Standard Chartered Forecasts Bitcoin to Reach $120,000 in Q2 Amid Shift from U.S. Assets

Bitcoin is poised to break its all-time record by reaching $120,000 in the second quarter of 2025, as investors shift their focus away from U.S. assets, according to Geoff Kendrick of Standard Chartered. In his report released Monday, Kendrick also reiterated his target of $200,000 for Bitcoin by the end of 2025.

At the time of writing, Bitcoin was trading at approximately $95,300.

Kendrick pointed to several key drivers behind this prediction, including the U.S. Treasury term premium, which is closely correlated to Bitcoin’s price, reaching a 12-year high. Additionally, large-scale accumulation by Bitcoin whales and a shift in American investor sentiment toward non-U.S. assets are contributing factors.

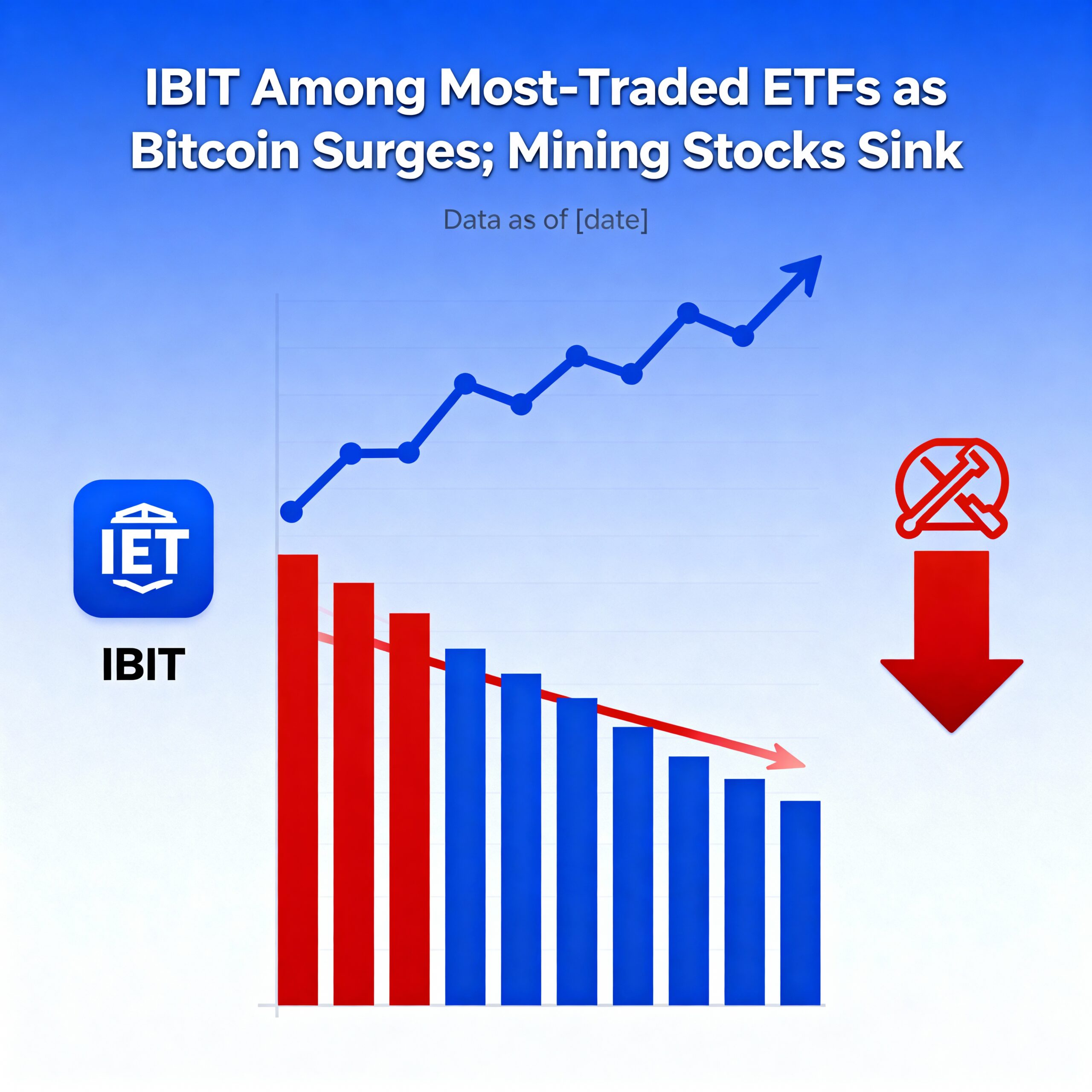

Kendrick also noted that recent ETF flows indicate a reallocation from gold to Bitcoin, as investors seek a safer alternative.

“Bitcoin may offer a more effective hedge than gold against potential risks to the financial system,” he concluded.