Strategy (MSTR), the world’s largest publicly traded holder of bitcoin, bolstered both its bitcoin holdings and cash reserves in transactions spanning late 2025 and early 2026, financing the moves through the sale of common stock.

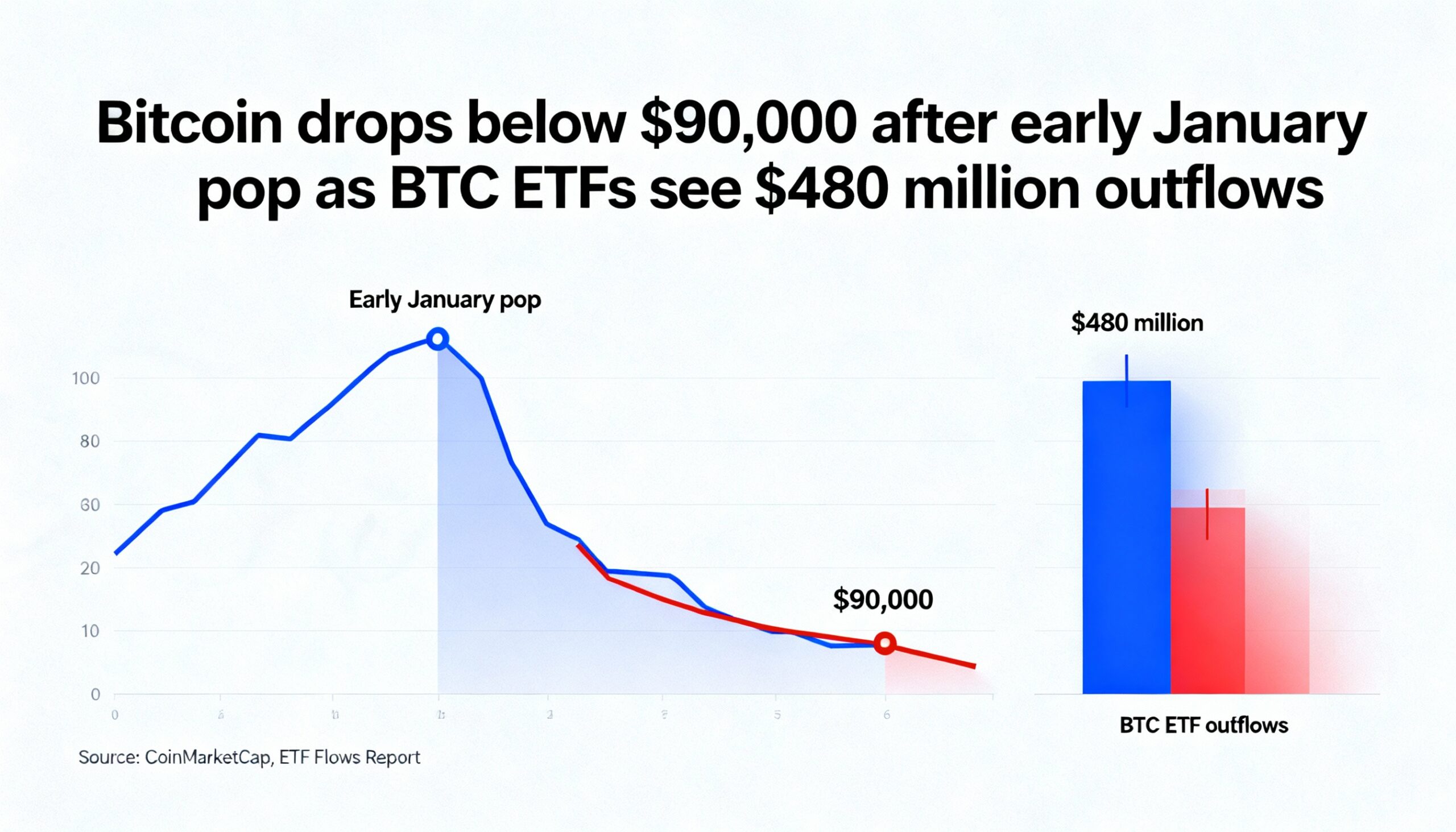

Under the leadership of Executive Chairman Michael Saylor, the company acquired 1,287 bitcoin for just over $116 million, paying an average price of roughly $90,000 per coin. Strategy now holds 673,783 bitcoin purchased for a total of $50.55 billion, equating to an average cost of $75,026 per bitcoin.

During the same period, the company increased its cash balance by $62 million, lifting total cash reserves to $2.25 billion.

Strategy said the additional cash is intended to support dividend payments on its perpetual preferred equity. At current levels, the company has sufficient liquidity to cover approximately 32.5 months of dividend obligations, according to its internal dashboard.

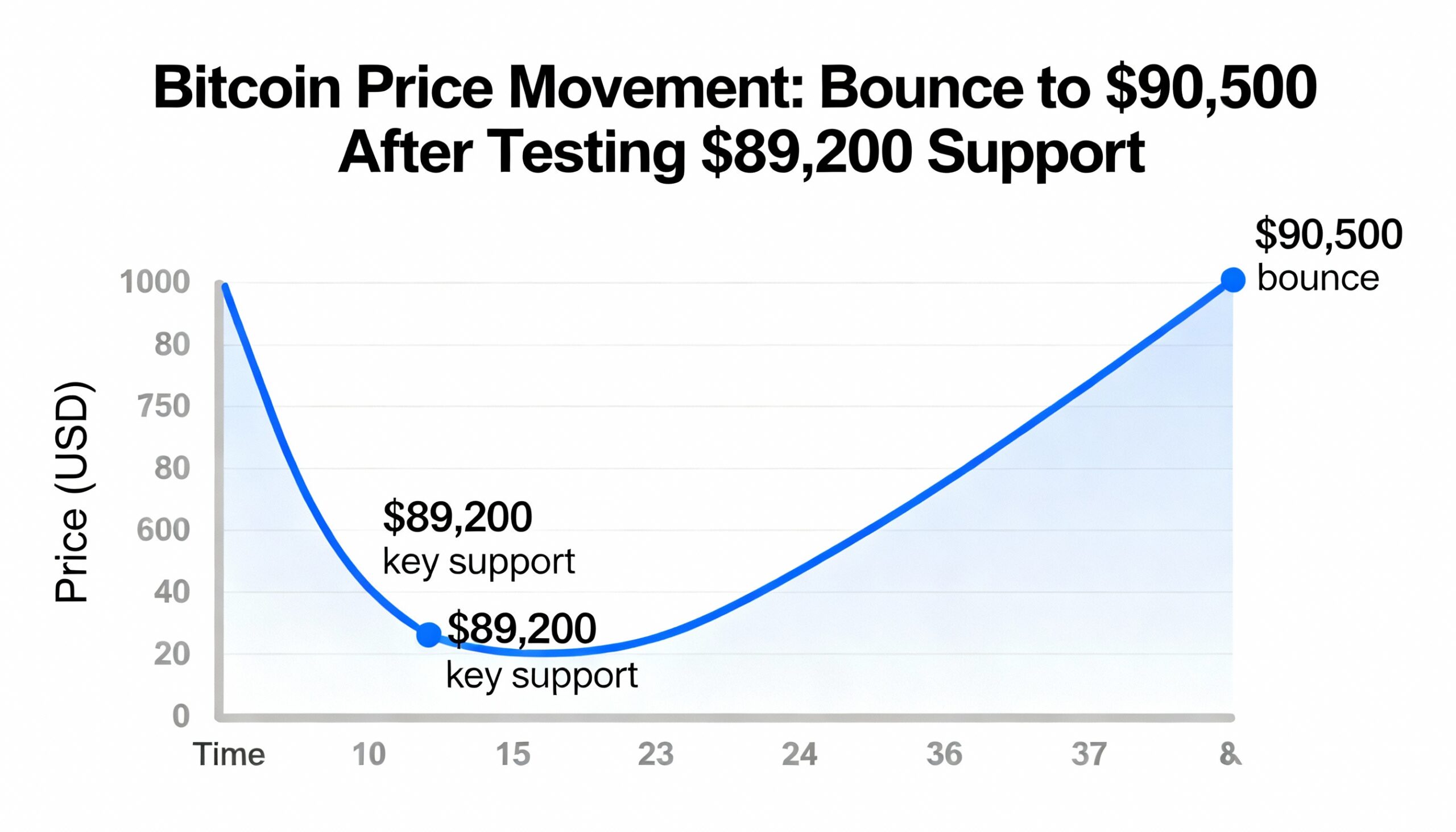

Alongside the balance sheet update, Strategy reported $17.44 billion in unrealized losses on its bitcoin holdings in the fourth quarter, reflecting the cryptocurrency’s decline from around $120,000 in early October to roughly $88,000 by the end of the year.

Shares of Strategy were up 4.5% in premarket trading, tracking a weekend rebound in bitcoin prices to about $92,900.