Two Abu Dhabi-based investment groups — Mubadala Investment Company and Al Warda Investments — expanded their bitcoin exposure in the fourth quarter of 2025, adding shares of BlackRock’s iShares Bitcoin Trust during a market downturn.

According to quarterly 13F filings, Mubadala purchased nearly four million additional IBIT shares between October and December, bringing its total stake to 12.7 million shares. The sovereign wealth fund first initiated its position in late 2024 and has steadily increased it since. Bitcoin declined roughly 23% over the fourth quarter.

Al Warda Investments also raised its holdings modestly, reporting 8.2 million shares at the end of December, up from 7.96 million shares in the previous quarter.

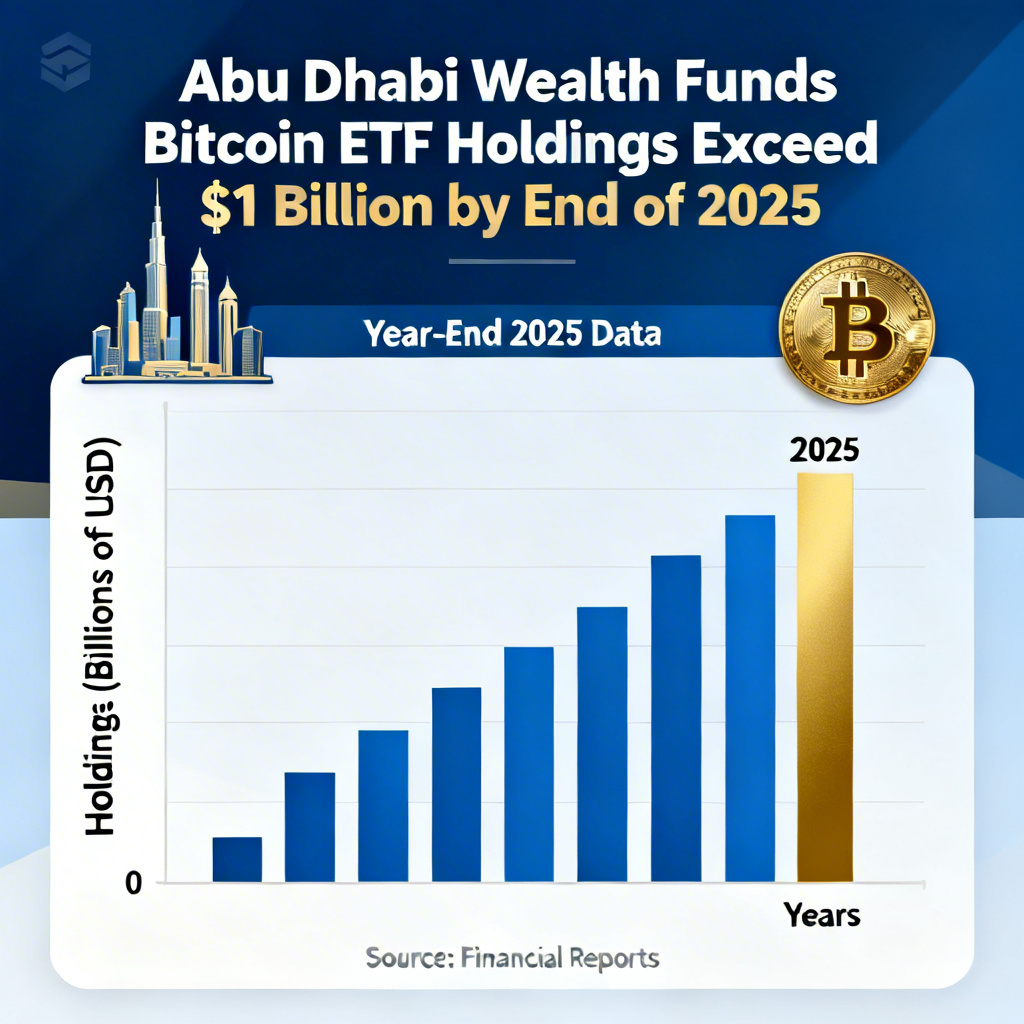

At year-end 2025, the two firms collectively held more than $1 billion in bitcoin exposure through IBIT. With bitcoin falling another 23% so far in 2026, the combined value of their holdings has decreased to just over $800 million as of Tuesday, assuming they have not added further shares this year.

The disclosures, filed with the U.S. Securities and Exchange Commission, highlight continued institutional appetite for spot bitcoin ETFs despite broader crypto market weakness. Since its launch in early 2024, IBIT has become the leading U.S.-listed vehicle for regulated bitcoin exposure.

While digital asset markets have faced headwinds in early 2026 — including muted volatility, softer retail participation and macroeconomic uncertainty — some long-term investors appear to be using price declines to accumulate positions in regulated, liquid crypto products.

Speaking at a recent panel discussion, BlackRock’s head of digital assets, Robert Mitchnick, said the idea that hedge fund ETF activity is driving heavy selling and volatility does not reflect what the firm is seeing. Instead, he noted, most IBIT investors appear to be maintaining long-term positions.