Bitcoin slipped overnight, pulling the broader crypto market lower as traders stayed cautious amid a lack of major catalysts. BTC traded at $88,248.23, down 1.5% from early Wednesday highs, while the CoinDesk 20 (CD20) index fell 1.6%, with all constituent tokens in the red.

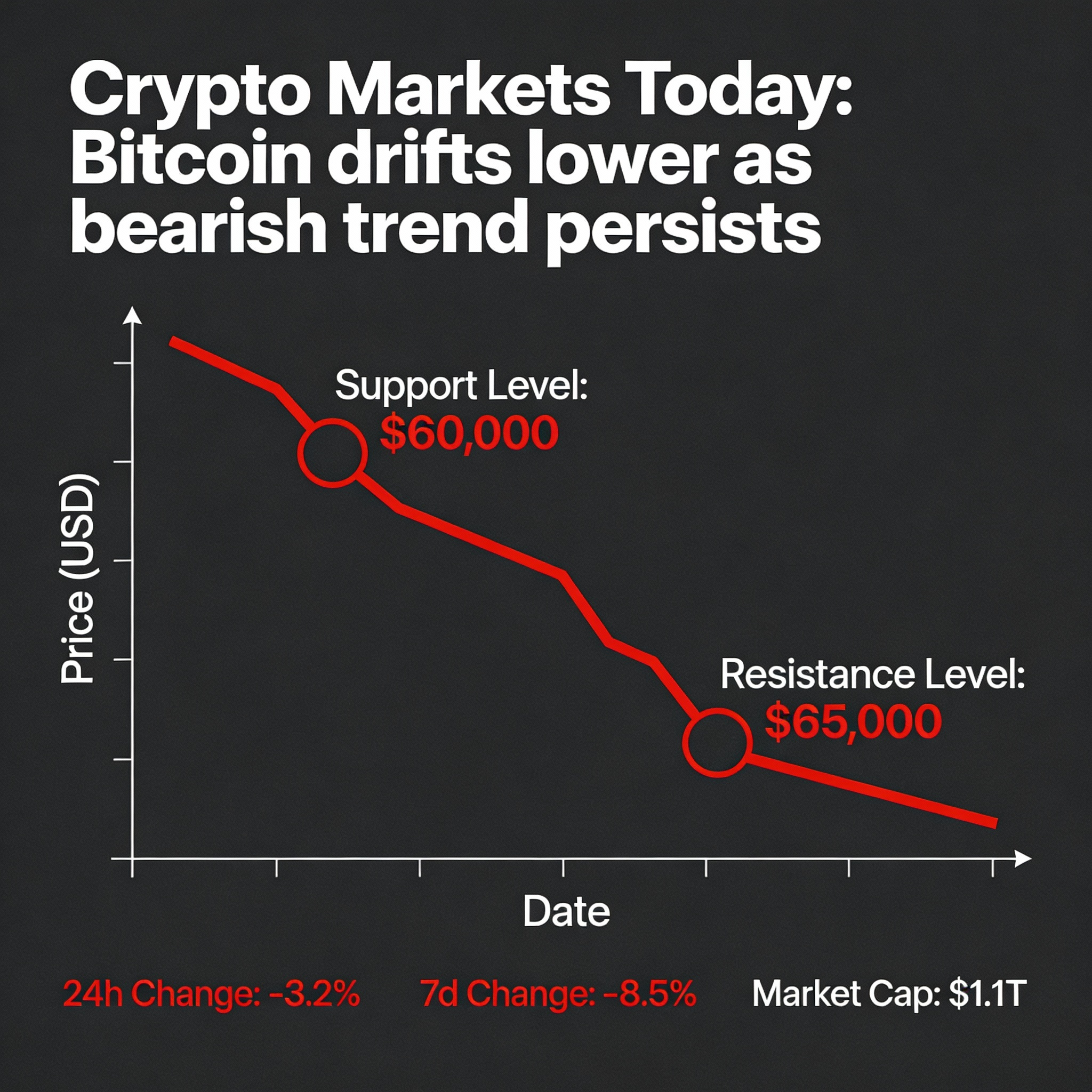

The sell-off continues a downtrend that began in early October, following a failure to break above $94,700 last week. For a meaningful recovery, bitcoin would need to reclaim $95,000 and ideally $98,000, though no year-end catalysts appear imminent. Technical indicators suggest a potential short-term relief rally, as the average crypto relative strength index (RSI) sits at 38.49, signaling oversold conditions.

Derivatives activity

BTC’s 30-day implied volatility, tracked by Volmex’s BVIV, remains below an annualized 50%, reflecting market calm ahead of Thursday’s U.S. inflation report and Friday’s Bank of Japan rate decision. The 90-day historical volatility of BTC is now comparable to major tech stocks like Tesla and Nvidia, indicating market maturation.

Long positions on Bitfinex have surged to their highest levels since February, while futures open interest across most tokens—including BTC and ether (ETH $2,973.28)—has declined over 24 hours. Exceptions include BCH, UNI, and NEAR, which saw moderate increases in open interest. On Deribit, put writing at bitcoin’s $85,000 strike and call writing at $95,000 and $100,000 strikes suggest expectations for a broad-range play in the near term. Block trades included BTC straddles, risk reversals, and ETH call calendar spreads. Overall, BTC and ETH puts remain pricier than calls, reflecting persistent downside concerns and call overwriting.

Altcoin market

Altcoins continue to underperform against bitcoin pairs, pushing bitcoin dominance higher to 58.7% from 57.8% on Nov. 26. ASTER and TAO were the worst performers among the top 100, down 6.5% and 6.1% respectively since midnight UTC. ASTER’s decline extends a bearish trend exceeding 20% from Monday’s weekly open, reflecting cooling hype around BNB Chain derivatives exchanges.

Some bullish outliers emerged, including Monero (XMR $438.72), up 0.2%, and Cardano’s privacy token NIGHT, which rose over 5% in European morning trading. The “altcoin season” indicator remains at 19/100, highlighting the market’s continued focus on bitcoin since October’s liquidation-driven downturn.