DDC Enterprise (DDC), an Asian food company, made headlines by purchasing 21 bitcoins worth about $2.28 million, marking the start of its ambitious plan to incorporate Bitcoin into its corporate treasury. The purchase was executed through an exchange of 254,333 class A ordinary shares, according to a recent press release.

Led by CEO Norma Chu, DDC aims to build a significant BTC reserve, with plans to acquire an additional 79 bitcoins soon, bringing its total holdings to 100 BTC. Chu also disclosed intentions to scale the treasury up to 500 BTC within six months and target 5,000 BTC over the next three years.

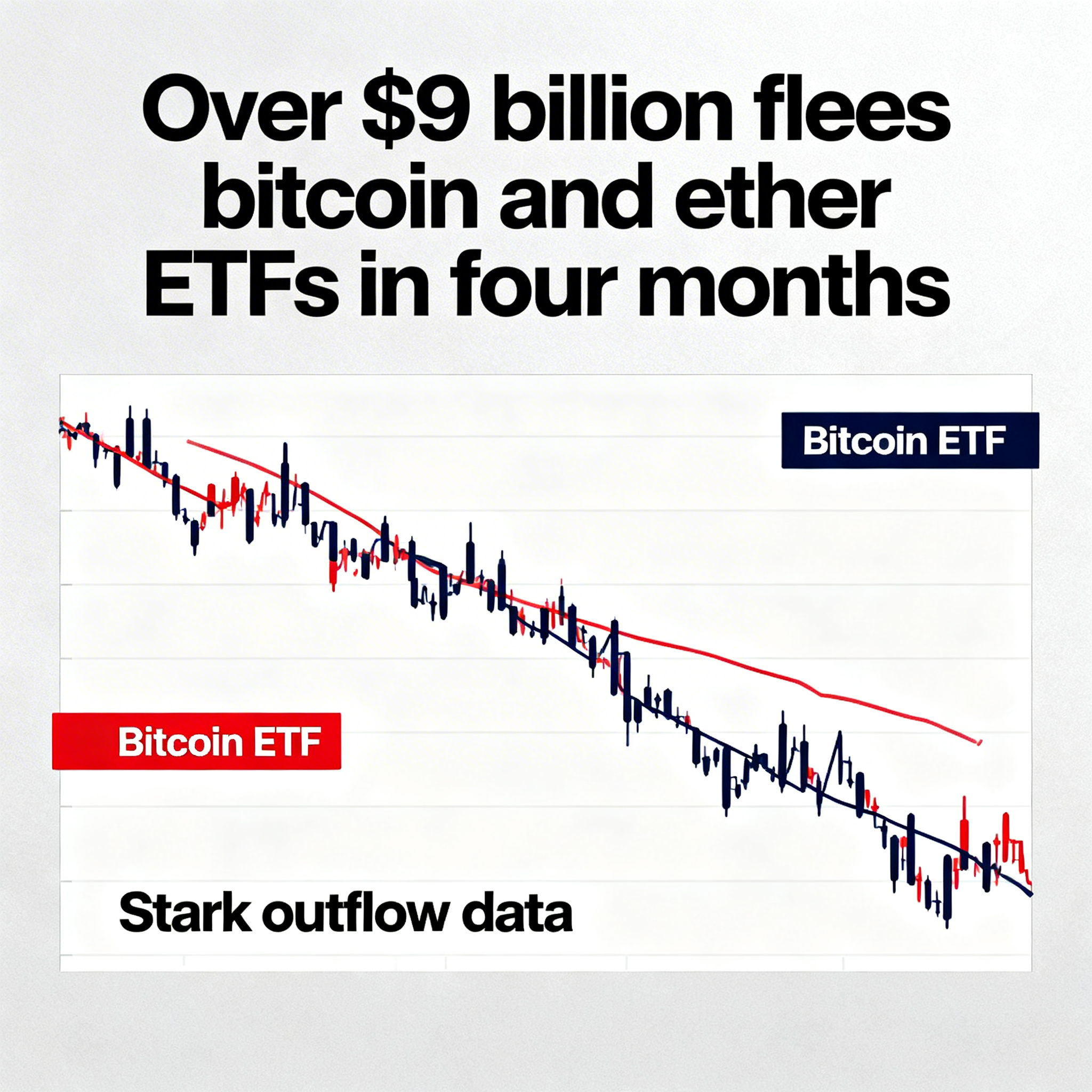

Despite this bold move aligning DDC with a wave of public companies embracing Bitcoin as a treasury asset, the company’s shares tumbled more than 12% during Friday’s trading session. This drop contrasts sharply with the broader market, where the S&P 500 slipped 0.6% and the Nasdaq dropped 1%.

Notably, other firms such as DigiAsia (FAAS) have seen strong market reactions to similar Bitcoin announcements, with FAAS’s stock surging over 90% after unveiling a $100 million Bitcoin treasury plan earlier this month.