Bitcoin Volatility Spikes as China Tariffs Shake Global Markets

Market turbulence intensified Friday after China announced sweeping retaliatory tariffs on U.S. goods, escalating global trade tensions and sending shockwaves through both traditional and crypto markets.

The Wall Street Volatility Index (VIX), often used to gauge investor fear, jumped to 39 — a level not seen since October 2020 — reflecting surging uncertainty following Beijing’s move. Simultaneously, U.S. stock futures sold off sharply, dragging sentiment lower across risk assets.

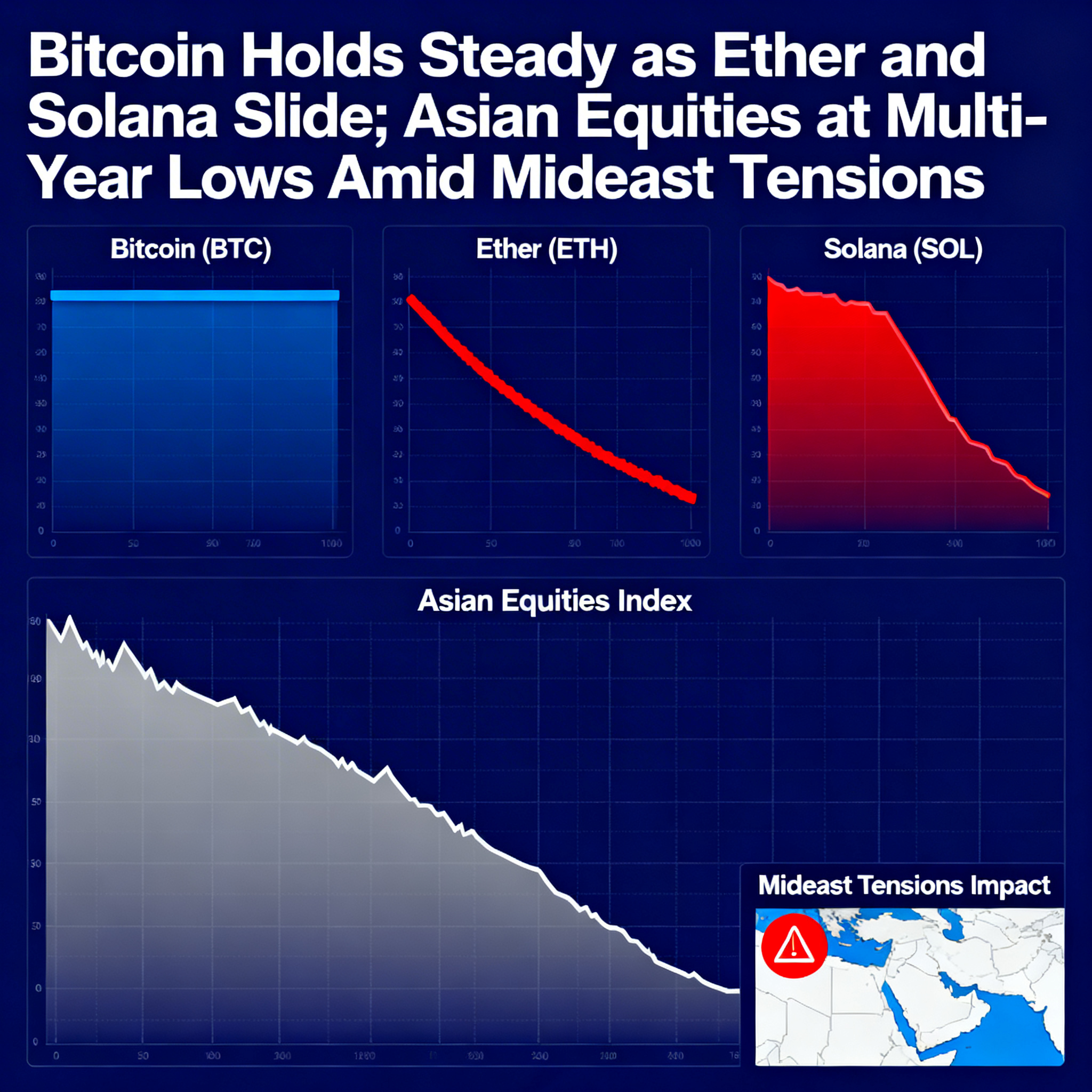

Bitcoin wasn’t immune. The cryptocurrency dropped 0.7% to $82,500 after briefly touching $84,600 earlier in the session. BTC’s 30-day implied volatility, tracked by Deribit’s DVOL index, surged to an annualized 54.6%, its highest mark in two weeks. This suggests traders are bracing for more pronounced price swings.

The developments also triggered a shift in interest-rate expectations. According to the CME’s FedWatch tool, markets now price in 116 basis points of Federal Reserve cuts this year — up from 100 bps earlier — as traders bet on monetary easing to cushion growing economic risks.

As macro pressures mount, Bitcoin’s role as a speculative asset in a shifting global landscape continues to be tested.