Privacy Tokens Surge as Market Rotates to 2018-Era Themes

Capital is rotating back into the privacy sector at a time when broader liquidity searches for fresh narratives, highlighting a “back-to-roots” trade reminiscent of the 2017–18 bull cycle.

Privacy-focused tokens have rallied sharply, posting an average 15% gain in the past 24 hours, according to CoinGecko. Zcash (ZEC, $233.69) led the charge with a 40% one-day gain, pushing its seven-day increase to over 85% and making it the top-performing large-cap token.

Other notable movers include Dash (DASH, $44.56), Verge (XVG, $0.00748), Decred (DCR, $19.84), and Tornado Cash (TORN, $15.02), each rising 13–35% over the past day. Railgun’s RAIL token stood out with a 117% one-day gain and more than 300% over the past week. Trading volumes have surged across the sector, with ZEC alone seeing $1.1 billion in spot turnover in the last 24 hours.

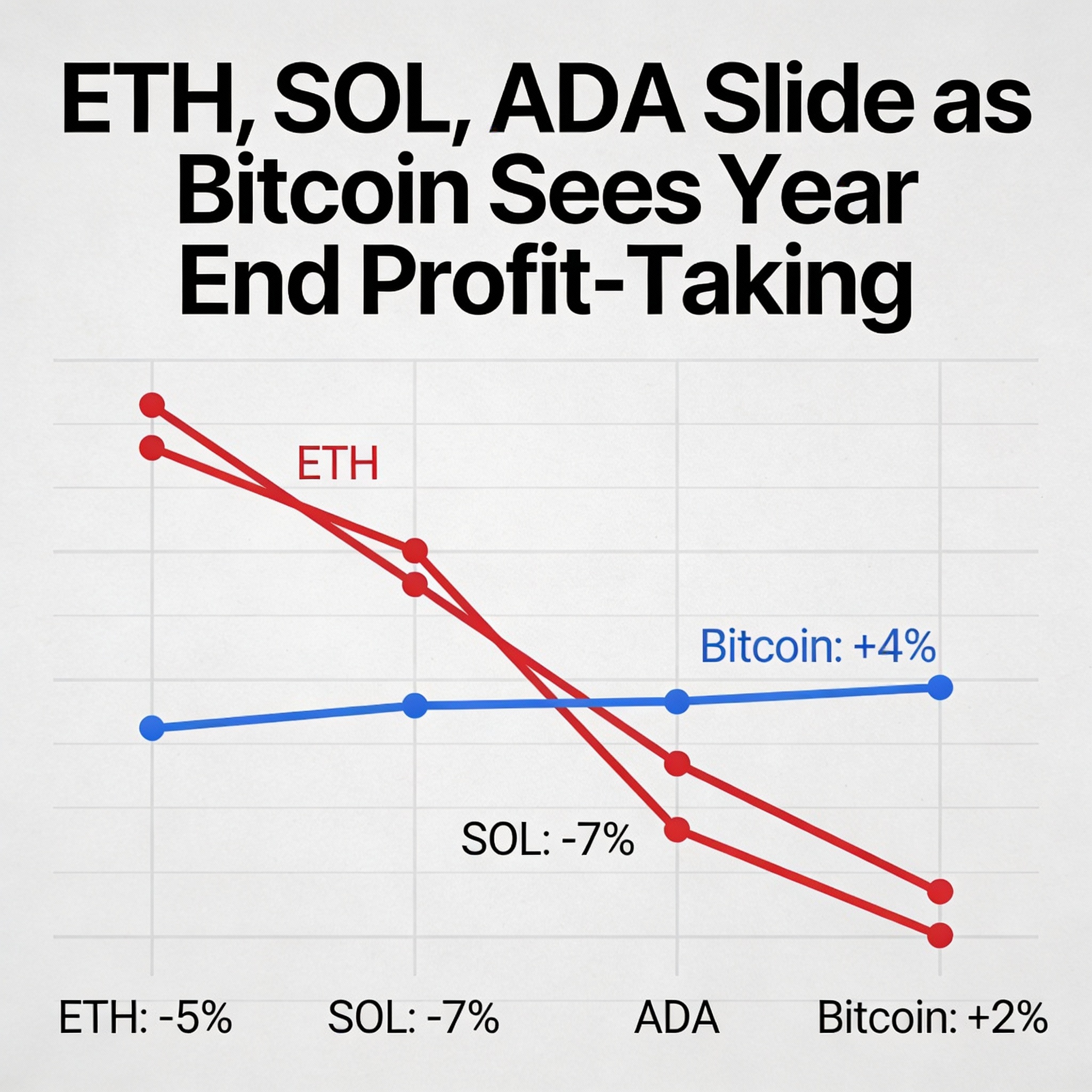

Meanwhile, major crypto assets remain steady. Bitcoin trades just under $122,000, and Ether sits around $4,350, as top coins take a breather following earlier highs this week.

Tech and Catalysts Drive the Rally

Monero (XMR) continues to be the default privacy play, but tokens with specific catalysts are seeing outsized gains. XMR’s recent “Fluorine Fermi” upgrade enhances user privacy against spy nodes, while Railgun benefits from renewed attention to its smart contract–based shielded transactions. Zcash’s rally is supported by mobile wallet Zashi, which now enables cross-chain shielded swaps.

Dash, long considered a relic, has surged as traders revisit its payments branding amid renewed stablecoin regulation debates. The flows suggest positioning for a broader regulatory cycle, with investors rotating into narratives beyond Bitcoin—AI, memes, infrastructure, and now privacy.

Multi-Day Strength Signals a Real Trend

The multi-day gains in privacy tokens suggest this is more than a short-lived spike. Historically, privacy assets have rallied during periods when surveillance or compliance dominated headlines. Today, a U.S. government shutdown, dovish central bank signals, and renewed financial censorship debates are creating a similar environment.

The backdrop positions privacy tokens as complementary to Bitcoin’s hedge narrative, offering traders both speculative upside and defensive appeal.