Speaking on stage at Bitcoin 2025, Strategy (MSTR) Executive Chairman Michael Saylor shrugged off concerns about a potential collapse in the company’s share price, emphasizing that the firm is engineered for financial resilience.

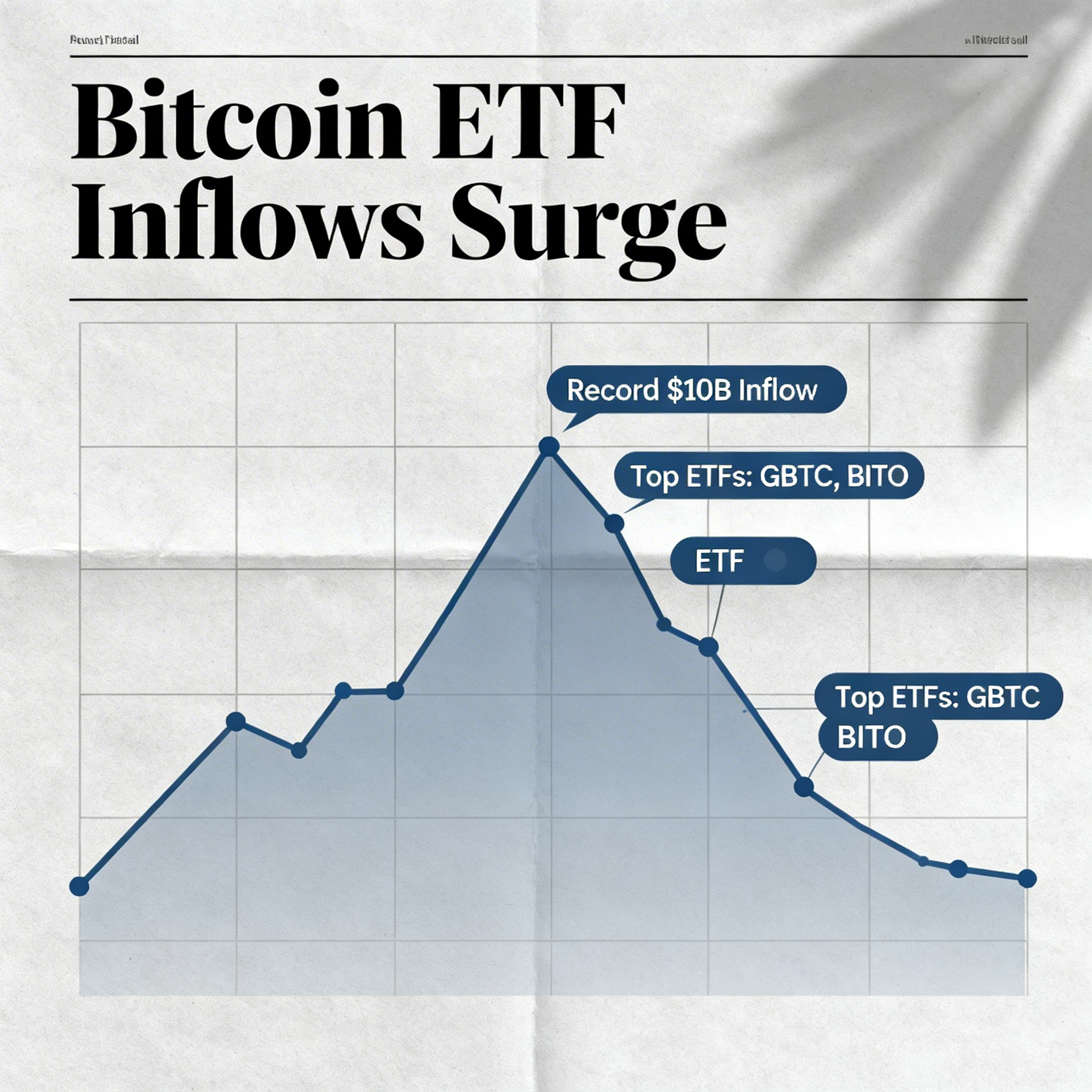

Asked how Strategy would respond if its multiple to net asset value (mNAV) dropped below 1—as it did during past bear markets—Saylor contrasted the company’s operational flexibility with that of Grayscale’s GBTC trust.

“GBTC is a closed-end fund with no levers to pull. It can’t react. Strategy is different—we’re a living, breathing business that can raise capital, take on debt, and pivot,” he said.

According to Saylor, any firm trading below 1x mNAV signals a deeper issue: a loss of confidence in leadership. But if Strategy’s stock ever fell that far, the company wouldn’t stand still. “If we went to $1, we’d issue preferreds like STRK or STRF, buy back common stock, and reset. That’s the playbook,” he told the audience.

At the core of Strategy’s approach is maximizing flexibility and access to liquidity. “The more optionality we create, the more value we can unlock,” he said.

Saylor wrapped his remarks by underscoring the company’s arsenal of financing tools. “We’ve got multiple ATMs across capital markets,” he said. “That’s our superpower—deep liquidity, multiple channels, and the ability to act fast.”