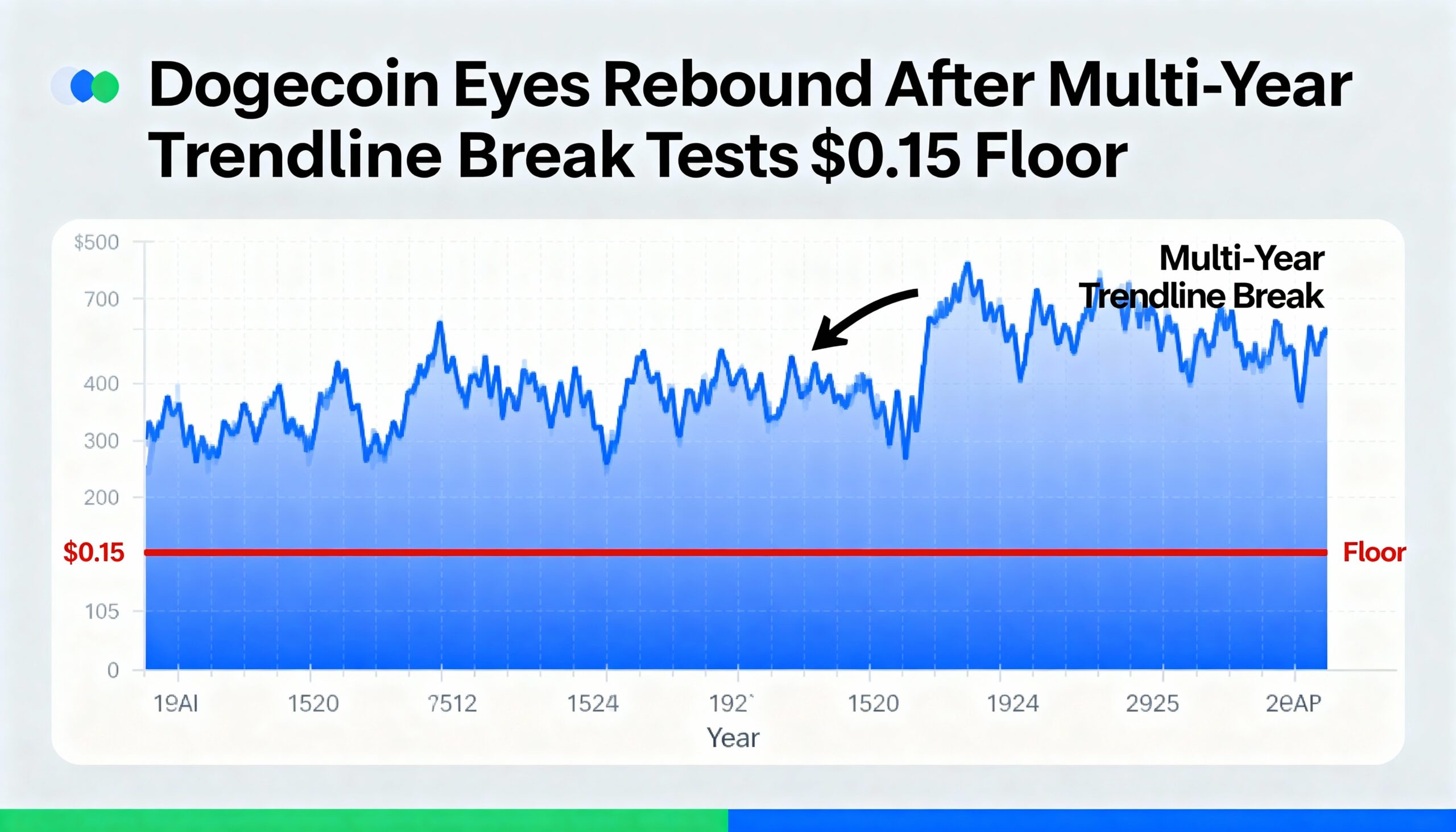

Dogecoin Tests $0.152 Support After Multi-Year Trendline Break Amid Whale Accumulation

Dogecoin (DOGE) faces heightened technical pressure after breaking its multi-year ascending trendline, with $0.1520 now a critical support level. Failure to hold could expose further downside, while a rebound above $0.159–$0.160 is needed to stabilize the trend.

Market Context

- Whale cohorts accumulated 4.72B DOGE (~$770M) over the past two weeks despite price declines.

- Speculation grows around Bitwise and Grayscale preparing spot DOGE ETF filings.

- Bitcoin’s death cross and extreme-fear sentiment weigh on high-beta assets like DOGE.

- Meme-coin sector underperforms as broader crypto market cap loses 2% amid renewed risk-off flows.

Price Action Summary

- DOGE fell 5% from $0.161 to $0.153, breaking multi-session support.

- Volume surged to 1.264B tokens (+168% above average), driven by institutional flows.

- Temporary support has emerged at $0.1520, with consolidation around $0.1534–$0.1537.

- Multi-year ascending trendline broken on both daily and monthly charts.

Technical Analysis

The breakdown through $0.1620 marks a significant deterioration in DOGE’s structure, occurring on institutional-grade volume rather than retail-driven panic. While whale accumulation has absorbed 4.72B tokens, creating a divergence that historically precedes volatility expansions, the structural risks remain elevated.

DOGE now hinges on $0.1520. A confirmed double bottom above $0.155, supported by RSI bullish divergence, could indicate slowing bearish momentum and potential for a reversal. Bulls must reclaim $0.159–$0.160 to neutralize immediate downside, while a break below $0.1520 could target $0.150 and $0.120, where multi-year volume nodes cluster.

Key Levels & Trader Watchpoints

- Support: $0.1520 (must hold to prevent deeper decline).

- Resistance: $0.159–$0.160 (trend stabilization) and $0.163–$0.170 (potential reversal targets).

- Whale accumulation remains a wildcard, potentially front-running ETF-driven catalysts.

- BTC’s death cross and macro risk-off conditions continue to weigh heavily on DOGE.

Traders are now at a decisive inflection point, with near-term direction contingent on whether $0.1520 support holds and how institutional positioning interacts with broader crypto risk sentiment