Strategy Raises $711M With STRF Offering to Fuel Bitcoin Expansion

25/3/2025

Strategy (MSTR), the leading corporate bitcoin (BTC) investor, has expanded its financial playbook with a new preferred stock issuance, STRF, designed to bolster its bitcoin accumulation strategy. The latest sale, set to close later Tuesday, will bring in approximately $711 million—exceeding the initial $500 million target.

The offering includes 8.5 million shares priced at $85 each. STRF joins Strategy’s previous preferred issuance, STRK, which originally raised $563 million.

STRF: A Stable, High-Yield Investment

As a perpetual preferred stock, STRF offers a 10% annual dividend on its $100 stated value, paid quarterly. If Strategy misses a dividend payment, the rate increases by 1% annually, up to a maximum of 18%, ensuring investors are compensated for any delays.

STRF holders do not have voting rights but benefit from stability, as perpetual preferred stocks typically see less price volatility than common equity. Strategy also has the option to redeem STRF if less than 25% of the initial shares remain or under certain tax-related events, with shareholders receiving the liquidation value plus any accrued dividends.

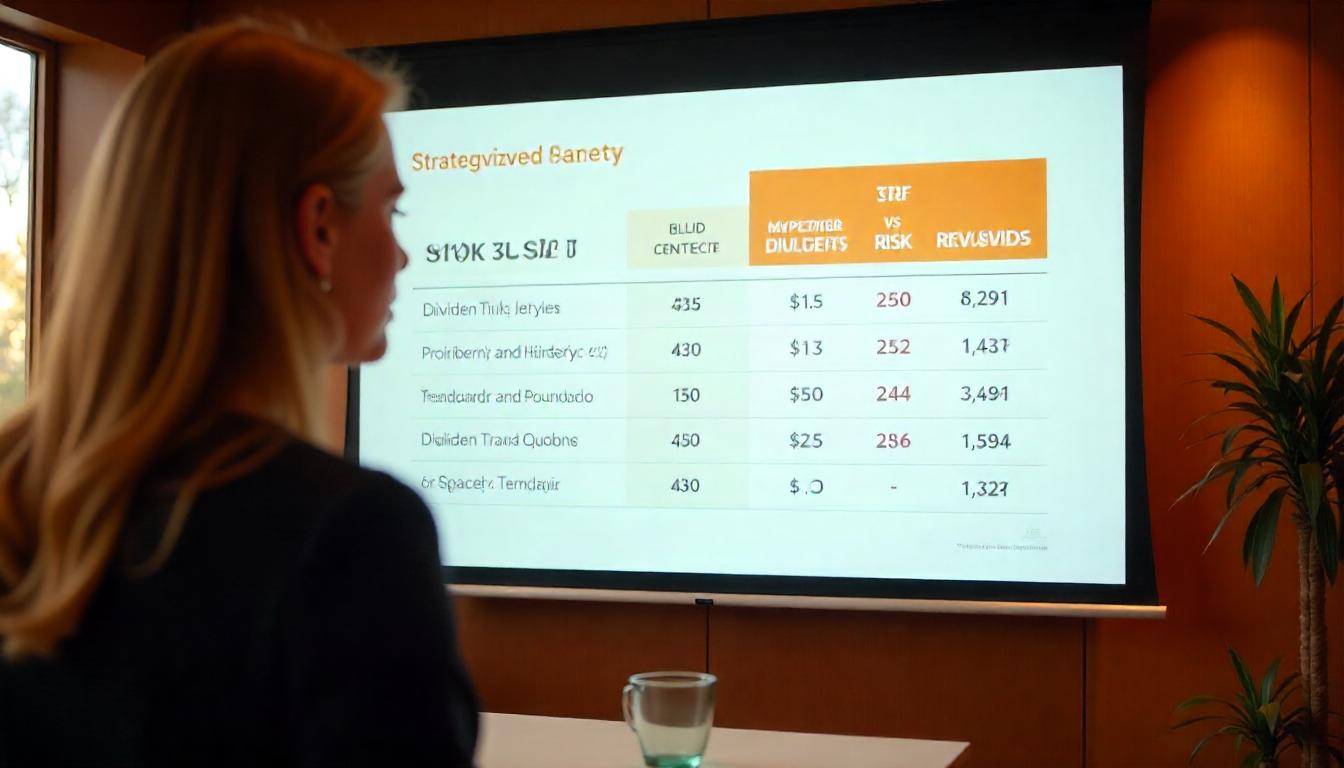

STRF vs. STRK: Key Differences

While STRF prioritizes fixed returns and stability, STRK offers an 8% dividend and a conversion feature that allows holders to swap preferred shares for common stock at a 10:1 ratio if Strategy’s stock reaches $1,000. This provides potential upside for investors looking for capital appreciation in addition to income.

STRK functions more like a hybrid between equity and fixed income, whereas STRF is a straightforward income-focused asset, making it attractive to investors seeking predictable returns.

Bitcoin Funding & Market Impact

Strategy will fund its dividend commitments through operational cash flow, convertible debt offerings, and at-the-market (ATM) share sales of its common stock. The company has also been using its ATM program to expand its bitcoin holdings, recently adding 130 BTC.

With $3.57 billion in remaining ATM capacity, Strategy remains well-positioned to support both its dividend strategy and continued bitcoin acquisitions. As of Monday, its BTC holdings reached 506,137, and its stock price surged more than 10% on the announcement of its latest capital raise.