Ink Foundation Unveils INK Token, Eyes Liquidity Strategy Despite Crowded Market

The Ink Foundation, the nonprofit organization behind the layer-2 network Ink, is preparing to launch its native token, INK, as part of a plan to spark onchain capital markets through a “liquidity-first” approach.

INK’s rollout will kick off on a decentralized finance (DeFi) lending and trading protocol built atop Aave, with an initial distribution via an airdrop targeting early users of the platform.

According to the foundation, INK will avoid common tokenomics pitfalls: there will be no complex governance mechanics or variable emission schedules. Instead, the token supply is capped at one billion, and governance proposals cannot change this maximum supply.

Unlike many other Superchain participants—which share software and infrastructure across multiple layer-2 networks—Ink says it intends to keep its layer-2 governance completely separate from its token. The Superchain concept can be thought of as various cities connected by the same highway, enabling shared security, upgrades, and tools.

INK’s first utility will be as the backbone asset of Ink’s native liquidity protocol, envisioned as a core DeFi primitive for lending and capital allocation.

Protocol participants will be eligible for the upcoming INK airdrops, although the foundation has not yet released precise details. A foundation subsidiary will manage the distribution process, and the team claims it has developed safeguards to deter airdrop farming.

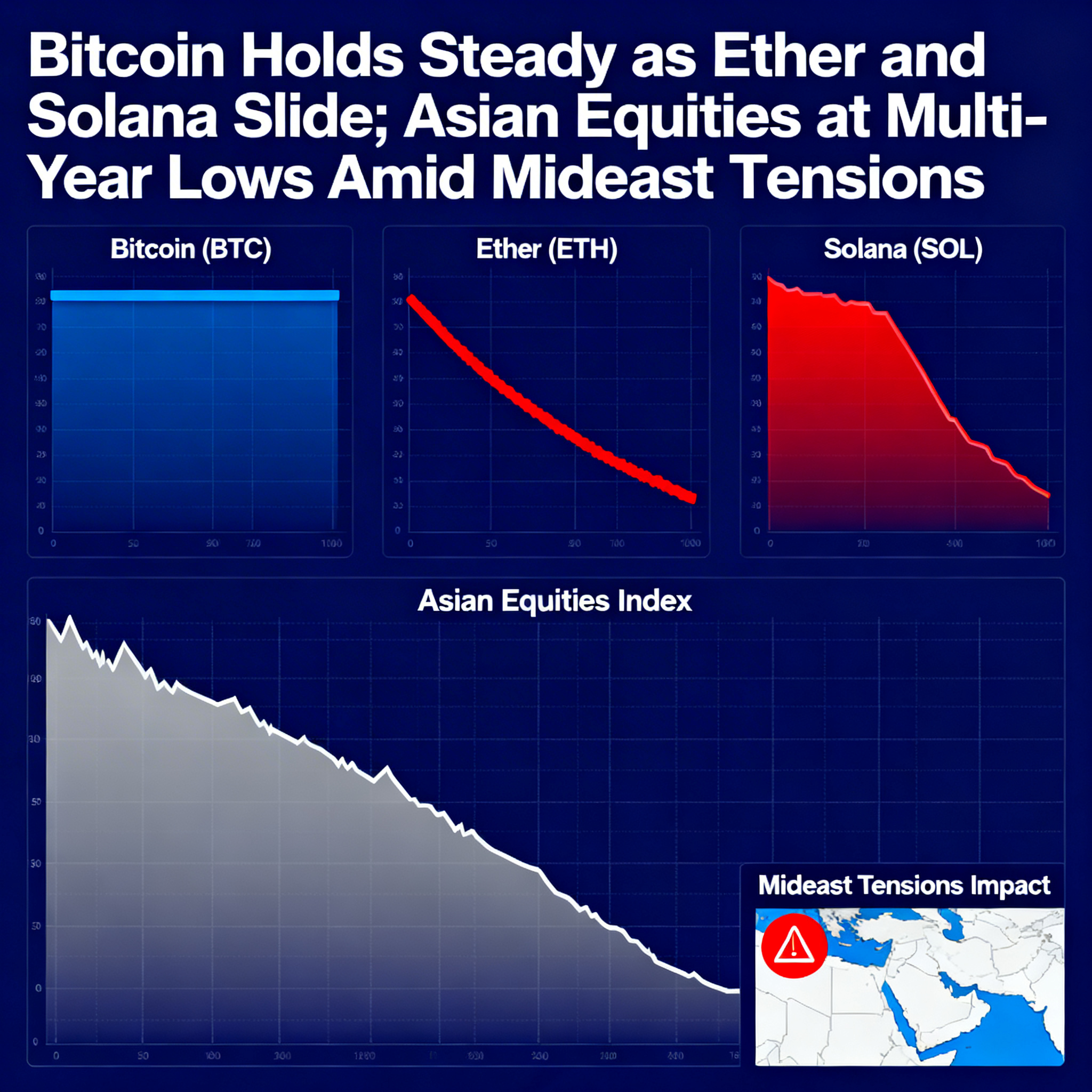

Still, the INK launch arrives in a crowded and challenging market environment. Many newly launched tokens, even those with significant venture capital backing and visible protocol traction, have struggled after debut.

Projects like Linea, Blast, Celestia, and Berachain all introduced high-profile layer-2 tokens during 2024 and 2025, only to face consistent selling pressure. Critics argue that, rather than aligning economic incentives, token launches too often resemble delayed exit liquidity opportunities for insiders.

INK’s debut comes amid a broader downtrend in token prices, diminished retail enthusiasm, and selective capital flows across crypto markets.

Ink’s DeFi ecosystem currently holds just over $7 million in total value locked (TVL), with merely $93 in layer-2 revenue recorded in the past 24 hours, according to DefiLlama—suggesting that real-world usage is still modest.

Nevertheless, by tying its token directly to a live product from day one—thanks to Aave governance participation and integrations—Ink is aiming to distinguish itself from recent launches that fell flat.