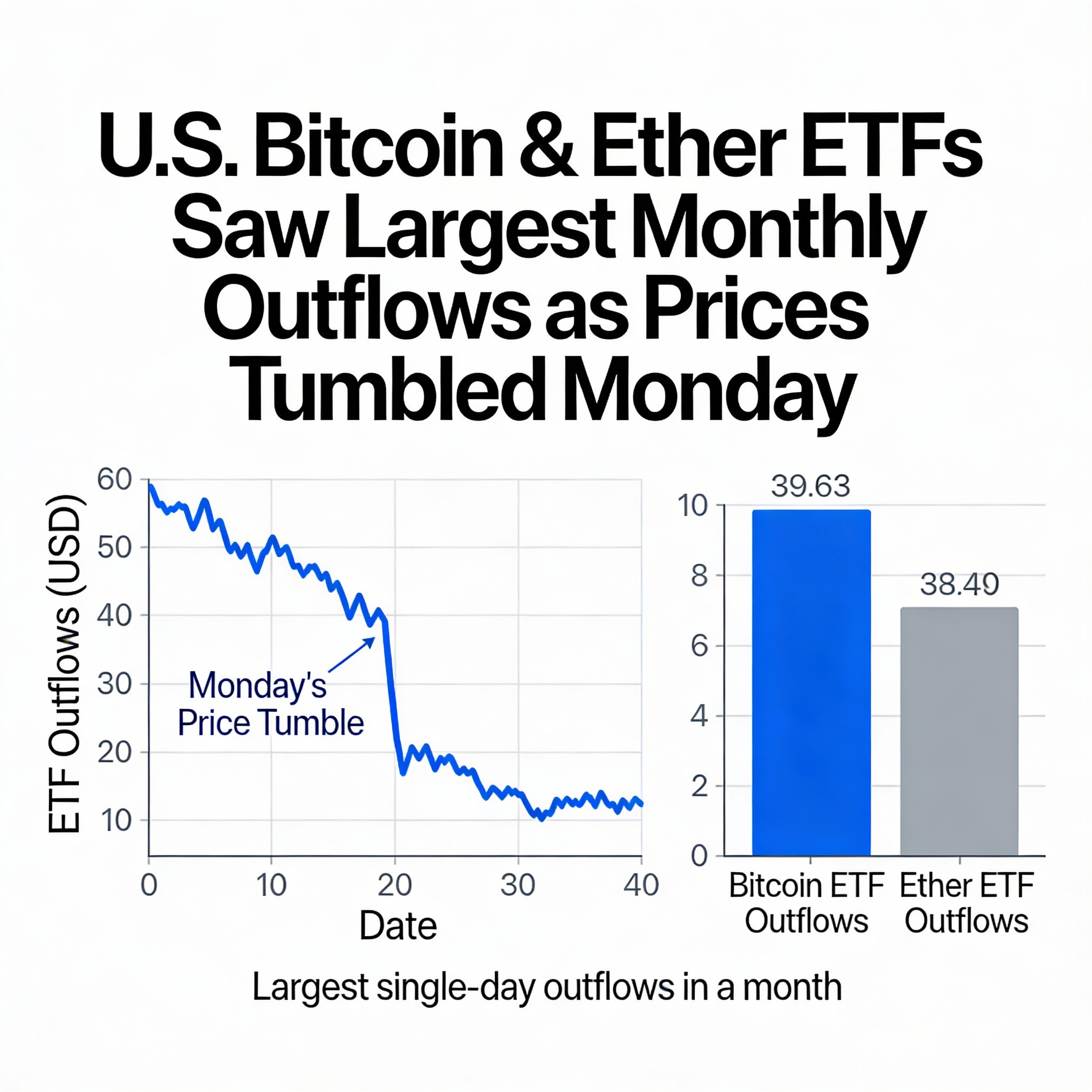

U.S. Bitcoin and Ether ETFs Post Largest Outflows Since November as Prices Slide

U.S. spot bitcoin (BTC$88,457.49) and ether (ETH$2,961.55) exchange-traded funds experienced a combined $582 million in net outflows on Monday, the largest since November 20, as crypto markets fell and bitcoin briefly touched $85,100.

Bitcoin ETFs led the withdrawals, with $357.6 million exiting—the heaviest outflows in nearly two weeks. Ether ETFs saw $224.8 million leave, marking a third consecutive day of redemptions, according to data from Farside.

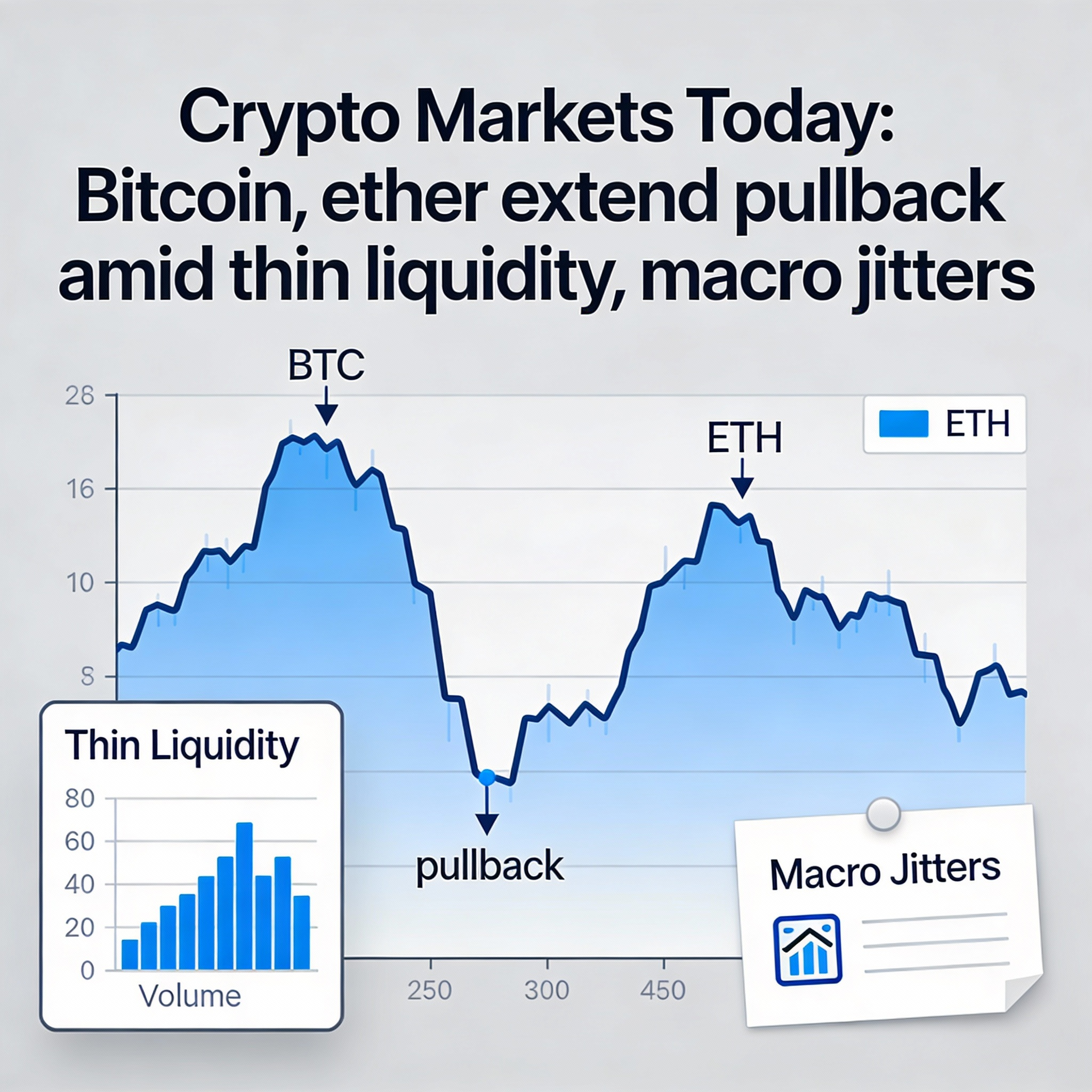

Historically, Mondays have been among the weaker weekdays for bitcoin. Velo data shows Monday is the third-worst performing day over the past 12 months, behind only Thursday and Friday. Several of bitcoin’s major local lows in 2025 have also occurred on Mondays, highlighting a recurring pattern.

A key support metric is the U.S. ETF cost basis, which calculates the average entry price of bitcoin held by ETFs by combining daily inflows with bitcoin’s price at the time of deposit. Currently, the aggregate cost basis sits near $83,000, a level that supported rebounds during previous lows on November 21 and December 1, according to Glassnode.

Among bitcoin ETFs, Fidelity Wise Origin Bitcoin Fund (FBTC) saw the largest redemptions at $230.1 million, while Bitwise Bitcoin ETF (BITB) and ARK 21Shares Bitcoin ETF (ARKB) recorded $44.3 million and $34.3 million in outflows, respectively. BlackRock’s iShares Bitcoin Trust (IBIT) reported no net flows for the day.

For ether ETFs, the iShares Ethereum Trust (ETHA) accounted for the bulk of outflows, with $139.1 million redeemed.