David Bailey, the CEO of BTC Inc. and the owner of Bitcoin Magazine, is preparing to launch a publicly traded bitcoin investment firm, as reported by The Information. Bailey, who advised Donald Trump on cryptocurrency policy during the 2024 presidential campaign, is seeking to raise $300 million to fund the venture.

The plan involves raising $200 million through a private share sale and an additional $100 million in convertible debt. The company will merge with BTC Inc. and operate under the name “Nakamoto,” honoring Bitcoin’s pseudonymous creator, Satoshi Nakamoto. The announcement of this deal could come as soon as next week.

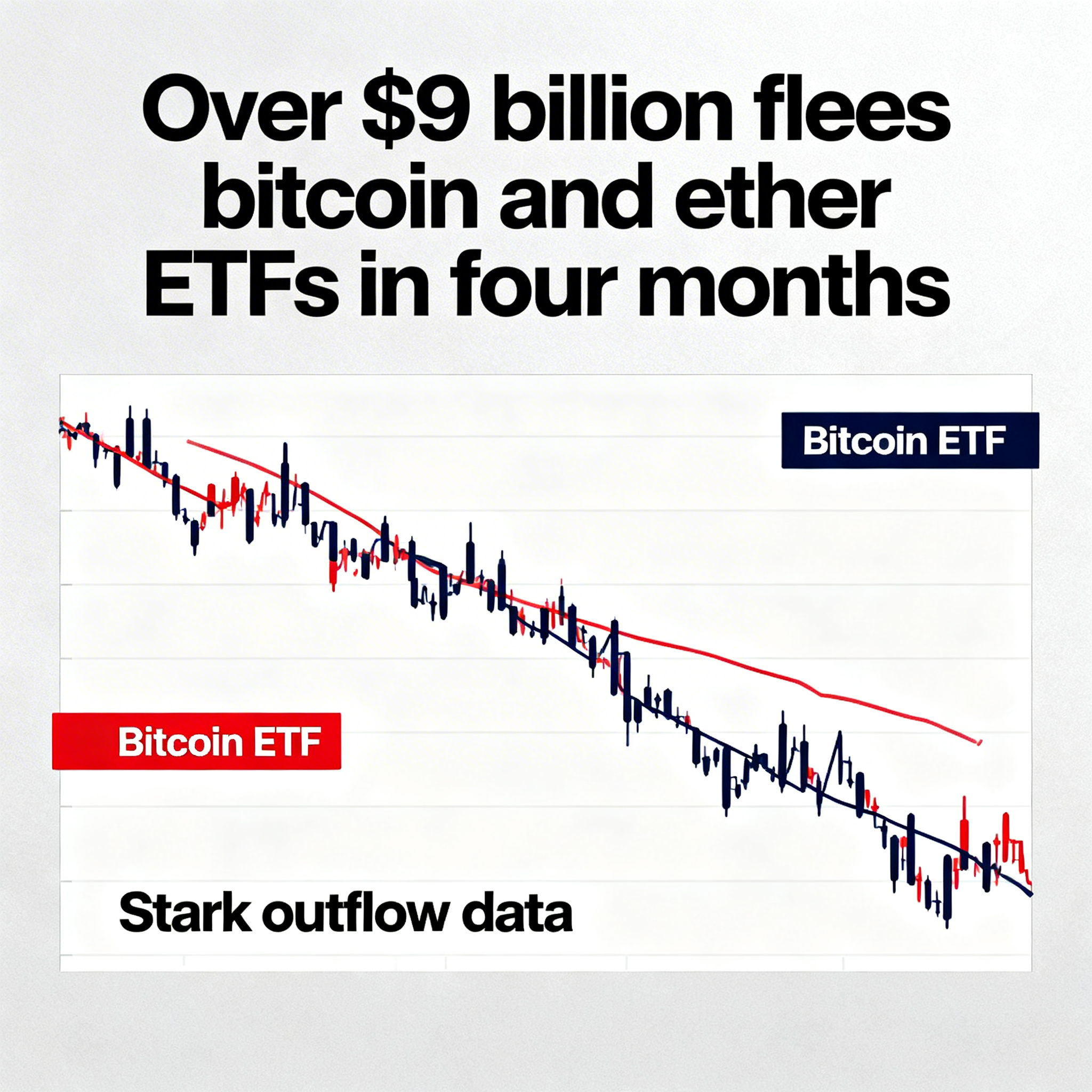

This move follows the success of Michael Saylor’s Strategy, which saw its stock price soar over 3,000% after shifting to a bitcoin-heavy treasury strategy and rebranding itself as a bitcoin-focused company.

Other major players in the space have also been ramping up bitcoin investment efforts. SoftBank, Tether, and Cantor Fitzgerald recently unveiled a $3.6 billion bitcoin investment initiative. Meanwhile, Strive Asset Management has announced plans to merge with Asset Entities to become a publicly traded firm focused on bitcoin asset management.