Bitcoin traded sideways during U.S. afternoon hours on Tuesday after an active start to the session, hovering near $87,500 and holding gains of roughly 2% over the past 24 hours.

The broader crypto market showed similar strength, with ether, XRP and solana posting modest advances. Crypto-linked equities also rebounded following Monday’s sharp sell-off, with Strategy (MSTR) rising about 3% and Coinbase (COIN) gaining roughly 1%.

“Clients are positioned with cautious optimism,” said Josh Barkhoarder, head of sales at FalconX. “Near term, most expect crypto to remain range-bound until a clear catalyst emerges, so they’re maintaining core bitcoin exposure while keeping additional capital on the sidelines.”

Rebalancing could support BTC

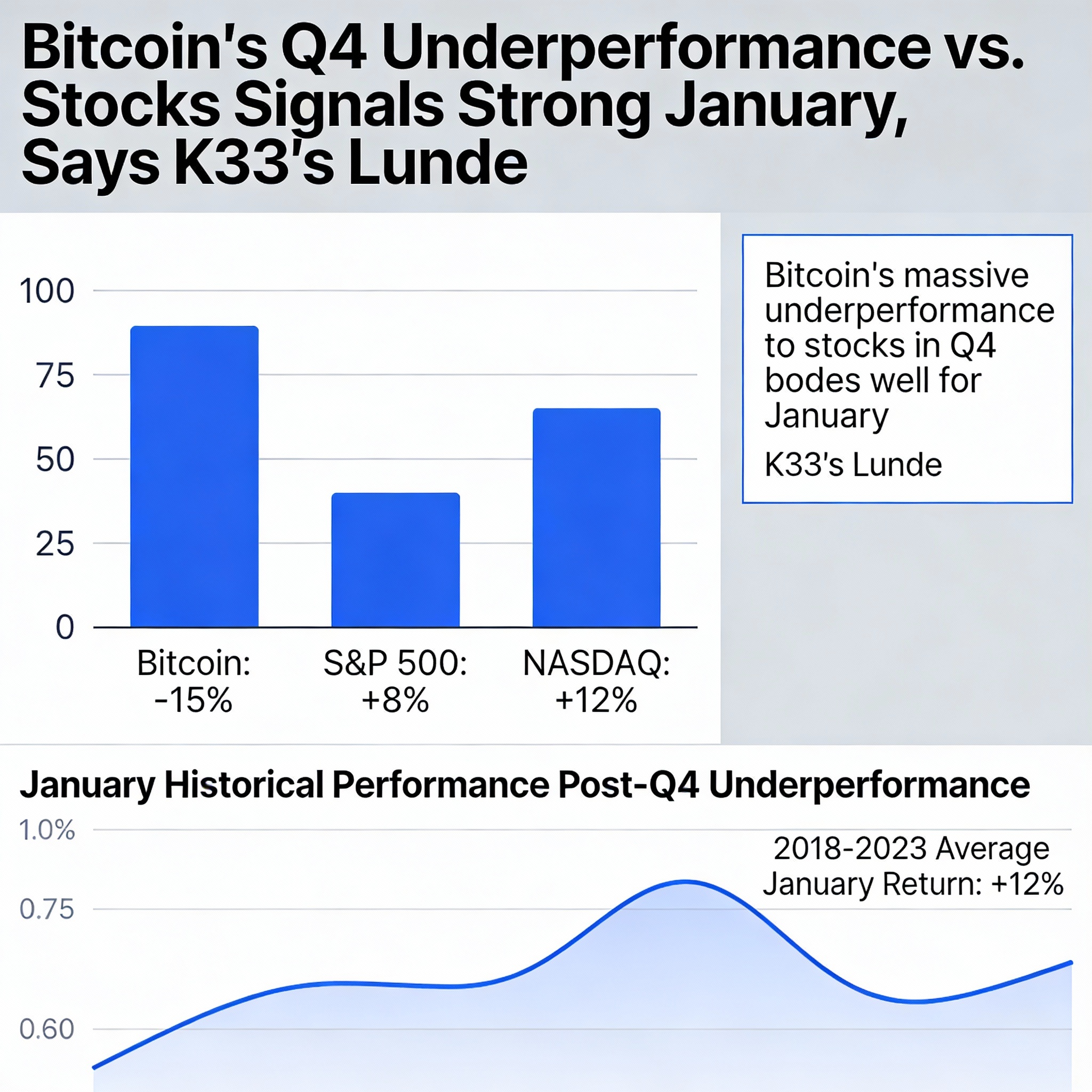

As year-end approaches, bitcoin could see support from portfolio rebalancing flows after lagging other asset classes during the quarter, according to Vetle Lunde, head of research at K33.

Lunde pointed to historical patterns showing that periods of relative underperformance have often been followed by rebounds. Earlier this year, bitcoin rallied at the start of the second quarter after trailing the S&P 500 in Q1, while a strong showing versus equities in Q2 was followed by weakness early in Q3.

So far in the fourth quarter, bitcoin has underperformed the S&P 500 by roughly 26%, increasing the likelihood of allocation-driven adjustments by asset managers.

“Fund managers with fixed bitcoin allocation targets may rebalance into year-end, potentially generating excess inflows during the final trading days of the year and into early January,” Lunde said.

Traders remain cautious

Despite price stabilization, appetite for new risk remains subdued. Lunde noted that derivatives activity on the Chicago Mercantile Exchange (CME) is near yearly lows, with bitcoin futures open interest hovering around 124,000 BTC.

On perpetual futures markets, funding rates remain close to neutral and open interest has seen little change, pointing to limited short-term directional conviction. Spot trading volumes have also declined, falling 12% through last week, reinforcing signs that many traders are stepping back as the year draws to a close.