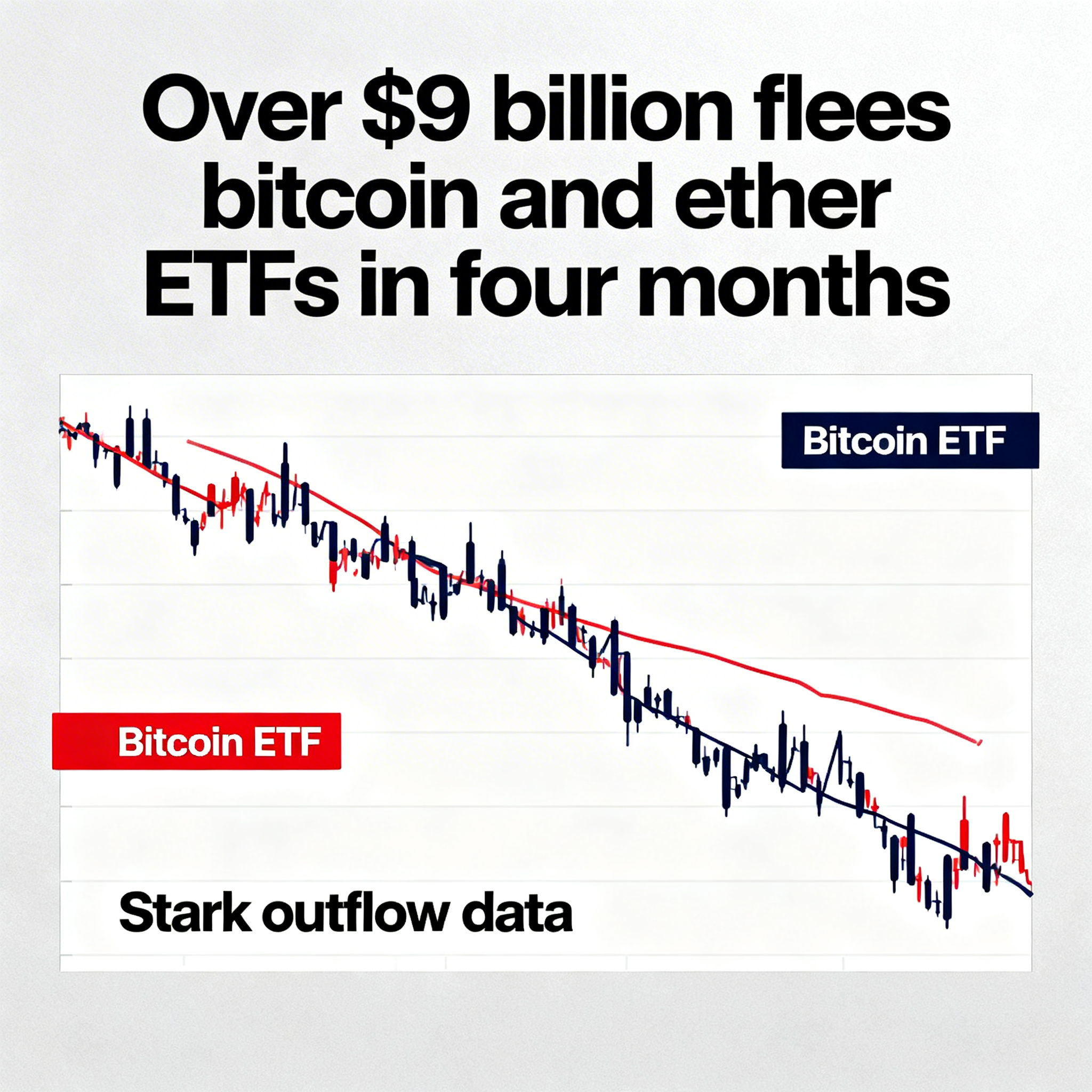

Institutions Steady Amid Volatility

The recent sell-off appears to have triggered buying interest from institutional players. Spot Ethereum ETFs have logged multiple consecutive days of net inflows, signaling growing confidence from large investors. This comes even as the broader crypto market navigates geopolitical tensions and shifting macro headwinds.

Price Action & Key Technical Zones

- Over the past 24 hours, ETH traded within a $99.85 range, reflecting elevated volatility.

- Price dipped sharply to $2,477.40 around midnight, forming a strong support base.

- Volume surged to nearly 291K ETH during the sell-off—well above average—marking intense buyer activity.

- Accumulation resumed between $2,467 and $2,480 during the 08:00–09:00 window, confirming support.

- Bulls pushed ETH to reclaim $2,515, forming what appears to be a potential higher low.

- A strong upward move at 13:35 saw ETH jump from $2,515.85 to $2,521.79 on heightened volume.

- A quick retracement followed, with price dropping to $2,508.02 by 14:00, highlighting continued indecision near resistance.

- ETH is now consolidating in a tight $2,508–$2,522 range as it prepares for its next move.

Outlook: Testing the Ceiling

The $2,520–$2,530 zone remains the key battleground. A breakout above this level could open the door to $2,580 and beyond, while failure to clear resistance may lead to a retest of support near $2,480.

For now, ETH appears resilient, with strong institutional backing and robust support—providing cautious optimism for bulls looking toward a longer-term breakout.