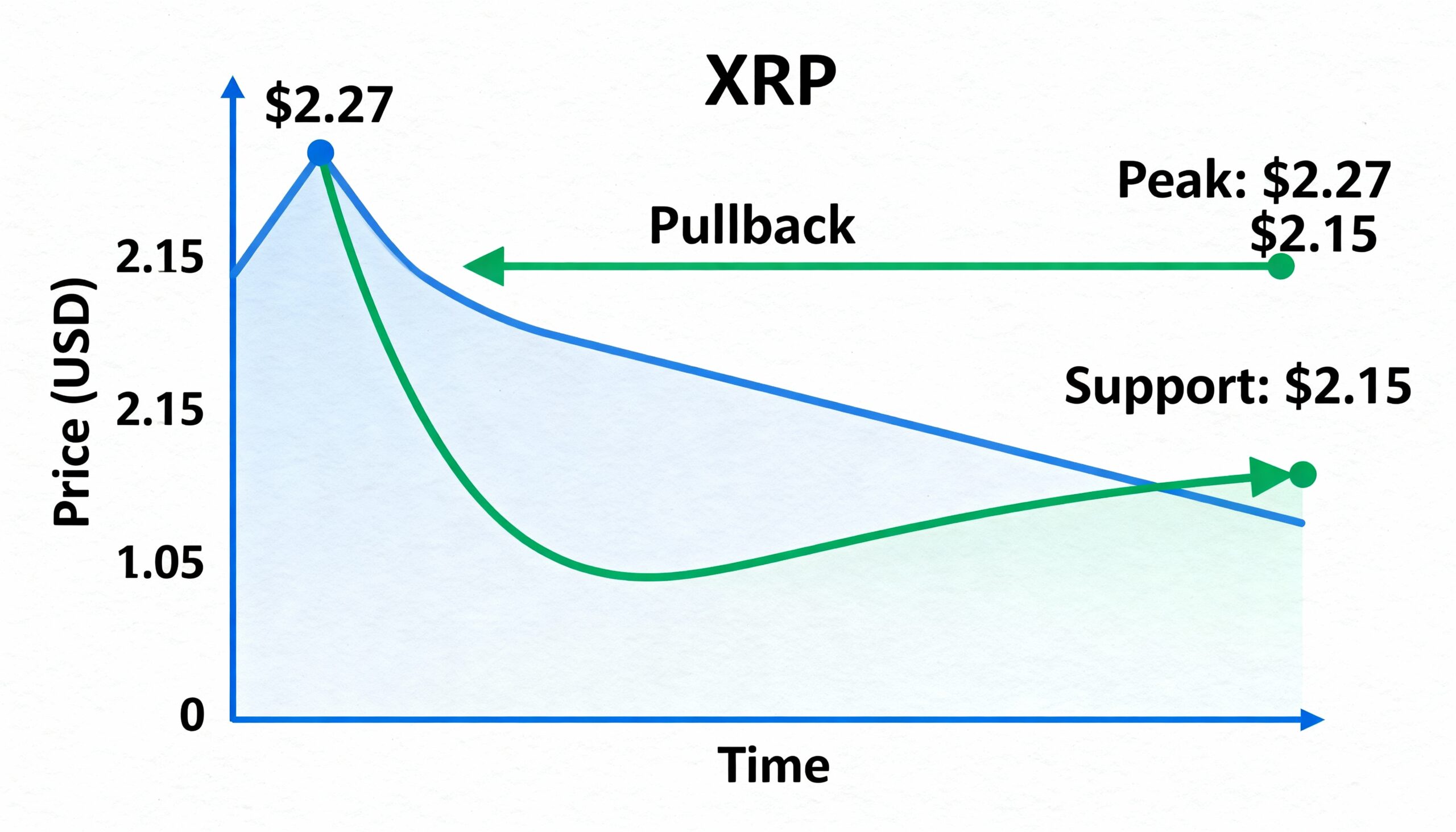

XRP Tests Key Support at $2.15 Amid Market Weakness Despite ETF Rollouts

XRP retreated from a $2.27 intraday high to trade near $2.15–$2.17, confirming a technical breakdown despite the ongoing rollout of institutional XRP products. Traders are watching the $2.15 pivot closely: holding this level could spark a bounce, while a decisive break may trigger further declines toward the $1.98 structural support cluster.

ETF Developments and Market Context

November saw several XRP ETFs launch, including Franklin Templeton’s EZRP on Nov. 18, joining Canary Capital’s XRPC and multiple Bitwise products. Combined first-week flows exceeded $245 million, reflecting strong institutional demand. However, ETF trading volumes have fallen 55% from peak levels, highlighting waning retail engagement.

Meanwhile, broader crypto markets softened as Bitcoin volatility increased ahead of its Death Cross, weighing on altcoins. ETF optimism offered limited support, as fragmented liquidity restricted sustained momentum for XRP in the spot market.

Price Action Summary

- XRP fell 4.96% from $2.27 to $2.16, briefly breaking below $2.20.

- Session volume spiked 54.56% above monthly averages, reaching 236.6M XRP traded.

- The token hit an intraday low of $2.11 before recovering to $2.15–$2.17.

- Resistance formed at $2.28, with consolidation around $2.155–$2.166 suggesting temporary seller exhaustion.

Technical Analysis

XRP’s drop confirms a breakdown of its short-term bullish structure. The failure to reclaim $2.28—despite ETF-related optimism—indicates that institutional inflows were insufficient to counter broader technical fragility.

- The surge in volume validated the selloff, triggering cascading stops and liquidations.

- The intraday rebound lacked conviction, stalling near $2.18, highlighting ongoing market imbalance.

- A bearish pennant has formed between $2.155 support and descending resistance at $2.18, signaling a potential directional move.

- Momentum indicators remain bearish, with price below key EMAs and no trend reversal signs.

For bulls to regain control, XRP must break above $2.18–$2.20 and reclaim $2.28, signaling renewed upward momentum.

Key Levels and Trader Watchpoints

- $2.15 is critical: holding could support a rebound toward $2.28–$2.30.

- A break below $2.15 could prompt a rapid slide toward $1.98.

- Upcoming ETF catalysts—including additional Bitwise launches through Nov. 25—may influence short-term price action, though diminishing trading activity limits near-term impact.

- XRP’s trajectory remains closely tied to Bitcoin’s volatility, particularly post-Death Cross behavior, which could either stabilize altcoins or extend the retracement