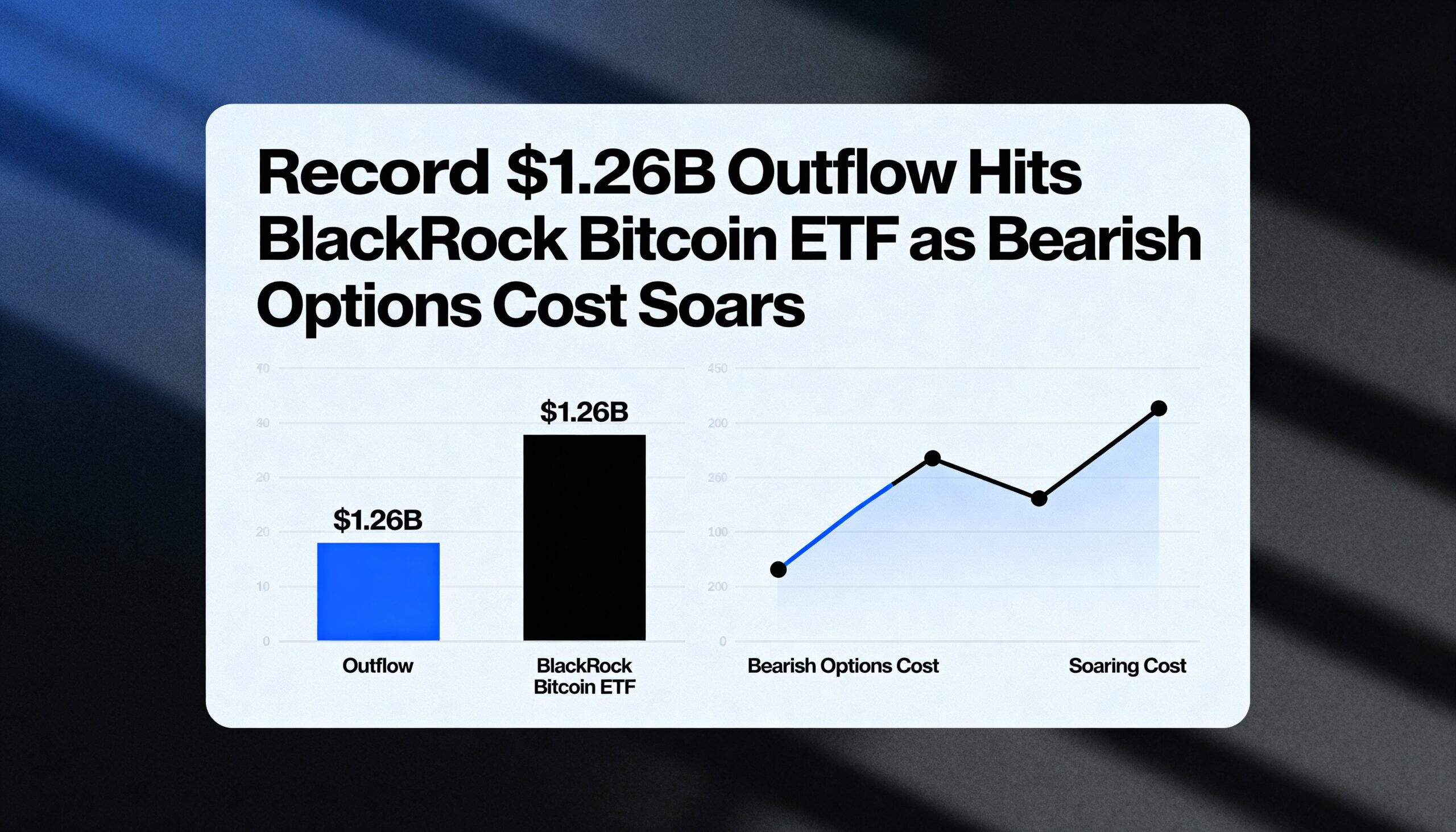

BlackRock Bitcoin ETF Faces Record $1.26B Outflows Amid Price Drop and Rising Bearish Option Costs

BlackRock’s spot Bitcoin ETF, IBIT, has suffered record outflows this month as its price slid and the cost of bearish options used for hedging surged.

The Nasdaq-listed ETF has seen a net outflow of $1.26 billion in November, the largest monthly redemption since its January 2024 debut, according to data from SoSoValue. This is part of a broader market trend, with 11 spot Bitcoin ETFs collectively seeing withdrawals of $2.59 billion.

IBIT’s price has tumbled 16% to $52, a level not seen since April 22, according to TradingView data. The decline has driven traders to buy put options as protection against further losses.

The 250-day put-call skew, which tracks the relative cost of puts versus calls, has climbed to 3.1%—a seven-month high—indicating that downside hedges are currently at their most expensive relative to calls since April, according to MarketChameleon.

This combination of heavy outflows and elevated hedging costs underscores the cautious sentiment surrounding BlackRock’s Bitcoin ETF as investors brace for continued volatility.