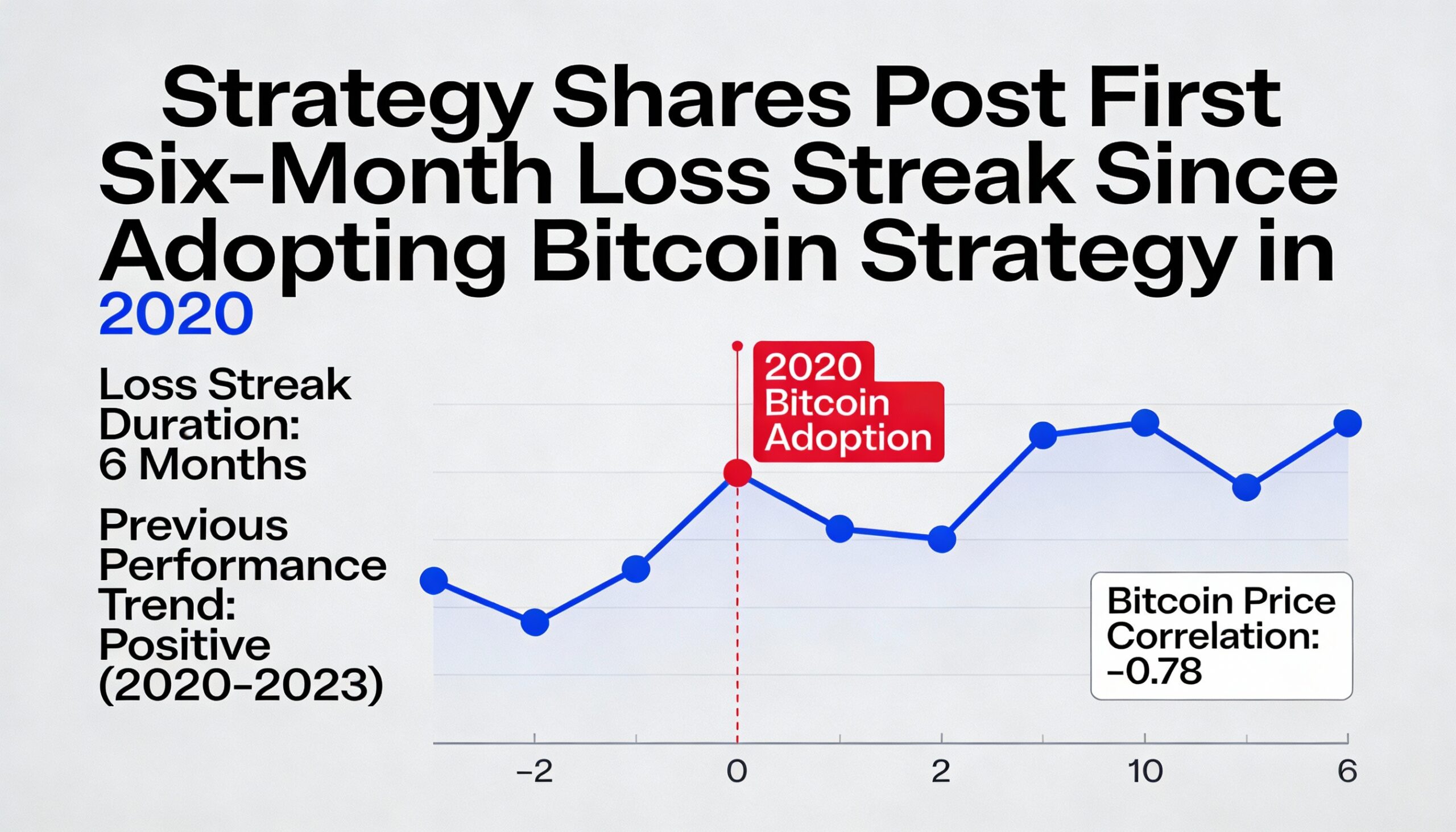

Strategy (MSTR) shares have posted six consecutive months of losses — the longest streak since the company adopted bitcoin as a treasury asset in August 2020 — according to crypto analyst Chris Millas.

In a Jan. 1 post on X, Millas highlighted the streak with a chart showing monthly returns since 2020. From July through December 2025, the stock fell each month, including 16.78% in August, 16.36% in October, 34.26% in November, and 14.24% in December.

Historically, steep single-month declines for Strategy were followed by sharp rebounds, such as in 2022 when losses were quickly offset by rallies exceeding 40%. The absence of a similar bounce in the latter half of 2025 points to a more persistent repricing rather than a short-lived sell-off.

Shares closed Dec. 31 at $151.95, down 2.35% on the day, marking declines of 11.36% over the past month, 59.30% over six months, and 49.35% over the year.

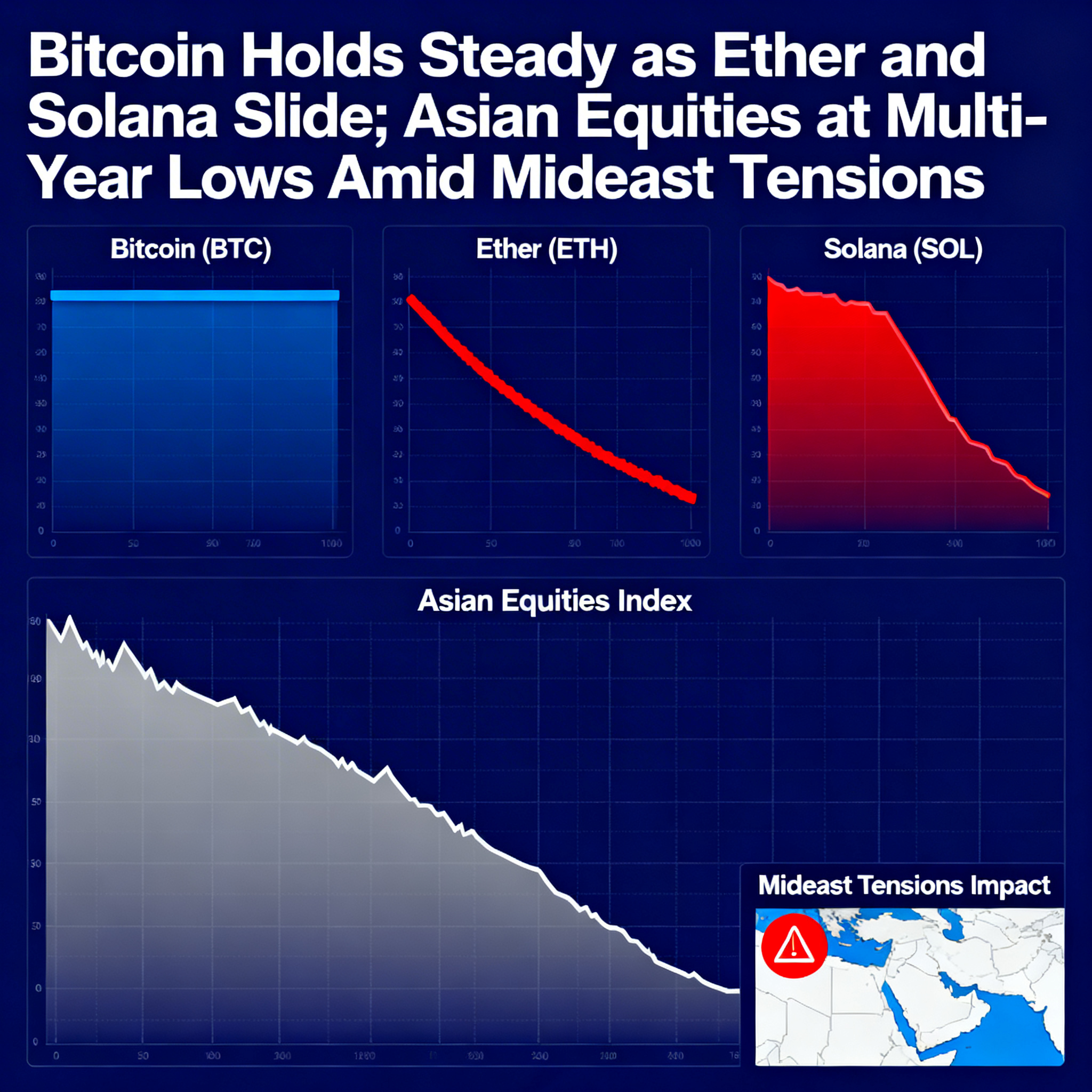

Bitcoin has fared better over the same period. As of Jan. 1, BTC traded at $87,879, down 5.06% over the past month, 27.36% over three months, and 9.65% over the past year.

The underperformance comes despite continued bitcoin accumulation. On Dec. 29, executive chairman Michael Saylor announced 1,229 BTC purchased for roughly $108.8 million, bringing Strategy’s total holdings to 672,497 BTC valued at about $50.44 billion.

Strategy’s stock also lagged the broader market, with the Nasdaq 100 up 20.17% in 2025, highlighting the gap between the company’s equity performance and broader indices.