Bitcoin Pulls Back Toward $90K as Crypto Market Unwinds Early-Week Gains

Bitcoin (BTC) slipped toward $90,000 on Thursday as crypto markets gave back much of Tuesday’s rebound, despite the Federal Reserve delivering a widely expected rate cut and restarting Treasury purchases. The pullback followed a brief spike above $94,500 earlier in the week, which triggered a minor short squeeze but failed to overcome resistance that has capped BTC for most of the past three weeks.

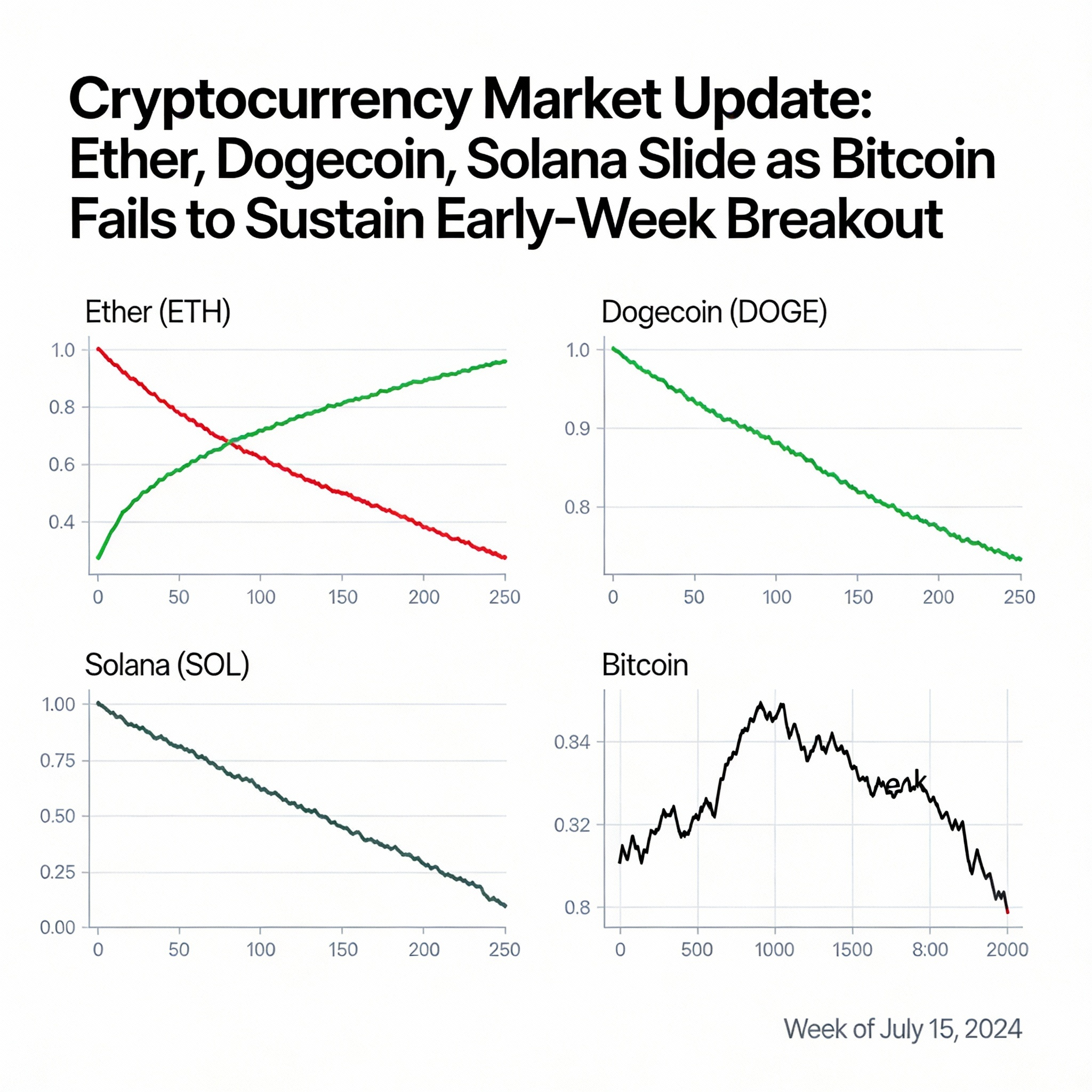

Major tokens extended weekly losses amid rising volatility, with more than $514 million in leveraged positions liquidated across derivatives venues. BTC traded around $90,250, down 2.4% over 24 hours. Ether (ETH) fell 3.4% to $3,208, Solana (SOL) slid 5.8% to $133.84, and Dogecoin (DOGE) dropped 5.5% to $0.139. Other large-cap tokens also posted losses over seven days, including XRP (-8.6%), ADA (-7.2%), and BNB (-5.9%), according to CoinGecko data.

The recent rejection sent BTC back into the middle of its month-long range, where thin market depth and concentrated liquidation clusters continue to influence price swings. “Strictly speaking, we have observed a series of higher local highs and lows since 21 November,” said Alex Kuptsikevich, senior market analyst at FxPro. “However, to classify the rebound as the start of meaningful capitalization growth, it would need to surpass $3.32 trillion,” roughly 6% above current levels. The global crypto market cap stands near $3.16 trillion, up 2.5% from earlier in the week but still below Tuesday’s local high of $3.21 trillion.

Leverage played a key role in Thursday’s decline. CoinGlass data shows $376 million in long positions were forcibly closed in 24 hours—nearly triple the $138 million in short liquidations—as BTC slipped below its short-term trend line.

Macro conditions offered little support. Although the Fed cut rates on Wednesday, policymakers projected fewer reductions over the next two years, highlighting a sharp split within the committee.

Looking ahead, QCP Capital suggested wider BTC trading bands of $84,000–$100,000 into year-end, citing reduced liquidity and persistent positioning imbalances. Bloomberg Intelligence strategist Mike McGlone warned that a “Santa Claus rally” may not materialize, forecasting BTC could finish the year below $84,000.

For now, traders are watching whether BTC can hold near $90,000–$91,000—a support zone repeatedly tested over the past month. A decisive break lower would expose the bottom of the current range, while stabilization could set the stage for another attempt at $94,000 resistance as markets recalibrate in the post-Fed environment.